Council Tax Leaflet - Basingstoke and Deane Borough Council

Council Tax Leaflet - Basingstoke and Deane Borough Council

Council Tax Leaflet - Basingstoke and Deane Borough Council

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Basingstoke</strong> <strong>and</strong> <strong>Deane</strong><strong>Borough</strong> <strong>Council</strong>Civic OfficesLondon Road<strong>Basingstoke</strong>RG21 4AHTel: 01256 844844Emailinfo@basingstoke.gov.ukWebsitewww.basingstoke.gov.ukHampshire County <strong>Council</strong>0800 028 0888 Textphone: 0808 100 2484or e-mail info.centres@hants.gov.ukwww.hants.gov.ukBudget questionsCounty Treasurer’s DepartmentHampshire County <strong>Council</strong>The Castle, Winchester SO23 8UBEmail: budget@hants.gov.ukwww.hants.gov.uk/finance/budgetHampshire Police AuthorityWestgate Chambers, Staple GardensWinchester SO23 8AW01962 871595e-mail police.authority@hampshire.pnn.police.ukwww.hantspa.orgYou can use the Single Non Emergency Number 101across Hampshire for concerns about antisocial behaviour,including litter <strong>and</strong> graffiti, but always use 999 if crime ordisorder is in progress or life or personal safety are at risk.yourguideto your council tax…workingtogether for asecure futureHampshire Fire <strong>and</strong> Rescue Authority023 8064 4000e-mail reception@hantsfire.gov.ukwww.hantsfire.gov.ukBudget questionsFinancial ServicesHampshire Fire <strong>and</strong> Rescue Service Headquarters,Leigh Road, Eastleigh SO50 9SJ023 8062 6867e-mail finance@hantsfire.gov.uk<strong>Basingstoke</strong> <strong>and</strong> <strong>Deane</strong> <strong>Borough</strong> <strong>Council</strong>Hampshire County <strong>Council</strong>20072008HampshirePOLICE AUTHORITYfor Hampshire & the Isle of WightHampshire Police AuthorityHampshireFire <strong>and</strong> Rescue AuthorityHampshire Fire <strong>and</strong> Rescue Authority

24 COMBINED_BASINGSTOKE 1/3/07 08:51 Page 3welcome!We all use public services. Some areprovided by authorities covering the wholecounty, others are provided by your localcouncil. Some of the funding for theseservices comes from a government grantwhich includes contributions from businessrates. The rest is paid for by collectingcouncil tax. For the first time this year wehave brought together information aboutthe services provided by each of theorganisations funded by your council tax.We hope this will give you a clearer pictureof how your council tax is set <strong>and</strong> how themoney is spent.f H hi & th I l f Wi htHampshirePOLICE AUTHORITYfor Hampshire & the Isle of WightProviding services like wastecollection <strong>and</strong> kerbside recycling,street cleaning, housing, community<strong>and</strong> leisure facilities.Providing services like care for the elderly,vulnerable children <strong>and</strong> those with physicaldisabilities, education, roads, disposal ofwaste, recycling centres, libraries <strong>and</strong>registration services.Together with Hampshire Constabulary,delivering efficient <strong>and</strong> effective policingfor Hampshire <strong>and</strong> the Isle of Wight.HampshireFire <strong>and</strong> Rescue Authority• Preventing fires <strong>and</strong> other risks.• Protecting lives <strong>and</strong> properties.• Responding to fires <strong>and</strong> other emergencies.

24 COMBINED_BASINGSTOKE 1/3/07 08:51 Page 5Inflation only rise in council taxOur borough council budget focuses ongetting the best value for money for yourcouncil tax.That is how the borough council’s share of counciltax has an ‘inflation only’ rise. <strong>Council</strong> tax payersat b<strong>and</strong> D pay just 27p per day for the serviceswe provide.We are constantly seeking more efficient ways toprovide our services to you. Over the next threeyears we are looking for more savings in how webuy supplies, in our staffing <strong>and</strong> in the way weprovide services. Through these savings we havebeen able to fund new initiatives in next year’sbudget to improve road safety, supportcommunity-based events <strong>and</strong> resource the use ofCCTV.The <strong>Council</strong> Plan 2007 to 2009 sets out the keypriorities that will guide our decisions <strong>and</strong> wherewe focus our resources. Our main aims are: Prosperity for the borough <strong>and</strong> everyone wholives <strong>and</strong> works here, attracting <strong>and</strong> retainingbusinesses <strong>and</strong> providing excellent, well-paidwork opportunities for local people. The long-term well-being of all residents -ensuring people feel safe <strong>and</strong> can live <strong>and</strong> workin attractive surroundings <strong>and</strong> in healthycommunities. Making sure everyone in the community isinvolved in making decisions about the areawhere they live <strong>and</strong> can access services <strong>and</strong>facilities. Forming effective partnerships where workingwith other bodies <strong>and</strong> groups is the best way todeliver services.What is the council going to do?Here are just some examples, giving a flavour ofproposed activities to put the priorities into action: Investing to meet local community needs – forexample by working with primary care trusts to buildnew GP surgeries in areas where they are needed. Image of the borough – working in partnershipwith the business community <strong>and</strong> other key playersto promote the borough by enhancing its reputationto ensure continued economic prosperity. Thriving local economy - working with other localauthorities on the diamonds for growth initiative toattract new businesses to the area. Investigating new ways to help people wanting toenter the housing market – for example ‘intermediaterental housing’ homes which are offered at 70% ofthe usual market rent.We will continue to look for the most innovative <strong>and</strong>creative ways to deliver good quality services that meetthe needs of the borough <strong>and</strong> make the best use of ourresources, both in terms of finances <strong>and</strong> property.Cllr John Leek<strong>Council</strong> LeaderWhere does yourcouncil tax go?You pay your council tax to <strong>Basingstoke</strong> <strong>and</strong> <strong>Deane</strong><strong>Borough</strong> <strong>Council</strong>, but not all the money goes to us.Our share of the council tax is only about 8% - theequivalent of 27p per day for a b<strong>and</strong> D property inthe borough.The council tax wecollect goes to:<strong>Basingstoke</strong><strong>and</strong> <strong>Deane</strong><strong>Borough</strong>Hampshire <strong>Council</strong>PoliceAuthority£125.3710 %£96.758 % HampshireFire <strong>and</strong>HampshireCounty<strong>Council</strong>Rescue £955.62Authority 77 %£56.075 %4www.basingstoke.gov.uk www.basingstoke.gov.uk 5

