Chapter 8 - Pearson Learning Solutions

Chapter 8 - Pearson Learning Solutions

Chapter 8 - Pearson Learning Solutions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

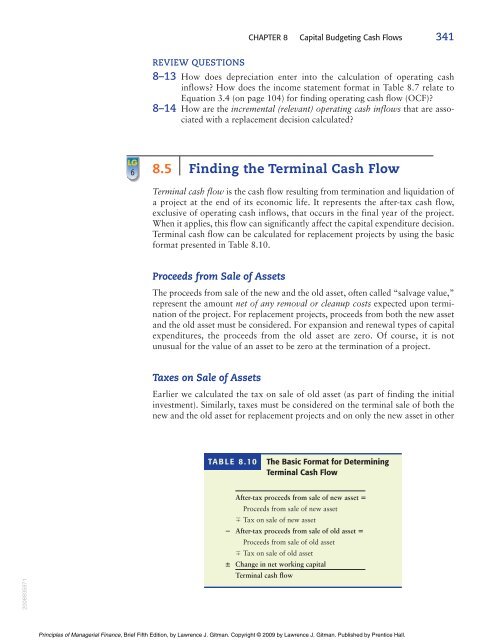

CHAPTER 8 Capital Budgeting Cash Flows 341REVIEW QUESTIONS8–13 How does depreciation enter into the calculation of operating cashinflows? How does the income statement format in Table 8.7 relate toEquation 3.4 (on page 104) for finding operating cash flow (OCF)?8–14 How are the incremental (relevant) operating cash inflows that are associatedwith a replacement decision calculated?LG68.5 Finding the Terminal Cash FlowTerminal cash flow is the cash flow resulting from termination and liquidation ofa project at the end of its economic life. It represents the after-tax cash flow,exclusive of operating cash inflows, that occurs in the final year of the project.When it applies, this flow can significantly affect the capital expenditure decision.Terminal cash flow can be calculated for replacement projects by using the basicformat presented in Table 8.10.Proceeds from Sale of AssetsThe proceeds from sale of the new and the old asset, often called “salvage value,”represent the amount net of any removal or cleanup costs expected upon terminationof the project. For replacement projects, proceeds from both the new assetand the old asset must be considered. For expansion and renewal types of capitalexpenditures, the proceeds from the old asset are zero. Of course, it is notunusual for the value of an asset to be zero at the termination of a project.Taxes on Sale of AssetsEarlier we calculated the tax on sale of old asset (as part of finding the initialinvestment). Similarly, taxes must be considered on the terminal sale of both thenew and the old asset for replacement projects and on only the new asset in otherTABLE 8.10The Basic Format for DeterminingTerminal Cash Flow2008935971After-tax proceeds from sale of new asset Proceeds from sale of new asset Tax on sale of new asset After-tax proceeds from sale of old asset Proceeds from sale of old asset Tax on sale of old asset Change in net working capitalTerminal cash flowPrinciples of Managerial Finance, Brief Fifth Edition, by Lawrence J. Gitman. Copyright © 2009 by Lawrence J. Gitman. Published by Prentice Hall.