Tanla Solutions (TANSOL) - ICICI Direct

Tanla Solutions (TANSOL) - ICICI Direct

Tanla Solutions (TANSOL) - ICICI Direct

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

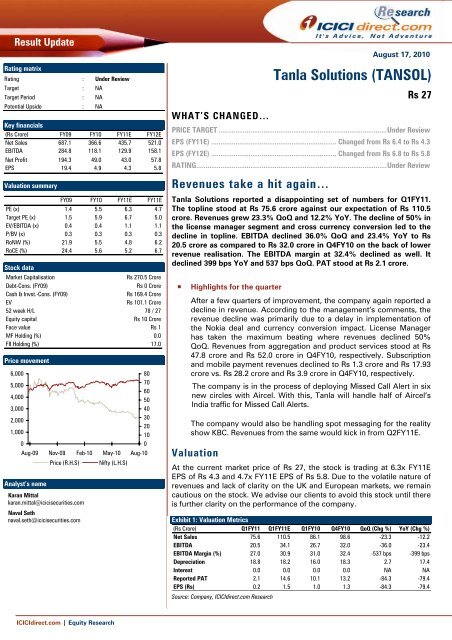

Result UpdateRating matrixRating : Under ReviewTarget : NATarget Period : NAPotential Upside : NAKey financials(Rs Crore) FY09 FY10 FY11E FY12ENet Sales 687.1 366.6 435.7 521.0EBITDA 284.8 118.1 129.9 158.1Net Profit 194.3 49.0 43.0 57.8EPS 19.4 4.9 4.3 5.8Valuation summaryFY09 FY10 FY11E FY11EPE (x) 1.4 5.5 6.3 4.7Target PE (x) 1.5 5.9 6.7 5.0EV/EBITDA (x) 0.4 0.4 1.1 1.1P/BV (x) 0.3 0.3 0.3 0.3RoNW (%) 21.9 5.5 4.8 6.2RoCE (%) 24.4 5.6 5.2 6.7Stock dataMarket CapitalisationRs 270.5 CroreDebt-Cons. (FY09)Rs 0 CroreCash & Invst.-Cons. (FY09)Rs 169.4 CroreEVRs 101.1 Crore52 week H/L 78 / 27Equity capitalRs 10 CroreFace value Rs 1MF Holding (%) 0.0FII Holding (%) 17.0Price movement6,0005,0004,0003,0002,0001,0000Aug-09Analyst’s nameNov-09Price (R.H.S)Feb-10Karan Mittalkaran.mittal@icicisecurities.comNaval Sethnaval.seth@icicisecurities.comMay-10Nifty (L.H.S)80706050403020100Aug-10WHAT’S CHANGED…August 17, 2010PRICE TARGET ..........................................................................................Under ReviewEPS (FY11E) ................................................................... Changed from Rs 6.4 to Rs 4.3EPS (FY12E) ................................................................... Changed from Rs 6.8 to Rs 5.8RATING......................................................................................................Under ReviewRevenues take a hit again…<strong>Tanla</strong> <strong>Solutions</strong> reported a disappointing set of numbers for Q1FY11.The topline stood at Rs 75.6 crore against our expectation of Rs 110.5crore. Revenues grew 23.3% QoQ and 12.2% YoY. The decline of 50% inthe license manager segment and cross currency conversion led to thedecline in topline. EBITDA declined 36.0% QoQ and 23.4% YoY to Rs20.5 crore as compared to Rs 32.0 crore in Q4FY10 on the back of lowerrevenue realisation. The EBITDA margin at 32.4% declined as well. Itdeclined 399 bps YoY and 537 bps QoQ. PAT stood at Rs 2.1 crore.• Highlights for the quarterAfter a few quarters of improvement, the company again reported adecline in revenue. According to the management’s comments, therevenue decline was primarily due to a delay in implementation ofthe Nokia deal and currency conversion impact. License Managerhas taken the maximum beating where revenues declined 50%QoQ. Revenues from aggregation and product services stood at Rs47.8 crore and Rs 52.0 crore in Q4FY10, respectively. Subscriptionand mobile payment revenues declined to Rs 1.3 crore and Rs 17.93crore vs. Rs 28.2 crore and Rs 3.9 crore in Q4FY10, respectively.The company is in the process of deploying Missed Call Alert in sixnew circles with Aircel. With this, <strong>Tanla</strong> will handle half of Aircel’sIndia traffic for Missed Call Alerts.The company would also be handling spot messaging for the realityshow KBC. Revenues from the same would kick in from Q2FY11E.ValuationAt the current market price of Rs 27, the stock is trading at 6.3x FY11EEPS of Rs 4.3 and 4.7x FY11E EPS of Rs 5.8. Due to the volatile nature ofrevenues and lack of clarity on the UK and European markets, we remaincautious on the stock. We advise our clients to avoid this stock until thereis further clarity on the performance of the company.Exhibit 1: Valuation Metrics(Rs Crore) Q1FY11 Q1FY11E Q1FY10 Q4FY10 QoQ (Chg %) YoY (Chg %)Net Sales 75.6 110.5 86.1 98.6 -23.3 -12.2EBITDA 20.5 34.1 26.7 32.0 -36.0 -23.4EBITDA Margin (%) 27.0 30.9 31.0 32.4 -537 bps -399 bpsDepreciation 18.8 18.2 16.0 18.3 2.7 17.4Interest 0.0 0.0 0.0 0.0 NA NAReported PAT 2.1 14.6 10.1 13.2 -84.3 -79.4EPS (Rs) 0.2 1.5 1.0 1.3 -84.3 -79.4Source: Company, <strong>ICICI</strong>direct.com Research<strong>Tanla</strong> <strong>Solutions</strong> (<strong>TANSOL</strong>)Rs 27<strong>ICICI</strong>direct.com | Equity Research