24 COMBINED_BASINGSTOKE 1/3/07 08:51 Page 9Why spending haschangedWhat this means for ab<strong>and</strong> D council tax payerPaying your bill, council taxbenefit <strong>and</strong> discountsThere are reasons other than inflation why ourbudget has to change.The table below shows the major changes to income<strong>and</strong> expenditure between 2006/2007 <strong>and</strong>2007/2008.Increased expenditure: £mcaused by inflation 1.5caused by extra dem<strong>and</strong> <strong>and</strong> improved services 0.1caused by increased contributions to reserves 0.4Offset by:efficiency savings -0.4increased income from investments -0.9increased income from property rents -0.3Total change in budget requirement 0.4(growth in net expenditure)All the information given in this leaflet refers tocouncil tax in a b<strong>and</strong> D property that doesn’t havea parish council. The total charge for the boroughcouncil for the b<strong>and</strong> D council tax payer for2007/08 is shown below.Gross expenditure on services £1,451.36Less : income <strong>and</strong> use of reserves -£1,199.16Budget requirement £252.20Less: government funding -£155.45To be met by council tax payers £96.75Your bill shows which b<strong>and</strong> your property is in <strong>and</strong>the exact charge to you. We’ve also includedinformation on the council tax for a b<strong>and</strong> Dproperty in the borough’s towns <strong>and</strong> parishes.Each property is placed in a property b<strong>and</strong> by theValuation Office Agency (Inl<strong>and</strong> Revenue). Theamount of council tax you have to pay is shown onyour bill issued by the council.It is important that we receive your payments on orbefore the date shown on your bill, to prevent theneed for recovery action to be taken.<strong>Council</strong> tax regulations state we must assume thereare at least two adults living in the property, unlessadvised otherwise. If you are the only person livingin your property <strong>and</strong> single person discount is notshown on your bill please contact the Local <strong>Tax</strong>team (contact details below).Some households are entitled to a discount ofbetween 10% <strong>and</strong> 50% on their bill. Examples ofthese are properties with only one resident,properties which are furnished but not occupied<strong>and</strong> second homes.A council tax bill may be reduced if the property hasa special feature, such as an additional bathroomwhich is required to meet the needs of a disabledresident. Some properties may be exempt fromcouncil tax, for example, if they are unfurnished <strong>and</strong>unoccupied or occupied solely by students.Residents on a low income may be entitled tocouncil tax benefit.If you would like to know more about discounts,exemptions, council tax benefit or if you are unableto pay the instalments shown on your bill, pleasecontact the Local <strong>Tax</strong> team on 01256 358555,e-mail localtax@basingstoke.gov.uk or visit ourwebsite www.basingstoke.gov.ukWant to know more?This leaflet is intended to give you a snapshot ofhow our part of your council tax is spent by us <strong>and</strong>our budget plans.If you want to find our more about our plans <strong>and</strong>finances, further information can be found in:• the Detailed Budget Book – giving a breakdownof the council’s budget• the <strong>Council</strong> Plan – outlining our futurepriorities <strong>and</strong> plans• the Statement of Accounts – detailing our pastperformance.All are available on the website or from our CivicOffices in London Road, <strong>Basingstoke</strong>, or by callingour customer contact centre on 01256 844844.If you require a large print version of this leaflet,please contact us on 01256 358555.8www.basingstoke.gov.uk www.basingstoke.gov.uk 9

