Talwalkars Better Value Fitness (TALWAL) - ICICI Direct

Talwalkars Better Value Fitness (TALWAL) - ICICI Direct

Talwalkars Better Value Fitness (TALWAL) - ICICI Direct

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

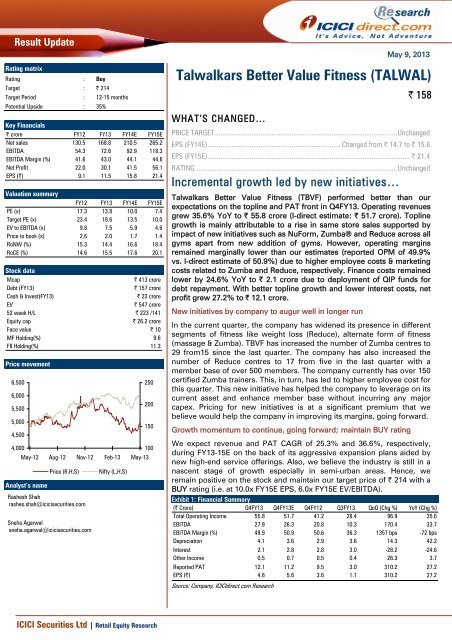

Result UpdateRating matrixRating : BuyTarget : | 214Target Period : 12-15 monthsPotential Upside : 35%Key Financials| crore FY12 FY13 FY14E FY15ENet sales 130.5 168.8 210.5 265.2EBITDA 54.3 72.6 92.9 118.3EBITDA Margin (%) 41.6 43.0 44.1 44.6Net Profit 22.0 30.1 41.5 56.1EPS (|) 9.1 11.5 15.8 21.4Valuation summaryFY12 FY13 FY14E FY15EPE (x) 17.3 13.8 10.0 7.4Target PE (x) 23.4 18.6 13.5 10.0EV to EBITDA (x) 9.8 7.5 5.9 4.6Price to book (x) 2.6 2.0 1.7 1.4RoNW (%) 15.3 14.4 16.6 18.4RoCE (%) 14.6 15.5 17.6 20.1Stock dataMcap| 413 croreDebt (FY13)| 157 croreCash & Invest(FY13)| 23 croreEV| 547 crore52 week H/L | 223 /141Equity cap| 26.2 croreFace value | 10MF Holding(%) 9.6FII Holding(%) 11.3Price movement6,5006,0005,5005,0004,5004,000May-12Analyst’s nameAug-12Price (R.H.S)Nov-12Rashesh Shahrashes.shah@icicisecurities.comSneha Agarwalsneha.agarwal@icicisecurities.comFeb-13Nifty (L.H.S)May-13250200150100WHAT’S CHANGED…May 9, 2013<strong>Talwalkars</strong> <strong>Better</strong> <strong>Value</strong> <strong>Fitness</strong> (<strong>TALWAL</strong>)PRICE TARGET ....................................................................................................UnchangedEPS (FY14E)......................................................................... Changed from | 14.7 to | 15.8EPS (FY15E)............................................................................................................... | 21.4RATING...............................................................................................................UnchangedIncremental growth led by new initiatives…<strong>Talwalkars</strong> <strong>Better</strong> <strong>Value</strong> <strong>Fitness</strong> (TBVF) performed better than ourexpectations on the topline and PAT front in Q4FY13. Operating revenuesgrew 35.6% YoY to | 55.8 crore (I-direct estimate: | 51.7 crore). Toplinegrowth is mainly attributable to a rise in same store sales supported byimpact of new initiatives such as NuForm, Zumba® and Reduce across allgyms apart from new addition of gyms. However, operating marginsremained marginally lower than our estimates (reported OPM of 49.9%vs. I-direct estimate of 50.9%) due to higher employee costs & marketingcosts related to Zumba and Reduce, respectively. Finance costs remainedlower by 24.6% YoY to | 2.1 crore due to deployment of QIP funds fordebt repayment. With better topline growth and lower interest costs, netprofit grew 27.2% to | 12.1 crore.New initiatives by company to augur well in longer runIn the current quarter, the company has widened its presence in differentsegments of fitness like weight loss (Reduce), alternate form of fitness(massage & Zumba). TBVF has increased the number of Zumba centres to29 from15 since the last quarter. The company has also increased thenumber of Reduce centres to 17 from five in the last quarter with amember base of over 500 members. The company currently has over 150certified Zumba trainers. This, in turn, has led to higher employee cost forthis quarter. This new initiative has helped the company to leverage on itscurrent asset and enhance member base without incurring any majorcapex. Pricing for new initiatives is at a significant premium that webelieve would help the company in improving its margins, going forward.Growth momentum to continue, going forward; maintain BUY ratingWe expect revenue and PAT CAGR of 25.3% and 36.6%, respectively,during FY13-15E on the back of its aggressive expansion plans aided bynew high-end service offerings. Also, we believe the industry is still in anascent stage of growth especially in semi-urban areas. Hence, weremain positive on the stock and maintain our target price of | 214 with aBUY rating (i.e. at 10.0x FY15E EPS, 6.0x FY15E EV/EBITDA).Exhibit 1: Financial Summary(| Crore) Q4FY13 Q4FY13E Q4FY12 Q3FY13 QoQ (Chg %) YoY (Chg %)Total Operating Income 55.8 51.7 41.2 28.4 96.9 35.6EBITDA 27.9 26.3 20.8 10.3 170.4 33.7EBITDA Margin (%) 49.9 50.9 50.6 36.3 1357 bps -72 bpsDepreciation 4.1 3.6 2.9 3.6 14.3 42.2Interest 2.1 2.8 2.8 3.0 -28.2 -24.6Other Income 0.5 0.7 0.5 0.4 26.3 3.7Reported PAT 12.1 11.2 9.5 3.0 310.2 27.2EPS (|) 4.6 5.6 3.6 1.1 310.2 27.2Source: Company, <strong>ICICI</strong>direct.com Research| 158<strong>ICICI</strong> Securities Ltd | Retail Equity Research

