M&M Financial (MAHFIN) - ICICI Direct

M&M Financial (MAHFIN) - ICICI Direct

M&M Financial (MAHFIN) - ICICI Direct

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

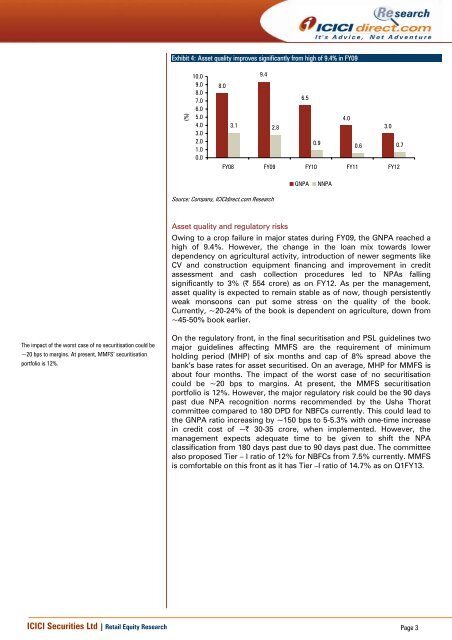

Exhibit 4: Asset quality improves significantly from high of 9.4% in FY09(%)10.09.08.07.06.05.04.03.02.01.00.09.48.06.54.03.1 2.83.00.90.6 0.7FY08 FY09 FY10 FY11 FY12GNPANNPASource: Company, <strong>ICICI</strong>direct.com ResearchAsset quality and regulatory risksOwing to a crop failure in major states during FY09, the GNPA reached ahigh of 9.4%. However, the change in the loan mix towards lowerdependency on agricultural activity, introduction of newer segments likeCV and construction equipment financing and improvement in creditassessment and cash collection procedures led to NPAs fallingsignificantly to 3% (| 554 crore) as on FY12. As per the management,asset quality is expected to remain stable as of now, though persistentlyweak monsoons can put some stress on the quality of the book.Currently, ~20-24% of the book is dependent on agriculture, down from~45-50% book earlier.The impact of the worst case of no securitisation could be~20 bps to margins. At present, MMFS’ securitisationportfolio is 12%.On the regulatory front, in the final securitisation and PSL guidelines twomajor guidelines affecting MMFS are the requirement of minimumholding period (MHP) of six months and cap of 8% spread above thebank’s base rates for asset securitised. On an average, MHP for MMFS isabout four months. The impact of the worst case of no securitisationcould be ~20 bps to margins. At present, the MMFS securitisationportfolio is 12%. However, the major regulatory risk could be the 90 dayspast due NPA recognition norms recommended by the Usha Thoratcommittee compared to 180 DPD for NBFCs currently. This could lead tothe GNPA ratio increasing by ~150 bps to 5-5.3% with one-time increasein credit cost of ~| 30-35 crore, when implemented. However, themanagement expects adequate time to be given to shift the NPAclassification from 180 days past due to 90 days past due. The committeealso proposed Tier – I ratio of 12% for NBFCs from 7.5% currently. MMFSis comfortable on this front as it has Tier –I ratio of 14.7% as on Q1FY13.<strong>ICICI</strong> Securities Ltd | Retail Equity Research Page 3