Portuguese - ADM

Portuguese - ADM

Portuguese - ADM

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

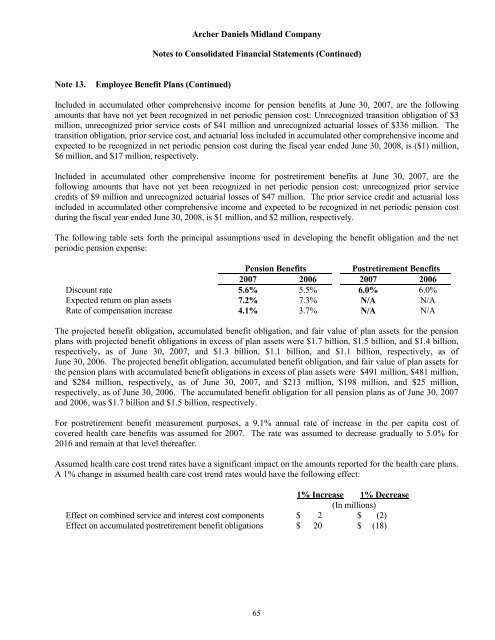

Archer Daniels Midland CompanyNotes to Consolidated Financial Statements (Continued)Note 13.Employee Benefit Plans (Continued)Included in accumulated other comprehensive income for pension benefits at June 30, 2007, are the followingamounts that have not yet been recognized in net periodic pension cost: Unrecognized transition obligation of $3million, unrecognized prior service costs of $41 million and unrecognized actuarial losses of $336 million. Thetransition obligation, prior service cost, and actuarial loss included in accumulated other comprehensive income andexpected to be recognized in net periodic pension cost during the fiscal year ended June 30, 2008, is ($1) million,$6 million, and $17 million, respectively.Included in accumulated other comprehensive income for postretirement benefits at June 30, 2007, are thefollowing amounts that have not yet been recognized in net periodic pension cost: unrecognized prior servicecredits of $9 million and unrecognized actuarial losses of $47 million. The prior service credit and actuarial lossincluded in accumulated other comprehensive income and expected to be recognized in net periodic pension costduring the fiscal year ended June 30, 2008, is $1 million, and $2 million, respectively.The following table sets forth the principal assumptions used in developing the benefit obligation and the netperiodic pension expense:Pension BenefitsPostretirement Benefits2007 2006 2007 2006Discount rate 5.6% 5.5% 6.0% 6.0%Expected return on plan assets 7.2% 7.3% N/A N/ARate of compensation increase 4.1% 3.7% N/A N/AThe projected benefit obligation, accumulated benefit obligation, and fair value of plan assets for the pensionplans with projected benefit obligations in excess of plan assets were $1.7 billion, $1.5 billion, and $1.4 billion,respectively, as of June 30, 2007, and $1.3 billion, $1.1 billion, and $1.1 billion, respectively, as ofJune 30, 2006. The projected benefit obligation, accumulated benefit obligation, and fair value of plan assets forthe pension plans with accumulated benefit obligations in excess of plan assets were $491 million, $481 million,and $284 million, respectively, as of June 30, 2007, and $213 million, $198 million, and $25 million,respectively, as of June 30, 2006. The accumulated benefit obligation for all pension plans as of June 30, 2007and 2006, was $1.7 billion and $1.5 billion, respectively.For postretirement benefit measurement purposes, a 9.1% annual rate of increase in the per capita cost ofcovered health care benefits was assumed for 2007. The rate was assumed to decrease gradually to 5.0% for2016 and remain at that level thereafter.Assumed health care cost trend rates have a significant impact on the amounts reported for the health care plans.A 1% change in assumed health care cost trend rates would have the following effect:1% Increase 1% Decrease(In millions)Effect on combined service and interest cost components $ 2 $ (2)Effect on accumulated postretirement benefit obligations $ 20 $ (18)65