Chapter 8 - Pearson Learning Solutions

Chapter 8 - Pearson Learning Solutions

Chapter 8 - Pearson Learning Solutions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

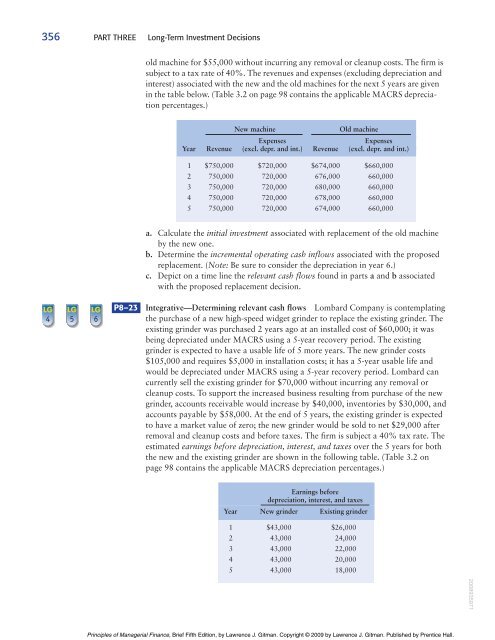

356 PART THREE Long-Term Investment Decisionsold machine for $55,000 without incurring any removal or cleanup costs. The firm issubject to a tax rate of 40%. The revenues and expenses (excluding depreciation andinterest) associated with the new and the old machines for the next 5 years are givenin the table below. (Table 3.2 on page 98 contains the applicable MACRS depreciationpercentages.)New machineOld machineExpensesExpensesYear Revenue (excl. depr. and int.) Revenue (excl. depr. and int.)1 $750,000 $720,000 $674,000 $660,0002 750,000 720,000 676,000 660,0003 750,000 720,000 680,000 660,0004 750,000 720,000 678,000 660,0005 750,000 720,000 674,000 660,000a. Calculate the initial investment associated with replacement of the old machineby the new one.b. Determine the incremental operating cash inflows associated with the proposedreplacement. (Note: Be sure to consider the depreciation in year 6.)c. Depict on a time line the relevant cash flows found in parts a and b associatedwith the proposed replacement decision.LG4LG5LG6P8–23 Integrative—Determining relevant cash flows Lombard Company is contemplatingthe purchase of a new high-speed widget grinder to replace the existing grinder. Theexisting grinder was purchased 2 years ago at an installed cost of $60,000; it wasbeing depreciated under MACRS using a 5-year recovery period. The existinggrinder is expected to have a usable life of 5 more years. The new grinder costs$105,000 and requires $5,000 in installation costs; it has a 5-year usable life andwould be depreciated under MACRS using a 5-year recovery period. Lombard cancurrently sell the existing grinder for $70,000 without incurring any removal orcleanup costs. To support the increased business resulting from purchase of the newgrinder, accounts receivable would increase by $40,000, inventories by $30,000, andaccounts payable by $58,000. At the end of 5 years, the existing grinder is expectedto have a market value of zero; the new grinder would be sold to net $29,000 afterremoval and cleanup costs and before taxes. The firm is subject a 40% tax rate. Theestimated earnings before depreciation, interest, and taxes over the 5 years for boththe new and the existing grinder are shown in the following table. (Table 3.2 onpage 98 contains the applicable MACRS depreciation percentages.)Earnings beforedepreciation, interest, and taxesYear New grinder Existing grinder1 $43,000 $26,0002 43,000 24,0003 43,000 22,0004 43,000 20,0005 43,000 18,0002008935971Principles of Managerial Finance, Brief Fifth Edition, by Lawrence J. Gitman. Copyright © 2009 by Lawrence J. Gitman. Published by Prentice Hall.