Annual Report 1999 - Parkway Pantai

Annual Report 1999 - Parkway Pantai

Annual Report 1999 - Parkway Pantai

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

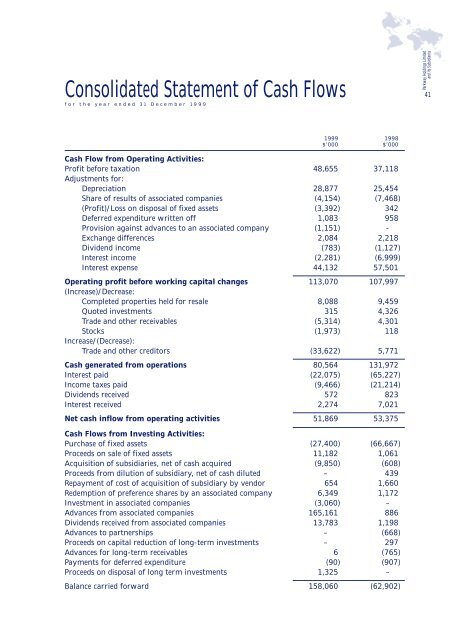

Consolidated Statement of Cash Flowsfor the year ended 31 December <strong>1999</strong><strong>Parkway</strong> Holdings Limitedand its Subsidiaries41<strong>1999</strong> 1998$’000 $’000Cash Flow from Operating Activities:Profit before taxation 48,655 37,118Adjustments for:Depreciation 28,877 25,454Share of results of associated companies (4,154) (7,468)(Profit)/Loss on disposal of fixed assets (3,392) 342Deferred expenditure written off 1,083 958Provision against advances to an associated company (1,151) -Exchange differences 2,084 2,218Dividend income (783) (1,127)Interest income (2,281) (6,999)Interest expense 44,132 57,501Operating profit before working capital changes 113,070 107,997(Increase)/Decrease:Completed properties held for resale 8,088 9,459Quoted investments 315 4,326Trade and other receivables (5,314) 4,301Stocks (1,973) 118Increase/(Decrease):Trade and other creditors (33,622) 5,771Cash generated from operations 80,564 131,972Interest paid (22,075) (65,227)Income taxes paid (9,466) (21,214)Dividends received 572 823Interest received 2,274 7,021Net cash inflow from operating activities 51,869 53,375Cash Flows from Investing Activities:Purchase of fixed assets (27,400) (66,667)Proceeds on sale of fixed assets 11,182 1,061Acquisition of subsidiaries, net of cash acquired (9,850) (608)Proceeds from dilution of subsidiary, net of cash diluted – 439Repayment of cost of acquisition of subsidiary by vendor 654 1,660Redemption of preference shares by an associated company 6,349 1,172Investment in associated companies (3,060) –Advances from associated companies 165,161 886Dividends received from associated companies 13,783 1,198Advances to partnerships – (668)Proceeds on capital reduction of long-term investments – 297Advances for long-term receivables 6 (765)Payments for deferred expenditure (90) (907)Proceeds on disposal of long term investments 1,325 –Balance carried forward 158,060 (62,902)