<strong>Tanla</strong> <strong>Solutions</strong> (<strong>TANSOL</strong>)RATING RATIONALE<strong>ICICI</strong>direct.com endeavours to provide objective opinions and recommendations. <strong>ICICI</strong>direct.com assignsratings to its stocks according to their notional target price vs. current market price and then categorises themas Strong Buy, Buy, Add, Reduce and Sell. The performance horizon is two years unless specified and thenotional target price is defined as the analysts' valuation for a stock.Strong Buy: 20% or more;Buy: Between 10% and 20%;Add: Up to 10%;Reduce: Up to -10%Sell: -10% or more;Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com<strong>ICICI</strong>direct.com Research Desk,<strong>ICICI</strong> Securities Limited,7 th Floor, Akruti Centre Point,MIDC Main Road, Marol Naka,Andheri (East)Mumbai – 400 093research@icicidirect.comANALYST CERTIFICATIONWe /I, Karan Mittal MBA Naval Seth MBA research analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect ourpersonal views about any and all of the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) orview(s) in this report. Analysts aren't registered as research analysts by FINRA and might not be an associated person of the <strong>ICICI</strong> Securities Inc.Disclosures:<strong>ICICI</strong> Securities Limited (<strong>ICICI</strong> Securities) and its affiliates are a full-service, integrated investment banking, investment management and brokerage and financing group. We along with affiliates are leadingunderwriter of securities and participate in virtually all securities trading markets in India. We and our affiliates have investment banking and other business relationship with a significant percentage ofcompanies covered by our Investment Research Department. Our research professionals provide important input into our investment banking and other business selection processes. <strong>ICICI</strong> Securitiesgenerally prohibits its analysts, persons reporting to analysts and their dependent family members from maintaining a financial interest in the securities or derivatives of any companies that the analystscover.The information and opinions in this report have been prepared by <strong>ICICI</strong> Securities and are subject to change without any notice. The report and information contained herein is strictly confidential andmeant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, withoutprior written consent of <strong>ICICI</strong> Securities. While we would endeavour to update the information herein on reasonable basis, <strong>ICICI</strong> Securities, its subsidiaries and associated companies, their directors andemployees (“<strong>ICICI</strong> Securities and affiliates”) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent <strong>ICICI</strong> Securitiesfrom doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or <strong>ICICI</strong> Securitiespolicies, in circumstances where <strong>ICICI</strong> Securities is acting in an advisory capacity to this company, or in certain other circumstances.This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. Thisreport and information herein is solely for informational purpose and may not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financialinstruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. <strong>ICICI</strong> Securities will not treat recipients as customers by virtue of theirreceiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specificcircumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investmentobjectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluatethe investment risks. The value and return of investment may vary because of changes in interest rates, foreign exchange rates or any other reason. <strong>ICICI</strong> Securities and affiliates accept no liabilities for anyloss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand therisks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject tochange without notice.<strong>ICICI</strong> Securities and its affiliates might have managed or co-managed a public offering for the subject company in the preceding twelve months. <strong>ICICI</strong> Securities and affiliates might have receivedcompensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of public offerings, corporate finance, investmentbanking or other advisory services in a merger or specific transaction. <strong>ICICI</strong> Securities and affiliates expect to receive compensation from the companies mentioned in the report within a period of threemonths following the date of publication of the research report for services in respect of public offerings, corporate finance, investment banking or other advisory services in a merger or specifictransaction. It is confirmed that Karan Mittal MBA Naval Seth MBA research analysts and the authors of this report have not received any compensation from the companies mentioned in the report in thepreceding twelve months. Our research professionals are paid in part based on the profitability of <strong>ICICI</strong> Securities, which include earnings from Investment Banking and other business.<strong>ICICI</strong> Securities or its subsidiaries collectively do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of theresearch report.It is confirmed that Karan Mittal MBA Naval Seth MBA research analysts and the authors of this report or any of their family members does not serve as an officer, director or advisory board member ofthe companies mentioned in the report.<strong>ICICI</strong> Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. <strong>ICICI</strong> Securities and affiliates may act upon or make useof information contained in the report prior to the publication thereof.This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution,publication, availability or use would be contrary to law, regulation or which would subject <strong>ICICI</strong> Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securitiesdescribed herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of andto observe such restriction.<strong>ICICI</strong>direct.com | Equity ResearchPage 2