Portuguese - ADM

Portuguese - ADM

Portuguese - ADM

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

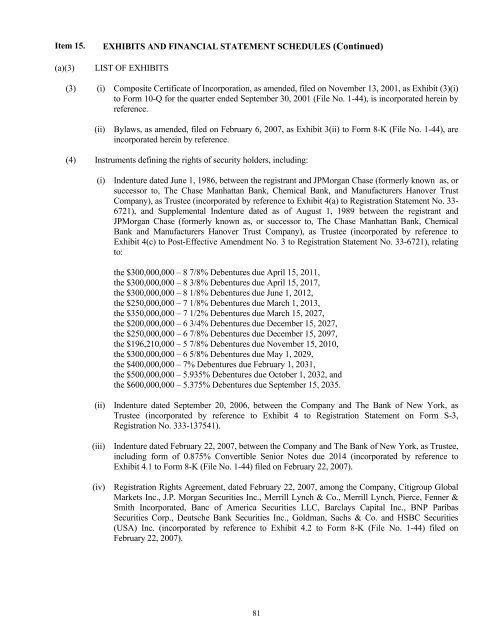

Item 15.(a)(3)EXHIBITS AND FINANCIAL STATEMENT SCHEDULES (Continued)LIST OF EXHIBITS(3) (i) Composite Certificate of Incorporation, as amended, filed on November 13, 2001, as Exhibit (3)(i)to Form 10-Q for the quarter ended September 30, 2001 (File No. 1-44), is incorporated herein byreference.(ii) Bylaws, as amended, filed on February 6, 2007, as Exhibit 3(ii) to Form 8-K (File No. 1-44), areincorporated herein by reference.(4) Instruments defining the rights of security holders, including:(i) Indenture dated June 1, 1986, between the registrant and JPMorgan Chase (formerly known as, orsuccessor to, The Chase Manhattan Bank, Chemical Bank, and Manufacturers Hanover TrustCompany), as Trustee (incorporated by reference to Exhibit 4(a) to Registration Statement No. 33-6721), and Supplemental Indenture dated as of August 1, 1989 between the registrant andJPMorgan Chase (formerly known as, or successor to, The Chase Manhattan Bank, ChemicalBank and Manufacturers Hanover Trust Company), as Trustee (incorporated by reference toExhibit 4(c) to Post-Effective Amendment No. 3 to Registration Statement No. 33-6721), relatingto:the $300,000,000 – 8 7/8% Debentures due April 15, 2011,the $300,000,000 – 8 3/8% Debentures due April 15, 2017,the $300,000,000 – 8 1/8% Debentures due June 1, 2012,the $250,000,000 – 7 1/8% Debentures due March 1, 2013,the $350,000,000 – 7 1/2% Debentures due March 15, 2027,the $200,000,000 – 6 3/4% Debentures due December 15, 2027,the $250,000,000 – 6 7/8% Debentures due December 15, 2097,the $196,210,000 – 5 7/8% Debentures due November 15, 2010,the $300,000,000 – 6 5/8% Debentures due May 1, 2029,the $400,000,000 – 7% Debentures due February 1, 2031,the $500,000,000 – 5.935% Debentures due October 1, 2032, andthe $600,000,000 – 5.375% Debentures due September 15, 2035.(ii) Indenture dated September 20, 2006, between the Company and The Bank of New York, asTrustee (incorporated by reference to Exhibit 4 to Registration Statement on Form S-3,Registration No. 333-137541).(iii) Indenture dated February 22, 2007, between the Company and The Bank of New York, as Trustee,including form of 0.875% Convertible Senior Notes due 2014 (incorporated by reference toExhibit 4.1 to Form 8-K (File No. 1-44) filed on February 22, 2007).(iv) Registration Rights Agreement, dated February 22, 2007, among the Company, Citigroup GlobalMarkets Inc., J.P. Morgan Securities Inc., Merrill Lynch & Co., Merrill Lynch, Pierce, Fenner &Smith Incorporated, Banc of America Securities LLC, Barclays Capital Inc., BNP ParibasSecurities Corp., Deutsche Bank Securities Inc., Goldman, Sachs & Co. and HSBC Securities(USA) Inc. (incorporated by reference to Exhibit 4.2 to Form 8-K (File No. 1-44) filed onFebruary 22, 2007).81