Annual Report 1999 - Parkway Pantai

Annual Report 1999 - Parkway Pantai

Annual Report 1999 - Parkway Pantai

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

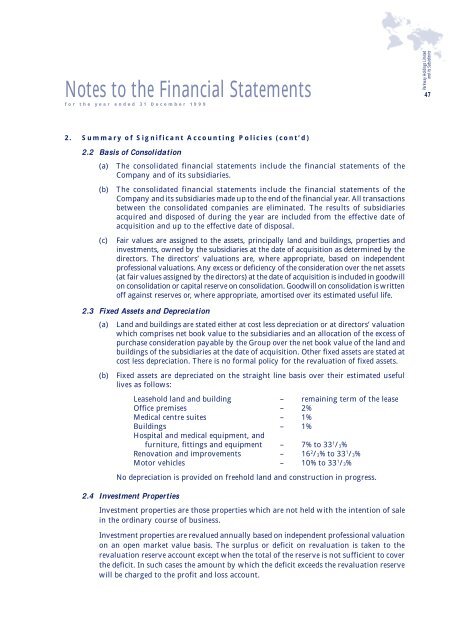

Notes to the Financial Statementsfor the year ended 31 December <strong>1999</strong><strong>Parkway</strong> Holdings Limitedand its Subsidiaries472. Summary of Significant Accounting Policies (cont’d)2.2 Basis of Consolidation(a) The consolidated financial statements include the financial statements of theCompany and of its subsidiaries.(b)(c)The consolidated financial statements include the financial statements of theCompany and its subsidiaries made up to the end of the financial year. All transactionsbetween the consolidated companies are eliminated. The results of subsidiariesacquired and disposed of during the year are included from the effective date ofacquisition and up to the effective date of disposal.Fair values are assigned to the assets, principally land and buildings, properties andinvestments, owned by the subsidiaries at the date of acquisition as determined by thedirectors. The directors’ valuations are, where appropriate, based on independentprofessional valuations. Any excess or deficiency of the consideration over the net assets(at fair values assigned by the directors) at the date of acquisition is included in goodwillon consolidation or capital reserve on consolidation. Goodwill on consolidation is writtenoff against reserves or, where appropriate, amortised over its estimated useful life.2.3 Fixed Assets and Depreciation(a) Land and buildings are stated either at cost less depreciation or at directors’ valuationwhich comprises net book value to the subsidiaries and an allocation of the excess ofpurchase consideration payable by the Group over the net book value of the land andbuildings of the subsidiaries at the date of acquisition. Other fixed assets are stated atcost less depreciation. There is no formal policy for the revaluation of fixed assets.(b)Fixed assets are depreciated on the straight line basis over their estimated usefullives as follows:Leasehold land and building – remaining term of the leaseOffice premises – 2%Medical centre suites – 1%Buildings – 1%Hospital and medical equipment, andfurniture, fittings and equipment – 7% to 33 1 /3%Renovation and improvements – 16 2 /3% to 33 1 /3%Motor vehicles – 10% to 33 1 /3%No depreciation is provided on freehold land and construction in progress.2.4 Investment PropertiesInvestment properties are those properties which are not held with the intention of salein the ordinary course of business.Investment properties are revalued annually based on independent professional valuationon an open market value basis. The surplus or deficit on revaluation is taken to therevaluation reserve account except when the total of the reserve is not sufficient to coverthe deficit. In such cases the amount by which the deficit exceeds the revaluation reservewill be charged to the profit and loss account.