Chapter 8 - Pearson Learning Solutions

Chapter 8 - Pearson Learning Solutions

Chapter 8 - Pearson Learning Solutions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

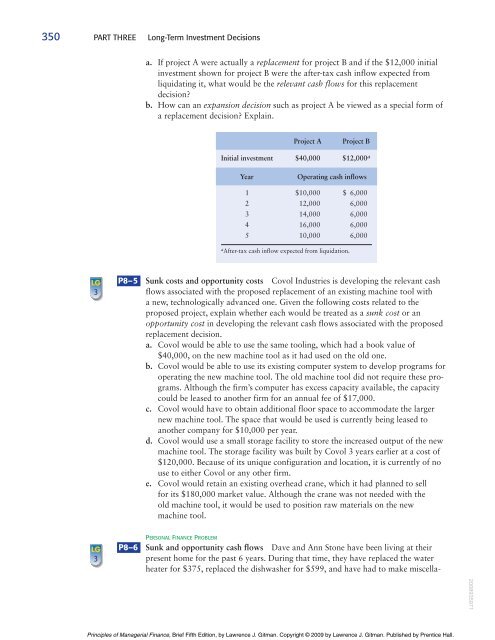

350 PART THREE Long-Term Investment Decisionsa. If project A were actually a replacement for project B and if the $12,000 initialinvestment shown for project B were the after-tax cash inflow expected fromliquidating it, what would be the relevant cash flows for this replacementdecision?b. How can an expansion decision such as project A be viewed as a special form ofa replacement decision? Explain.Project AProject BInitial investment $40,000 $12,000 aYearOperating cash inflows1 $10,000 $ 6,0002 12,000 6,0003 14,000 6,0004 16,000 6,0005 10,000 6,000a After-tax cash inflow expected from liquidation.LG3P8–5 Sunk costs and opportunity costs Covol Industries is developing the relevant cashflows associated with the proposed replacement of an existing machine tool witha new, technologically advanced one. Given the following costs related to theproposed project, explain whether each would be treated as a sunk cost or anopportunity cost in developing the relevant cash flows associated with the proposedreplacement decision.a. Covol would be able to use the same tooling, which had a book value of$40,000, on the new machine tool as it had used on the old one.b. Covol would be able to use its existing computer system to develop programs foroperating the new machine tool. The old machine tool did not require these programs.Although the firm’s computer has excess capacity available, the capacitycould be leased to another firm for an annual fee of $17,000.c. Covol would have to obtain additional floor space to accommodate the largernew machine tool. The space that would be used is currently being leased toanother company for $10,000 per year.d. Covol would use a small storage facility to store the increased output of the newmachine tool. The storage facility was built by Covol 3 years earlier at a cost of$120,000. Because of its unique configuration and location, it is currently of nouse to either Covol or any other firm.e. Covol would retain an existing overhead crane, which it had planned to sellfor its $180,000 market value. Although the crane was not needed with theold machine tool, it would be used to position raw materials on the newmachine tool.LG3PERSONAL FINANCE PROBLEMP8–6 Sunk and opportunity cash flows Dave and Ann Stone have been living at theirpresent home for the past 6 years. During that time, they have replaced the waterheater for $375, replaced the dishwasher for $599, and have had to make miscella-2008935971Principles of Managerial Finance, Brief Fifth Edition, by Lawrence J. Gitman. Copyright © 2009 by Lawrence J. Gitman. Published by Prentice Hall.