Exhibit 2: Consolidated revenue and QoQ growth trend6056.155.8120Net sales for Q4FY13 grew 35.6% YoY driven by 7-8% risein fees, increase in number of gyms and launch of newservices(| crore)5040302041.228.528.4100806040200(%)10-20-400-60Q4FY12 Q1FY13 Q2FY13 Q3FY13 Q4FY13RevenueQoQ GrowthSource: Company, <strong>ICICI</strong>direct.com ResearchExhibit 3: EBITDA & PAT margin trend60The EBITDA margin declined 70 bps YoY due to a sharprise in employee and marketing cost owing to newservice offerings(%)50403050.632.345.036.349.92023.221.721.7109.210.40Q4FY12 Q1FY13 Q2FY13 Q3FY13 Q4FY13EBITDA MarginPAT MarginSource: Company, <strong>ICICI</strong>direct.com ResearchExhibit 4: Number of health clubsExhibit 5: Number of health clubs by ownership250200150175205Licensed/Franchised9%HiFi10%Nos1005094128130130137144Subsidiaries10%Owned71%0FY11FY12Q1FY13Q2FY13Q3FY13Q4FY13FY14EFY15ESource: Company, <strong>ICICI</strong>direct.com ResearchSource: Company, <strong>ICICI</strong>direct.com Research<strong>ICICI</strong> Securities Ltd | Retail Equity Research Page 2

Exhibit 6: Members growth trendTotal gyms for the quarter increased marginally QoQ.However, on a YoY basis, it grew over 10% to 1,33,000members(In '000)200180160140120100806040200185162125 126 130 132 1338359.0FY10 FY11 FY12 Q1FY13 Q2FY13 Q3FY13 Q4FY13 FY14E FY15ESource: Company, <strong>ICICI</strong>direct.com ResearchRecent initiatives taken by companyIn the current quarter, the company has widened its presence in differentsegments of fitness like weight loss (Reduce), alternate form of fitness(massage & Zumba). These initiatives are earnings accretive for thebusiness due to its low dependence on capex. Some of these activitiescan also be developed as standalone services outside the fitness centre.TBVF has increased the Zumba centres to 29 from 15 since the lastquarter result. The company currently has over 150 certified Zumbatrainers. Currently, large corporates, including MNCs, are availing Zumbaprogramme and NuForm. The company is actively looking at otheravenues like schools, colleges, home based services, etc.TBVF has also increased the number of Reduce centres to 17 from five inthe last quarter. The member base has widened to over 500 members.Reduce is also offered as “Home based Reduce”, primarily catering to HNIand corporates at their door step. This requires minimal capex. Hence, ithas an incremental positive impact on the fitness centre’s profitability.These new initiatives have helped the company to leverage on its currentasset and enhance the member base without incurring any major capex.Pricing for new initiatives is at a significant premium that we believewould help the company in improve its margins, going forward.<strong>ICICI</strong> Securities Ltd | Retail Equity Research Page 3

