Portuguese - ADM

Portuguese - ADM

Portuguese - ADM

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

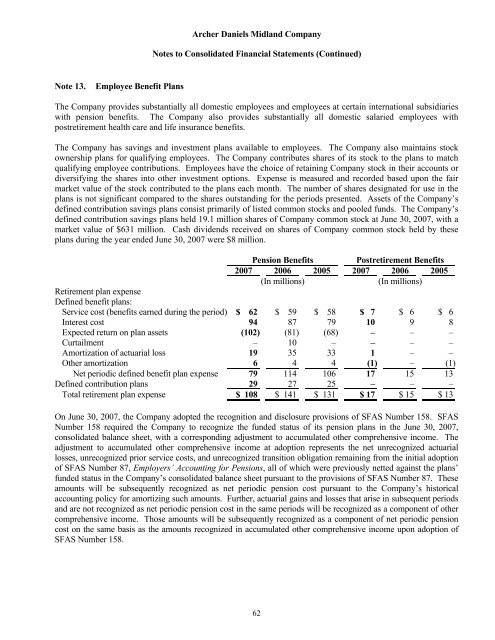

Archer Daniels Midland CompanyNotes to Consolidated Financial Statements (Continued)Note 13.Employee Benefit PlansThe Company provides substantially all domestic employees and employees at certain international subsidiarieswith pension benefits. The Company also provides substantially all domestic salaried employees withpostretirement health care and life insurance benefits.The Company has savings and investment plans available to employees. The Company also maintains stockownership plans for qualifying employees. The Company contributes shares of its stock to the plans to matchqualifying employee contributions. Employees have the choice of retaining Company stock in their accounts ordiversifying the shares into other investment options. Expense is measured and recorded based upon the fairmarket value of the stock contributed to the plans each month. The number of shares designated for use in theplans is not significant compared to the shares outstanding for the periods presented. Assets of the Company’sdefined contribution savings plans consist primarily of listed common stocks and pooled funds. The Company’sdefined contribution savings plans held 19.1 million shares of Company common stock at June 30, 2007, with amarket value of $631 million. Cash dividends received on shares of Company common stock held by theseplans during the year ended June 30, 2007 were $8 million.Pension Benefits Postretirement Benefits2007 2006 2005 2007 2006 2005(In millions)(In millions)Retirement plan expenseDefined benefit plans:Service cost (benefits earned during the period) $ 62 $ 59 $ 58 $ 7 $ 6 $ 6Interest cost 94 87 79 10 9 8Expected return on plan assets (102) (81) (68) – – –Curtailment – 10 – – – –Amortization of actuarial loss 19 35 33 1 – –Other amortization 6 4 4 (1) – (1)Net periodic defined benefit plan expense 79 114 106 17 15 13Defined contribution plans 29 27 25 – – –Total retirement plan expense $ 108 $ 141 $ 131 $ 17 $ 15 $ 13On June 30, 2007, the Company adopted the recognition and disclosure provisions of SFAS Number 158. SFASNumber 158 required the Company to recognize the funded status of its pension plans in the June 30, 2007,consolidated balance sheet, with a corresponding adjustment to accumulated other comprehensive income. Theadjustment to accumulated other comprehensive income at adoption represents the net unrecognized actuariallosses, unrecognized prior service costs, and unrecognized transition obligation remaining from the initial adoptionof SFAS Number 87, Employers’ Accounting for Pensions, all of which were previously netted against the plans’funded status in the Company’s consolidated balance sheet pursuant to the provisions of SFAS Number 87. Theseamounts will be subsequently recognized as net periodic pension cost pursuant to the Company’s historicalaccounting policy for amortizing such amounts. Further, actuarial gains and losses that arise in subsequent periodsand are not recognized as net periodic pension cost in the same periods will be recognized as a component of othercomprehensive income. Those amounts will be subsequently recognized as a component of net periodic pensioncost on the same basis as the amounts recognized in accumulated other comprehensive income upon adoption ofSFAS Number 158.62