Rising Above

Rising Above

Rising Above

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

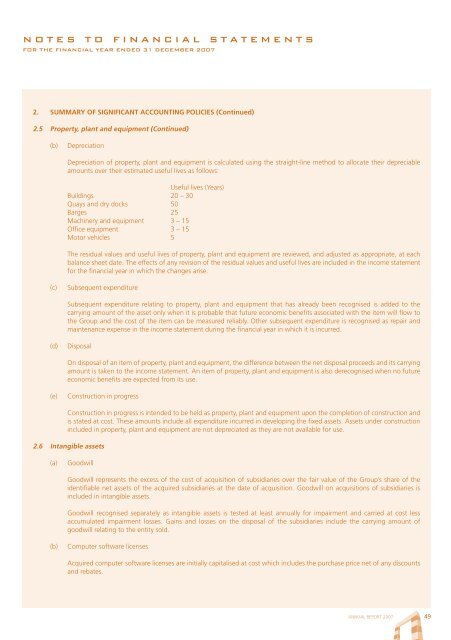

NOTES TO FINANCIAL STATEMENTSFOR THE FINANCIAL YEAR ENDED 31 DECEMBER 20072. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)2.5 Property, plant and equipment (Continued)(b)DepreciationDepreciation of property, plant and equipment is calculated using the straight-line method to allocate their depreciableamounts over their estimated useful lives as follows:Useful lives (Years)Buildings 20 – 30Quays and dry docks 50Barges 25Machinery and equipment 3 – 15Office equipment 3 – 15Motor vehicles 5The residual values and useful lives of property, plant and equipment are reviewed, and adjusted as appropriate, at eachbalance sheet date. The effects of any revision of the residual values and useful lives are included in the income statementfor the financial year in which the changes arise.(c)Subsequent expenditureSubsequent expenditure relating to property, plant and equipment that has already been recognised is added to thecarrying amount of the asset only when it is probable that future economic benefits associated with the item will flow tothe Group and the cost of the item can be measured reliably. Other subsequent expenditure is recognised as repair andmaintenance expense in the income statement during the financial year in which it is incurred.(d)DisposalOn disposal of an item of property, plant and equipment, the difference between the net disposal proceeds and its carryingamount is taken to the income statement. An item of property, plant and equipment is also derecognised when no futureeconomic benefits are expected from its use.(e)Construction in progressConstruction in progress is intended to be held as property, plant and equipment upon the completion of construction andis stated at cost. These amounts include all expenditure incurred in developing the fixed assets. Assets under constructionincluded in property, plant and equipment are not depreciated as they are not available for use.2.6 Intangible assets(a)GoodwillGoodwill represents the excess of the cost of acquisition of subsidiaries over the fair value of the Group’s share of theidentifiable net assets of the acquired subsidiaries at the date of acquisition. Goodwill on acquisitions of subsidiaries isincluded in intangible assets.Goodwill recognised separately as intangible assets is tested at least annually for impairment and carried at cost lessaccumulated impairment losses. Gains and losses on the disposal of the subsidiaries include the carrying amount ofgoodwill relating to the entity sold.(b)Computer software licensesAcquired computer software licenses are initially capitalised at cost which includes the purchase price net of any discountsand rebates.ANNUAL REPORT 2007 49