Rising Above

Rising Above

Rising Above

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

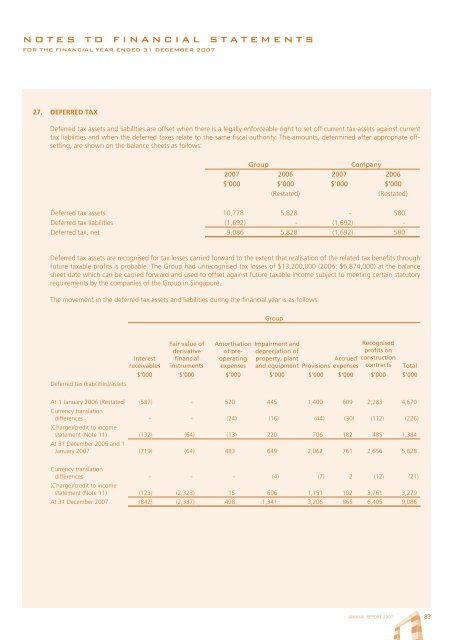

NOTES TO FINANCIAL STATEMENTSFOR THE FINANCIAL YEAR ENDED 31 DECEMBER 200727. DEFERRED TAXDeferred tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against currenttax liabilities and when the deferred taxes relate to the same fiscal authority. The amounts, determined after appropriate offsetting,are shown on the balance sheets as follows:GroupCompany2007 2006 2007 2006$’000 $’000 $’000 $’000(Restated)(Restated)Deferred tax assets 10,778 5,828 - 580Deferred tax liabilities (1,692) - (1,692) -Deferred tax, net 9,086 5,828 (1,692) 580Deferred tax assets are recognised for tax losses carried forward to the extent that realisation of the related tax benefits throughfuture taxable profits is probable. The Group had unrecognised tax losses of $13,200,000 (2006: $6,874,000) at the balancesheet date which can be carried forward and used to offset against future taxable income subject to meeting certain statutoryrequirements by the companies of the Group in Singapore.The movement in the deferred tax assets and liabilities during the financial year is as follows:GroupDeferred tax (liabilities)/assetsInterestreceivablesFair value ofderivativefinancialinstrumentsAmortisationof preoperatingexpensesImpairment anddepreciation ofproperty, plantand equipment ProvisionsAccruedexpensesRecognisedprofits onconstructioncontractsTotal$’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000At 1 January 2006 (Restated) (587) - 520 445 1,400 609 2,283 4,670Currency translationdifferences - - (24) (16) (44) (30) (112) (226)(Charge)/credit to incomestatement (Note 11) (132) (64) (13) 220 706 182 485 1,384At 31 December 2006 and 1January 2007 (719) (64) 483 649 2,062 761 2,656 5,828Currency translationdifferences - - - (4) (7) 2 (12) (21)(Charge)/credit to incomestatement (Note 11) (123) (2,323) 15 696 1,151 102 3,761 3,279At 31 December 2007 (842) (2,387) 498 1,341 3,206 865 6,405 9,086ANNUAL REPORT 2007 83