M&M Financial (MAHFIN) - ICICI Direct

M&M Financial (MAHFIN) - ICICI Direct

M&M Financial (MAHFIN) - ICICI Direct

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

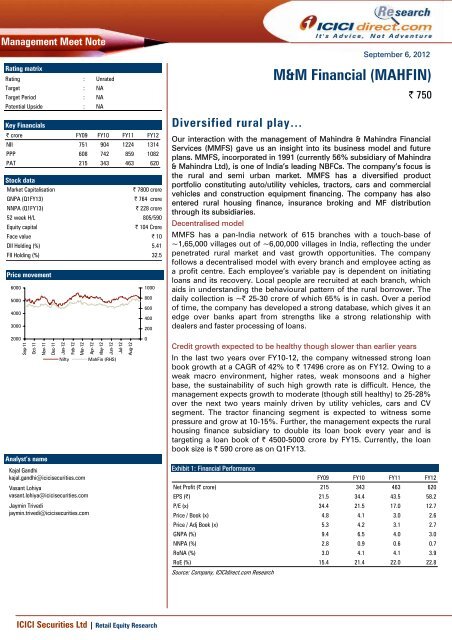

Management Meet NoteRating matrixRating : UnratedTarget : NATarget Period : NAPotential Upside : NAKey <strong>Financial</strong>s| crore FY09 FY10 FY11 FY12NII 751 904 1224 1314PPP 608 742 859 1082PAT 215 343 463 620Stock dataMarket Capitalisation| 7800 croreGNPA (Q1FY13)| 764 croreNNPA (Q1FY13)| 228 crore52 week H/L 805/590Equity capital| 104 CroreFace value | 10DII Holding (%) 5.41FII Holding (%) 32.5Price movement60005000400030001000800600400200Diversified rural play…September 6, 2012M&M <strong>Financial</strong> (<strong>MAHFIN</strong>)| 750Our interaction with the management of Mahindra & Mahindra <strong>Financial</strong>Services (MMFS) gave us an insight into its business model and futureplans. MMFS, incorporated in 1991 (currently 56% subsidiary of Mahindra& Mahindra Ltd), is one of India’s leading NBFCs. The company’s focus isthe rural and semi urban market. MMFS has a diversified productportfolio constituting auto/utility vehicles, tractors, cars and commercialvehicles and construction equipment financing. The company has alsoentered rural housing finance, insurance broking and MF distributionthrough its subsidiaries.Decentralised modelMMFS has a pan-India network of 615 branches with a touch-base of~1,65,000 villages out of ~6,00,000 villages in India, reflecting the underpenetrated rural market and vast growth opportunities. The companyfollows a decentralised model with every branch and employee acting asa profit centre. Each employee’s variable pay is dependent on initiatingloans and its recovery. Local people are recruited at each branch, whichaids in understanding the behavioural pattern of the rural borrower. Thedaily collection is ~| 25-30 crore of which 65% is in cash. Over a periodof time, the company has developed a strong database, which gives it anedge over banks apart from strengths like a strong relationship withdealers and faster processing of loans.2000Sep-11Oct-11Nov-11Analyst’s nameDec-11Jan-12NiftyFeb-12Mar-12Kajal Gandhikajal.gandhi@icicisecurities.comVasant Lohiyavasant.lohiya@icicisecurities.comJaymin Trivedijaymin.trivedi@icicisecurities.comApr-12May-12Jun-12MahFin (RHS)Jul-12Aug-120Credit growth expected to be healthy though slower than earlier yearsIn the last two years over FY10-12, the company witnessed strong loanbook growth at a CAGR of 42% to | 17496 crore as on FY12. Owing to aweak macro environment, higher rates, weak monsoons and a higherbase, the sustainability of such high growth rate is difficult. Hence, themanagement expects growth to moderate (though still healthy) to 25-28%over the next two years mainly driven by utility vehicles, cars and CVsegment. The tractor financing segment is expected to witness somepressure and grow at 10-15%. Further, the management expects the ruralhousing finance subsidiary to double its loan book every year and istargeting a loan book of | 4500-5000 crore by FY15. Currently, the loanbook size is | 590 crore as on Q1FY13.Exhibit 1: <strong>Financial</strong> PerformanceFY09 FY10 FY11 FY12Net Profit (| crore) 215 343 463 620EPS (|) 21.5 34.4 43.5 58.2P/E (x) 34.4 21.5 17.0 12.7Price / Book (x) 4.8 4.1 3.0 2.6Price / Adj Book (x) 5.3 4.2 3.1 2.7GNPA (%) 9.4 6.5 4.0 3.0NNPA (%) 2.8 0.9 0.6 0.7RoNA (%) 3.0 4.1 4.1 3.9RoE (%) 15.4 21.4 22.0 22.8Source: Company, <strong>ICICI</strong>direct.com Research<strong>ICICI</strong> Securities Ltd | Retail Equity Research