Financial summaryProfit and loss statement(| Crore)(Year-end March) FY12 FY13 FY14E FY15ETotal operating Income 130.5 168.8 210.5 265.2Growth (%) 27.6 29.3 24.7 26.0Employee Expenses 24.8 31.2 38.9 49.0Marketing Expenses 4.1 47.0 53.5 66.1Administrative Expenses 36.2 0.0 0.0 0.0Rent 0.0 0.0 0.0 0.0Other Exp 11 18 25 32Total Operating Expenditure 76.2 96.1 117.6 146.9EBITDA 54.3 72.7 92.9 118.3Growth (%) 35.5 33.9 27.7 27.4Depreciation 11.8 14.6 18.3 20.9Interest 9.1 10.8 11.4 11.7Other Income 1.6 1.3 1.6 1.8PBT 34.9 48.6 64.7 87.5Others 2.5 2.7 1.9 2.5Total Tax 10.4 15.8 21.3 28.9PAT 22.0 30.1 41.5 56.1Growth (%) 37.5 36.4 37.9 35.4EPS (|) 9.1 11.5 15.8 21.4Source: Company, <strong>ICICI</strong>direct.com ResearchBalance sheet(| Crore)(Year-end March) FY12 FY13 FY14E FY15ELiabilitiesEquity Capital 24.12 26.2 26.2 26.2Reserve and Surplus 120.0 182.1 223.6 279.7Total Shareholders funds 144.1 208.3 249.7 305.9Total Debt 141.2 156.6 163.6 167.0Deferred Tax Liability 14.3 19.2 20.5 21.7Minority Interest / Others 5.0 8.1 9.9 12.4Total Liabilities 304.8 392.2 443.9 507.0AssetsGross Block 261.5 377.4 422.4 487.4Less: Acc Depreciation 37.0 51.6 70.0 90.8Net Block 224.5 325.8 352.5 396.6Capital WIP 27.4 27.4 32.4 32.4Total Fixed Assets 251.9 353.2 384.9 429.0Intangibles 4.6 4.6 4.6 4.6Investments 18.4 22.7 26.7 30.7Long term Loans and Adv 0.0 0.0 0.0 0.0Debtors 20.1 17.8 26.0 32.7Loans and Advances 22.6 29.3 35.4 44.1Cash 19.8 22.9 29.1 35.2Total Current Assets 62.5 69.9 90.5 112.0Creditors 22.6 42.8 46.1 50.9Provisions 10.1 15.5 16.7 18.4Other current liabilities 0.0 0.0 0.0 0.0Total Current Liabilities 32.7 58.3 62.8 69.3Net Current Assets 29.9 11.7 27.6 42.7Application of Funds 304.8 392.3 443.9 507.1Source: Company, <strong>ICICI</strong>direct.com ResearchCash flow statement(| Crore)(Year-end March) FY12 FY13 FY14E FY15EProfit after Tax 22.0 30.1 41.5 56.1Add: Depreciation 11.8 14.6 18.3 20.9(Inc)/dec in Current Assets 1.9 -4.4 -14.3 -15.5Inc/(dec) in CL and Provisions 4.1 25.5 4.6 6.4CF from operating activities 39.8 65.9 50.1 68.0(Inc)/dec in Investments -9.8 -4.3 -4.0 -4.0(Inc)/dec in Fixed Assets -62.4 -116.0 -50.0 -65.0Others 6.2 8.0 3.2 3.7CF from investing activities -65.9 -112.3 -50.8 -65.3Issue/(Buy back) of Equity 0.0 2.1 0.0 0.0Inc/(dec) in loan funds 20.1 15.3 7.0 3.4Dividend paid & dividend tax 0.0 0.0 0.0 0.0Inc/(dec) in Sec. premium 0.0 27.2 0.0 0.0Others -4.8 4.8 0.0 0.0CF from financing activities 15.3 49.4 7.0 3.4Net Cash flow -10.8 3.0 6.2 6.1Opening Cash 30.6 19.8 22.9 29.1Closing Cash 19.8 22.9 29.1 35.2Source: Company, <strong>ICICI</strong>direct.com ResearchKey ratios(Year-end March) FY12 FY13 FY14E FY15EPer share data (|)EPS 9.1 11.5 15.8 21.4Cash EPS 14.0 17.1 22.8 29.4BV 59.8 79.6 95.4 116.8DPS 0.5 0.0 0.0 0.0Cash Per Share 9.5 14.0 17.1 22.8Operating Ratios (%)EBITDA Margin 41.6 43.0 44.1 44.6PBT / Total Operating income 16.9 17.8 19.7 21.2Asset Turnover 0.5 0.5 0.5 0.6Debtor days 56.2 38.4 45.0 45.0Creditor days 63.2 92.5 80.0 70.0Return Ratios (%)RoE 15.3 14.4 16.6 18.4RoCE 14.6 15.5 17.6 20.1RoIC 10.5 10.6 12.0 13.8Valuation Ratios (x)P/E 17.3 13.8 10.0 7.4EV / EBITDA 9.8 7.5 5.9 4.6EV / Net Sales 4.1 3.2 2.6 2.1Market Cap / Sales 3.2 2.5 2.0 1.6Price to Book <strong>Value</strong> 2.6 2.0 1.7 1.4Solvency RatiosDebt/EBITDA 2.6 2.2 1.8 1.4Debt / Equity 1.0 0.8 0.7 0.5Current Ratio 1.9 1.2 1.4 1.6Quick Ratio 1.3 0.8 1.0 1.1Source: Company, <strong>ICICI</strong>direct.com Research<strong>ICICI</strong> Securities Ltd | Retail Equity Research Page 4