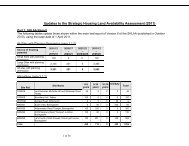

24 COMBINED_BASINGSTOKE 1/3/07 08:51 Page 11B<strong>and</strong> Dcouncil taxin parishesHere is an at a glanceguide to b<strong>and</strong> D counciltax charges in differentparts of the borough. Itshows the total counciltax for a b<strong>and</strong> Dproperty in each area<strong>and</strong> includes theamounts required forHampshire County<strong>Council</strong>, HampshirePolice Authority,Hampshire Fire <strong>and</strong>Rescue Authority,<strong>Basingstoke</strong> <strong>and</strong> <strong>Deane</strong><strong>Borough</strong> <strong>Council</strong> <strong>and</strong>your parish or towncouncil (if this applies):PARISH/AREA 2006/07 2007/08 2007/08 2007/08PARISH TOTAL PARISH TOTAL PARISH TOTAL BAND DAMOUNT AMOUNT AMOUNT COUNCILREQUIRED REQUIRED ADDED TO TAXBAND D£ £ £ £Ashford Hill with Headley 14,435.00 16,435.00 29.80 1,263.61Ashmansworth 0.00 500.00 4.76 1,238.57Baughurst 23,000.00 23,500.00 23.60 1,257.41Bramley 22,000.00 22,000.00 15.05 1,248.86Burghclere 9,000.00 9,000.00 17.09 1,250.90C<strong>and</strong>overs 2,000.00 2,000.00 20.28 1,254.09Chineham 42,900.00 43,900.00 13.75 1,247.56Cliddesden 5,367.00 5,410.00 22.92 1,256.73Dummer 4,580.00 6,500.00 29.59 1,263.40East Woodhay 17,500.00 18,000.00 14.19 1,248.00Ecchinswell, Sydmonton& Bishops Green 6,800.00 7,282.00 17.29 1,251.10Ellisfield 2,760.00 3,566.00 23.19 1,257.00Hannington 3,000.00 3,000.00 16.16 1,249.97Highclere 12,879.00 13,265.00 17.76 1,251.57Hurstbourne Priors 4,300.00 4,600.00 29.19 1,263.00Kingsclere 40,000.00 40,500.00 29.32 1,263.13Laverstoke 5,000.00 5,000.00 29.48 1,263.29Mapledurwell & Up Nately 2,350.00 3,800.00 13.13 1,246.94Monk Sherborne 6,900.00 7,150.00 39.09 1,272.90Mortimer West End 5,305.00 5,305.00 29.39 1,263.20Newnham 4,250.00 4,400.00 18.54 1,252.35Newtown 4,000.00 4,000.00 29.78 1,263.59North Waltham 9,500.00 9,785.00 25.29 1,259.10Oakley & <strong>Deane</strong> 61,850.00 64,850.00 27.64 1,261.45Old Basing & Lychpit 120,475.00 120,450.00 37.79 1,271.60Overton 52,911.00 52,911.00 32.24 1,266.05Pamber 24,500.00 24,500.00 20.47 1,254.28PARISH/AREA 2006/07 2007/08 2007/08 2007/08PARISH TOTAL PARISH TOTAL PARISH TOTAL BAND DAMOUNT AMOUNT AMOUNT COUNCILREQUIRED REQUIRED ADDED TO TAXBAND D£ £ £ £Preston C<strong>and</strong>over & Nutley 6,100.00 6,300.00 28.13 1,261.94Rooksdown 9,695.00 9,400.00 13.74 1,247.55Sherborne St John 16,900.00 24,700.00 36.48 1,270.29Sherfield-on-Loddon 23,965.00 32,179.00 35.85 1,269.66Silchester 9,500.00 10,213.00 24.21 1,258.02St Mary Bourne 15,355.00 15,225.00 26.50 1,260.31Stratfield Saye 3,000.00 2,000.00 14.57 1,248.38Tadley 133,680.00 121,525.00 28.67 1,262.48Upton Grey 5,000.00 6,000.00 18.32 1,252.13Whitchurch 61,325.00 67,136.00 35.91 1,269.72Wootton St Lawrence 3,200.00 3,200.00 11.24 1,245.05If you do not live in one of theareas above 1,233.81Property b<strong>and</strong>ingsAll homes within the borough are placed withineight broad valuation groupings, which initiallydetermine the level of council tax each householdwill pay.These valuation b<strong>and</strong>s, <strong>and</strong> the specific propertiesthat fall within them, are decided by theGovernment Valuation Office Agency. They arebased on the price that the property would haveachieved if it had been sold on 1 April 1991.All figures in the borough council section of thisleaflet are based on b<strong>and</strong> D valuations. To work outyour exact council tax from this, use the table onthe right.B<strong>and</strong>ProportionA Multiply by 6 then divide by 9B Multiply by 7 then divide by 9C Multiply by 8 then divide by 9DAs shownE Multiply by 11 then divide by 9F Multiply by 13 then divide by 9G Multiply by 15 then divide by 9H Multiply by 210www.basingstoke.gov.uk www.basingstoke.gov.uk 11