Annual Report 1999 - Parkway Pantai

Annual Report 1999 - Parkway Pantai

Annual Report 1999 - Parkway Pantai

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

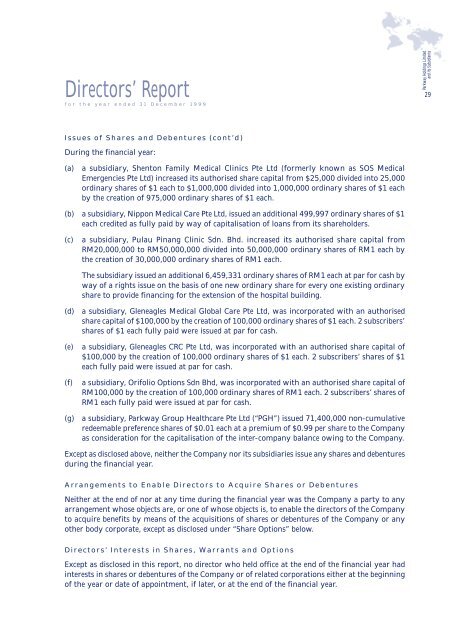

Directors’ <strong>Report</strong>for the year ended 31 December <strong>1999</strong><strong>Parkway</strong> Holdings Limitedand its Subsidiaries29Issues of Shares and Debentures (cont’d)During the financial year:(a)a subsidiary, Shenton Family Medical Clinics Pte Ltd (formerly known as SOS MedicalEmergencies Pte Ltd) increased its authorised share capital from $25,000 divided into 25,000ordinary shares of $1 each to $1,000,000 divided into 1,000,000 ordinary shares of $1 eachby the creation of 975,000 ordinary shares of $1 each.(b) a subsidiary, Nippon Medical Care Pte Ltd, issued an additional 499,997 ordinary shares of $1each credited as fully paid by way of capitalisation of loans from its shareholders.(c)a subsidiary, Pulau Pinang Clinic Sdn. Bhd. increased its authorised share capital fromRM20,000,000 to RM50,000,000 divided into 50,000,000 ordinary shares of RM1 each bythe creation of 30,000,000 ordinary shares of RM1 each.The subsidiary issued an additional 6,459,331 ordinary shares of RM1 each at par for cash byway of a rights issue on the basis of one new ordinary share for every one existing ordinaryshare to provide financing for the extension of the hospital building.(d)(e)(f)(g)a subsidiary, Gleneagles Medical Global Care Pte Ltd, was incorporated with an authorisedshare capital of $100,000 by the creation of 100,000 ordinary shares of $1 each. 2 subscribers’shares of $1 each fully paid were issued at par for cash.a subsidiary, Gleneagles CRC Pte Ltd, was incorporated with an authorised share capital of$100,000 by the creation of 100,000 ordinary shares of $1 each. 2 subscribers’ shares of $1each fully paid were issued at par for cash.a subsidiary, Orifolio Options Sdn Bhd, was incorporated with an authorised share capital ofRM100,000 by the creation of 100,000 ordinary shares of RM1 each. 2 subscribers’ shares ofRM1 each fully paid were issued at par for cash.a subsidiary, <strong>Parkway</strong> Group Healthcare Pte Ltd (“PGH”) issued 71,400,000 non-cumulativeredeemable preference shares of $0.01 each at a premium of $0.99 per share to the Companyas consideration for the capitalisation of the inter-company balance owing to the Company.Except as disclosed above, neither the Company nor its subsidiaries issue any shares and debenturesduring the financial year.Arrangements to Enable Directors to Acquire Shares or DebenturesNeither at the end of nor at any time during the financial year was the Company a party to anyarrangement whose objects are, or one of whose objects is, to enable the directors of the Companyto acquire benefits by means of the acquisitions of shares or debentures of the Company or anyother body corporate, except as disclosed under “Share Options” below.Directors’ Interests in Shares, Warrants and OptionsExcept as disclosed in this report, no director who held office at the end of the financial year hadinterests in shares or debentures of the Company or of related corporations either at the beginningof the year or date of appointment, if later, or at the end of the financial year.