Chapter 8 - Pearson Learning Solutions

Chapter 8 - Pearson Learning Solutions

Chapter 8 - Pearson Learning Solutions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

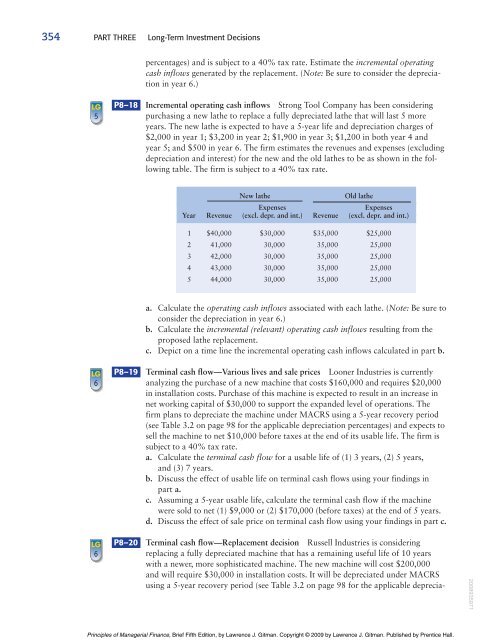

354 PART THREE Long-Term Investment Decisionspercentages) and is subject to a 40% tax rate. Estimate the incremental operatingcash inflows generated by the replacement. (Note: Be sure to consider the depreciationin year 6.)LG5P8–18 Incremental operating cash inflows Strong Tool Company has been consideringpurchasing a new lathe to replace a fully depreciated lathe that will last 5 moreyears. The new lathe is expected to have a 5-year life and depreciation charges of$2,000 in year 1; $3,200 in year 2; $1,900 in year 3; $1,200 in both year 4 andyear 5; and $500 in year 6. The firm estimates the revenues and expenses (excludingdepreciation and interest) for the new and the old lathes to be as shown in the followingtable. The firm is subject to a 40% tax rate.New latheOld latheExpensesExpensesYear Revenue (excl. depr. and int.) Revenue (excl. depr. and int.)1 $40,000 $30,000 $35,000 $25,0002 41,000 30,000 35,000 25,0003 42,000 30,000 35,000 25,0004 43,000 30,000 35,000 25,0005 44,000 30,000 35,000 25,000a. Calculate the operating cash inflows associated with each lathe. (Note: Be sure toconsider the depreciation in year 6.)b. Calculate the incremental (relevant) operating cash inflows resulting from theproposed lathe replacement.c. Depict on a time line the incremental operating cash inflows calculated in part b.LG6LG6P8–19 Terminal cash flow—Various lives and sale prices Looner Industries is currentlyanalyzing the purchase of a new machine that costs $160,000 and requires $20,000in installation costs. Purchase of this machine is expected to result in an increase innet working capital of $30,000 to support the expanded level of operations. Thefirm plans to depreciate the machine under MACRS using a 5-year recovery period(see Table 3.2 on page 98 for the applicable depreciation percentages) and expects tosell the machine to net $10,000 before taxes at the end of its usable life. The firm issubject to a 40% tax rate.a. Calculate the terminal cash flow for a usable life of (1) 3 years, (2) 5 years,and (3) 7 years.b. Discuss the effect of usable life on terminal cash flows using your findings inpart a.c. Assuming a 5-year usable life, calculate the terminal cash flow if the machinewere sold to net (1) $9,000 or (2) $170,000 (before taxes) at the end of 5 years.d. Discuss the effect of sale price on terminal cash flow using your findings in part c.P8–20 Terminal cash flow—Replacement decision Russell Industries is consideringreplacing a fully depreciated machine that has a remaining useful life of 10 yearswith a newer, more sophisticated machine. The new machine will cost $200,000and will require $30,000 in installation costs. It will be depreciated under MACRSusing a 5-year recovery period (see Table 3.2 on page 98 for the applicable deprecia-2008935971Principles of Managerial Finance, Brief Fifth Edition, by Lawrence J. Gitman. Copyright © 2009 by Lawrence J. Gitman. Published by Prentice Hall.