M&M Financial (MAHFIN) - ICICI Direct

M&M Financial (MAHFIN) - ICICI Direct

M&M Financial (MAHFIN) - ICICI Direct

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

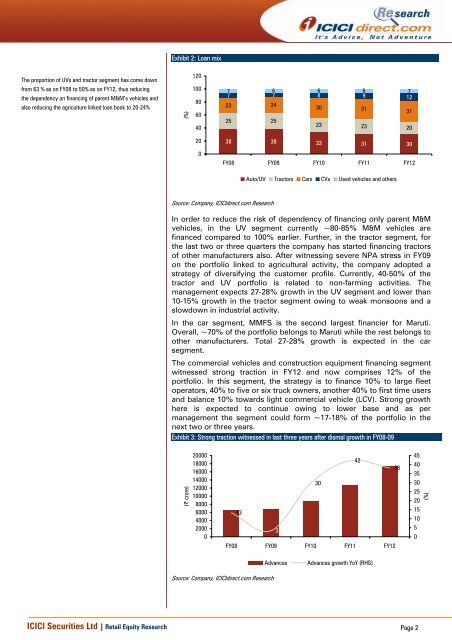

Exhibit 2: Loan mixThe proportion of UVs and tractor segment has come downfrom 63 % as on FY08 to 50% as on FY12, thus reducingthe dependency on financing of parent M&M’s vehicles andalso reducing the agriculture linked loan book to 20-24%(%)1201008060402007 6 6 6 77 8 9 1223 2425 2530 3123 23 2038 38 33 31 30FY08 FY09 FY10 FY11 FY1231Auto/UV Tractors Cars CVs Used vehicles and othersSource: Company, <strong>ICICI</strong>direct.com ResearchIn order to reduce the risk of dependency of financing only parent M&Mvehicles, in the UV segment currently ~80-85% M&M vehicles arefinanced compared to 100% earlier. Further, in the tractor segment, forthe last two or three quarters the company has started financing tractorsof other manufacturers also. After witnessing severe NPA stress in FY09on the portfolio linked to agricultural activity, the company adopted astrategy of diversifying the customer profile. Currently, 40-50% of thetractor and UV portfolio is related to non-farming activities. Themanagement expects 27-28% growth in the UV segment and lower than10-15% growth in the tractor segment owing to weak monsoons and aslowdown in industrial activity.In the car segment, MMFS is the second largest financier for Maruti.Overall, ~70% of the portfolio belongs to Maruti while the rest belongs toother manufacturers. Total 27-28% growth is expected in the carsegment.The commercial vehicles and construction equipment financing segmentwitnessed strong traction in FY12 and now comprises 12% of theportfolio. In this segment, the strategy is to finance 10% to large fleetoperators, 40% to five or six truck owners, another 40% to first time usersand balance 10% towards light commercial vehicle (LCV). Strong growthhere is expected to continue owing to lower base and as permanagement the segment could form ~17-18% of the portfolio in thenext two or three years.Exhibit 3: Strong traction witnessed in last three years after dismal growth in FY08-09(| crore)20000180001600014000120001000080006000400020000423830133FY08 FY09 FY10 FY11 FY12454035302520151050(%)AdvancesAdvances growth YoY (RHS)Source: Company, <strong>ICICI</strong>direct.com Research<strong>ICICI</strong> Securities Ltd | Retail Equity Research Page 2