Portuguese - ADM

Portuguese - ADM

Portuguese - ADM

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

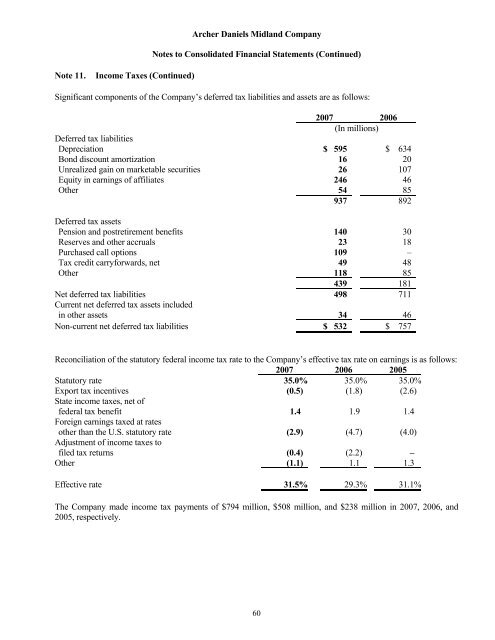

Archer Daniels Midland CompanyNotes to Consolidated Financial Statements (Continued)Note 11.Income Taxes (Continued)Significant components of the Company’s deferred tax liabilities and assets are as follows:2007 2006(In millions)Deferred tax liabilitiesDepreciation $ 595 $ 634Bond discount amortization 16 20Unrealized gain on marketable securities 26 107Equity in earnings of affiliates 246 46Other 54 85937 892Deferred tax assetsPension and postretirement benefits 140 30Reserves and other accruals 23 18Purchased call options 109 –Tax credit carryforwards, net 49 48Other 118 85439 181Net deferred tax liabilities 498 711Current net deferred tax assets includedin other assets 34 46Non-current net deferred tax liabilities $ 532 $ 757Reconciliation of the statutory federal income tax rate to the Company’s effective tax rate on earnings is as follows:2007 2006 2005Statutory rate 35.0% 35.0% 35.0%Export tax incentives (0.5) (1.8) (2.6)State income taxes, net offederal tax benefit 1.4 1.9 1.4Foreign earnings taxed at ratesother than the U.S. statutory rate (2.9) (4.7) (4.0)Adjustment of income taxes tofiled tax returns (0.4) (2.2) –Other (1.1) 1.1 1.3Effective rate 31.5% 29.3% 31.1%The Company made income tax payments of $794 million, $508 million, and $238 million in 2007, 2006, and2005, respectively.60