Exhibit 2: Loan mixThe proportion of UVs and tractor segment has come downfrom 63 % as on FY08 to 50% as on FY12, thus reducingthe dependency on financing of parent M&M’s vehicles andalso reducing the agriculture linked loan book to 20-24%(%)1201008060402007 6 6 6 77 8 9 1223 2425 2530 3123 23 2038 38 33 31 30FY08 FY09 FY10 FY11 FY1231Auto/UV Tractors Cars CVs Used vehicles and othersSource: Company, <strong>ICICI</strong>direct.com ResearchIn order to reduce the risk of dependency of financing only parent M&Mvehicles, in the UV segment currently ~80-85% M&M vehicles arefinanced compared to 100% earlier. Further, in the tractor segment, forthe last two or three quarters the company has started financing tractorsof other manufacturers also. After witnessing severe NPA stress in FY09on the portfolio linked to agricultural activity, the company adopted astrategy of diversifying the customer profile. Currently, 40-50% of thetractor and UV portfolio is related to non-farming activities. Themanagement expects 27-28% growth in the UV segment and lower than10-15% growth in the tractor segment owing to weak monsoons and aslowdown in industrial activity.In the car segment, MMFS is the second largest financier for Maruti.Overall, ~70% of the portfolio belongs to Maruti while the rest belongs toother manufacturers. Total 27-28% growth is expected in the carsegment.The commercial vehicles and construction equipment financing segmentwitnessed strong traction in FY12 and now comprises 12% of theportfolio. In this segment, the strategy is to finance 10% to large fleetoperators, 40% to five or six truck owners, another 40% to first time usersand balance 10% towards light commercial vehicle (LCV). Strong growthhere is expected to continue owing to lower base and as permanagement the segment could form ~17-18% of the portfolio in thenext two or three years.Exhibit 3: Strong traction witnessed in last three years after dismal growth in FY08-09(| crore)20000180001600014000120001000080006000400020000423830133FY08 FY09 FY10 FY11 FY12454035302520151050(%)AdvancesAdvances growth YoY (RHS)Source: Company, <strong>ICICI</strong>direct.com Research<strong>ICICI</strong> Securities Ltd | Retail Equity Research Page 2

Exhibit 4: Asset quality improves significantly from high of 9.4% in FY09(%)10.09.08.07.06.05.04.03.02.01.00.09.48.06.54.03.1 2.83.00.90.6 0.7FY08 FY09 FY10 FY11 FY12GNPANNPASource: Company, <strong>ICICI</strong>direct.com ResearchAsset quality and regulatory risksOwing to a crop failure in major states during FY09, the GNPA reached ahigh of 9.4%. However, the change in the loan mix towards lowerdependency on agricultural activity, introduction of newer segments likeCV and construction equipment financing and improvement in creditassessment and cash collection procedures led to NPAs fallingsignificantly to 3% (| 554 crore) as on FY12. As per the management,asset quality is expected to remain stable as of now, though persistentlyweak monsoons can put some stress on the quality of the book.Currently, ~20-24% of the book is dependent on agriculture, down from~45-50% book earlier.The impact of the worst case of no securitisation could be~20 bps to margins. At present, MMFS’ securitisationportfolio is 12%.On the regulatory front, in the final securitisation and PSL guidelines twomajor guidelines affecting MMFS are the requirement of minimumholding period (MHP) of six months and cap of 8% spread above thebank’s base rates for asset securitised. On an average, MHP for MMFS isabout four months. The impact of the worst case of no securitisationcould be ~20 bps to margins. At present, the MMFS securitisationportfolio is 12%. However, the major regulatory risk could be the 90 dayspast due NPA recognition norms recommended by the Usha Thoratcommittee compared to 180 DPD for NBFCs currently. This could lead tothe GNPA ratio increasing by ~150 bps to 5-5.3% with one-time increasein credit cost of ~| 30-35 crore, when implemented. However, themanagement expects adequate time to be given to shift the NPAclassification from 180 days past due to 90 days past due. The committeealso proposed Tier – I ratio of 12% for NBFCs from 7.5% currently. MMFSis comfortable on this front as it has Tier –I ratio of 14.7% as on Q1FY13.<strong>ICICI</strong> Securities Ltd | Retail Equity Research Page 3