Company Description<strong>Talwalkars</strong> <strong>Better</strong> <strong>Value</strong> <strong>Fitness</strong> (TBVF) is a fitness chain offering a suite ofsolutions, including gyms, spa therapy, nutrition counselling,physiotherapy guidance, aerobic activity classes and yoga sessions underthe brand <strong>Talwalkars</strong>. Its other products and services include spinningstudio, pilates and weight loss regimen. The company has an 8,000 sq ftresidential training academy at Thane. The training academy offers atraining programme of four to six weeks for its staff joining at the newcentres. As of December 2012, it operated 137 health dubs in 73 citiesand has more than 132,000 members. Its health clubs and training centresare located in Andhra Pradesh, Gujarat, Karnataka, Kerala, Maharashtra,Madhya Pradesh, Punjab, Rajasthan, Tamil Nadu, Uttar Pradesh and WestBengal. In April 2012, the company, through its subsidiary, opened ahealth club in Gandhinagar.Exhibit 7: Recommendation History250200150100500May-12Jun-12Aug-12Sep-12Nov-12Dec-12Feb-13Mar-13May-13PriceTarget PriceSource: <strong>ICICI</strong>direct.com ResearchExhibit 8: Recent ReleasesDate Event CMP Target Price Rating13-Feb-12 Initiating coverage 157 190 BUY24-May-12 Q4F12 Result update 163 190 BUY14-Aug-12 Q1F13 Result update 156 190 BUY19-Oct-12 Q2F13 Result update 195 219 BUY11-Feb-13 Q3FY13 Result update 168 219 BUYSource: <strong>ICICI</strong>direct.com ResearchExhibit 9: AssumptionsYear FY12 FY13 FY14E FY15ENew Gym additions 20 13 29 23Members per Gym 1011 1083 1080 1000Revenue per member (|) 13813 14227 14938 15835Average revenue per gym (| cr) 1.3 1.5 1.2 1.3Source: <strong>ICICI</strong>direct.com Research<strong>ICICI</strong> Securities Ltd | Retail Equity Research Page 5