RATING RATIONALE<strong>ICICI</strong>direct.com endeavours to provide objective opinions and recommendations. <strong>ICICI</strong>direct.com assignsratings to its stocks according to their notional target price vs. current market price and then categorises themas Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the notionaltarget price is defined as the analysts' valuation for a stock.Strong Buy: >15%/20% for large caps/midcaps, respectively, with high conviction;Buy: >10%/15% for large caps/midcaps, respectively;Hold: Up to +/-10%;Sell: -10% or more;Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com<strong>ICICI</strong>direct.com Research Desk,<strong>ICICI</strong> Securities Limited,1 st Floor, Akruti Trade Centre,Road No. 7, MIDC,Andheri (East)Mumbai – 400 093research@icicidirect.comANALYST CERTIFICATIONWe /I, Kajal Gandhi CA Vasant Lohiya CA Jaymin Trivedi MBA-CM research analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research reportaccurately reflect our personal views about any and all of the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specificrecommendation(s) or view(s) in this report. Analysts aren't registered as research analysts by FINRA and might not be an associated person of the <strong>ICICI</strong> Securities Inc.Disclosures:<strong>ICICI</strong> Securities Limited (<strong>ICICI</strong> Securities) and its affiliates are a full-service, integrated investment banking, investment management and brokerage and financing group. We along with affiliates are leadingunderwriter of securities and participate in virtually all securities trading markets in India. We and our affiliates have investment banking and other business relationship with a significant percentage ofcompanies covered by our Investment Research Department. Our research professionals provide important input into our investment banking and other business selection processes. <strong>ICICI</strong> Securitiesgenerally prohibits its analysts, persons reporting to analysts and their dependent family members from maintaining a financial interest in the securities or derivatives of any companies that the analystscover.The information and opinions in this report have been prepared by <strong>ICICI</strong> Securities and are subject to change without any notice. The report and information contained herein is strictly confidential andmeant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, withoutprior written consent of <strong>ICICI</strong> Securities. While we would endeavour to update the information herein on reasonable basis, <strong>ICICI</strong> Securities, its subsidiaries and associated companies, their directors andemployees (“<strong>ICICI</strong> Securities and affiliates”) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent <strong>ICICI</strong> Securitiesfrom doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or <strong>ICICI</strong> Securitiespolicies, in circumstances where <strong>ICICI</strong> Securities is acting in an advisory capacity to this company, or in certain other circumstances.This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. Thisreport and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financialinstruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. <strong>ICICI</strong> Securities will not treat recipients as customers by virtue of theirreceiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specificcircumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investmentobjectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluatethe investment risks. The value and return of investment may vary because of changes in interest rates, foreign exchange rates or any other reason. <strong>ICICI</strong> Securities and affiliates accept no liabilities for anyloss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand therisks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject tochange without notice.<strong>ICICI</strong> Securities and its affiliates might have managed or co-managed a public offering for the subject company in the preceding twelve months. <strong>ICICI</strong> Securities and affiliates might have receivedcompensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of public offerings, corporate finance, investmentbanking or other advisory services in a merger or specific transaction. It is confirmed that Kajal Gandhi CA Vasant Lohiya CA Jaymin Trivedi MBA-CM research analysts and the authors of this report havenot received any compensation from the companies mentioned in the report in the preceding twelve months. Our research professionals are paid in part based on the profitability of <strong>ICICI</strong> Securities, whichinclude earnings from Investment Banking and other business.<strong>ICICI</strong> Securities or its subsidiaries collectively do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of theresearch report.It is confirmed that Kajal Gandhi CA Vasant Lohiya CA Jaymin Trivedi MBA-CM research analysts and the authors of this report or any of their family members does not serve as an officer, director oradvisory board member of the companies mentioned in the report.<strong>ICICI</strong> Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. <strong>ICICI</strong> Securities and affiliates may act upon or make useof information contained in the report prior to the publication thereof.This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution,publication, availability or use would be contrary to law, regulation or which would subject <strong>ICICI</strong> Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securitiesdescribed herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of andto observe such restriction.<strong>ICICI</strong> Securities Ltd | Retail Equity Research Page 4