RATING RATIONALE<strong>ICICI</strong>direct.com endeavours to provide objective opinions and recommendations. <strong>ICICI</strong>direct.com assignsratings to its stocks according to their notional target price vs. current market price and then categorises themas Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the notionaltarget price is defined as the analysts' valuation for a stock.Strong Buy: >15%/20% for large caps/midcaps, respectively, with high conviction;Buy: >10%/15% for large caps/midcaps, respectively;Hold: Up to +/-10%;Sell: -10% or more;Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com<strong>ICICI</strong>direct.com Research Desk,<strong>ICICI</strong> Securities Limited,1 st Floor, Akruti Trade Centre,Road No. 7, MIDC,Andheri (East)Mumbai – 400 093research@icicidirect.comANALYST CERTIFICATIONWe /I, Rashesh Shah CA, Sneha Agarwal MBA, research analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect ourpersonal views about any and all of the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) orview(s) in this report. Analysts aren't registered as research analysts by FINRA and might not be an associated person of the <strong>ICICI</strong> Securities Inc.Disclosures:<strong>ICICI</strong> Securities Limited (<strong>ICICI</strong> Securities) and its affiliates are a full-service, integrated investment banking, investment management and brokerage and financing group. We along with affiliates are leadingunderwriter of securities and participate in virtually all securities trading markets in India. We and our affiliates have investment banking and other business relationship with a significant percentage ofcompanies covered by our Investment Research Department. Our research professionals provide important input into our investment banking and other business selection processes. <strong>ICICI</strong> Securitiesgenerally prohibits its analysts, persons reporting to analysts and their dependent family members from maintaining a financial interest in the securities or derivatives of any companies that the analystscover.The information and opinions in this report have been prepared by <strong>ICICI</strong> Securities and are subject to change without any notice. The report and information contained herein is strictly confidential andmeant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, withoutprior written consent of <strong>ICICI</strong> Securities. While we would endeavour to update the information herein on reasonable basis, <strong>ICICI</strong> Securities, its subsidiaries and associated companies, their directors andemployees (“<strong>ICICI</strong> Securities and affiliates”) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent <strong>ICICI</strong> Securitiesfrom doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or <strong>ICICI</strong> Securitiespolicies, in circumstances where <strong>ICICI</strong> Securities is acting in an advisory capacity to this company, or in certain other circumstances.This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. Thisreport and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financialinstruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. <strong>ICICI</strong> Securities will not treat recipients as customers by virtue of theirreceiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specificcircumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investmentobjectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluatethe investment risks. The value and return of investment may vary because of changes in interest rates, foreign exchange rates or any other reason. <strong>ICICI</strong> Securities and affiliates accept no liabilities for anyloss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand therisks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject tochange without notice.<strong>ICICI</strong> Securities and its affiliates might have managed or co-managed a public offering for the subject company in the preceding twelve months. <strong>ICICI</strong> Securities and affiliates might have receivedcompensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of public offerings, corporate finance, investmentbanking or other advisory services in a merger or specific transaction. It is confirmed that Rashesh Shah CA, Sneha Agarwal MBA research analysts and the authors of this report have not received anycompensation from the companies mentioned in the report in the preceding twelve months. Our research professionals are paid in part based on the profitability of <strong>ICICI</strong> Securities, which include earningsfrom Investment Banking and other business.<strong>ICICI</strong> Securities or its subsidiaries collectively do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of theresearch report.It is confirmed that Rashesh Shah CA Sneha Agarwal MBA, research analysts and the authors of this report or any of their family members does not serve as an officer, director or advisory board memberof the companies mentioned in the report.<strong>ICICI</strong> Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. <strong>ICICI</strong> Securities and affiliates may act upon or make useof information contained in the report prior to the publication thereof.This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution,publication, availability or use would be contrary to law, regulation or which would subject <strong>ICICI</strong> Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securitiesdescribed herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of andto observe such restriction.<strong>ICICI</strong> Securities Ltd | Retail Equity Research Page 6