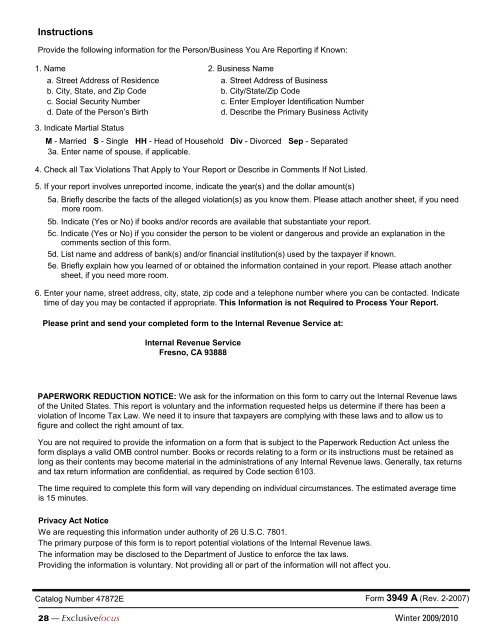

InstructionsProvide the following inform<strong>at</strong>ion for the Person/Business You Are Reporting if Known:1. Namea. Street Address of Residenceb. City, St<strong>at</strong>e, and Zip Codec. Social Security Numberd. D<strong>at</strong>e of the Person’s Birth2. Business Namea. Street Address of Businessb. City/St<strong>at</strong>e/Zip Codec. Enter Employer Identific<strong>at</strong>ion Numberd. Describe the Primary Business Activity3. Indic<strong>at</strong>e Martial St<strong>at</strong>usM - Married S - Single HH - Head of Household Div - Divorced Sep - Separ<strong>at</strong>ed3a. Enter name of spouse, if applicable.4. Check all Tax Viol<strong>at</strong>ions Th<strong>at</strong> Apply to Your Report or Describe in Comments If Not L<strong>is</strong>ted.5. If your report involves unreported income, indic<strong>at</strong>e the year(s) and the dollar amount(s)5a. Briefly describe the facts of the alleged viol<strong>at</strong>ion(s) as you know them. Please <strong>at</strong>tach another sheet, if you needmore room.5b. Indic<strong>at</strong>e (Yes or No) if books and/or records are available th<strong>at</strong> substanti<strong>at</strong>e your report.5c. Indic<strong>at</strong>e (Yes or No) if you consider the person to be violent or dangerous and provide an explan<strong>at</strong>ion in thecomments section of th<strong>is</strong> form.5d. L<strong>is</strong>t name and address of bank(s) and/or financial institution(s) used by the taxpayer if known.5e. Briefly explain how you learned of or obtained the inform<strong>at</strong>ion contained in your report. Please <strong>at</strong>tach anothersheet, if you need more room.6. Enter your name, street address, city, st<strong>at</strong>e, zip code and a telephone number where you can be contacted. Indic<strong>at</strong>etime of day you may be contacted if appropri<strong>at</strong>e. Th<strong>is</strong> Inform<strong>at</strong>ion <strong>is</strong> not Required to Process Your Report.Please print and send your completed form to the Internal Revenue Service <strong>at</strong>:Internal Revenue ServiceFresno, CA 93888PAPERWORK REDUCTION NOTICE: We ask for the inform<strong>at</strong>ion on th<strong>is</strong> form to carry out the Internal Revenue lawsof the United St<strong>at</strong>es. Th<strong>is</strong> report <strong>is</strong> voluntary and the inform<strong>at</strong>ion requested helps us determine if there has been aviol<strong>at</strong>ion of Income Tax Law. We need it to insure th<strong>at</strong> taxpayers are complying with these laws and to allow us tofigure and collect the right amount of tax.You are not required to provide the inform<strong>at</strong>ion on a form th<strong>at</strong> <strong>is</strong> subject to the Paperwork Reduction Act unless theform d<strong>is</strong>plays a valid OMB control number. Books or records rel<strong>at</strong>ing to a form or its instructions must be retained aslong as their contents may become m<strong>at</strong>erial in the admin<strong>is</strong>tr<strong>at</strong>ions of any Internal Revenue laws. Generally, tax returnsand tax return inform<strong>at</strong>ion are confidential, as required by Code section 6103.The time required to complete th<strong>is</strong> form will vary depending on individual circumstances. The estim<strong>at</strong>ed average time<strong>is</strong> 15 minutes.Privacy Act NoticeWe are requesting th<strong>is</strong> inform<strong>at</strong>ion under authority of 26 U.S.C. 7801.The primary purpose of th<strong>is</strong> form <strong>is</strong> to report potential viol<strong>at</strong>ions of the Internal Revenue laws.The inform<strong>at</strong>ion may be d<strong>is</strong>closed to the Department of Justice to enforce the tax laws.Providing the inform<strong>at</strong>ion <strong>is</strong> voluntary. Not providing all or part of the inform<strong>at</strong>ion will not affect you.C<strong>at</strong>alog Number 47872E Form 3949 A (Rev. 2-2007)28 — Exclusivefocus Winter 2009/2010

fe<strong>at</strong>ureKeeping up the PressureFor the past several years your associ<strong>at</strong>ionhas talked about and writtenabout the “independent contractor” <strong>is</strong>sue<strong>at</strong> Allst<strong>at</strong>e. During those years, NAPAAhad hoped th<strong>at</strong> the company would see theerror of its ways and begin to tre<strong>at</strong> agentsas true independent contractors. Regrettably,th<strong>is</strong> v<strong>is</strong>ion never came to pass and,in fact, conditions have steadily worsened.It <strong>is</strong> clear the company will never acquiesceunless forced by the courts or sometype of government intervention.To th<strong>at</strong> end, NAPAA has initi<strong>at</strong>edcampaigns to ra<strong>is</strong>e awareness about theindependent contractor m<strong>is</strong>classific<strong>at</strong>ionproblem <strong>at</strong> Allst<strong>at</strong>e. First there wasthe IRS postcard campaign last winter.Then in the last <strong>is</strong>sue of th<strong>is</strong> magazine,we included petitions to the IRS and<strong>President</strong> Obama and the hypotheticalexample of an IRS Form SS-8.In th<strong>is</strong> <strong>is</strong>sue, we are introducingtwo more tools th<strong>at</strong> agents can use toanonymously report the company’sbehavior to st<strong>at</strong>e and federal agencies.The first <strong>is</strong> described in the article: MeetIRS Form 3949 A – an Anonymous Way toReport IC Abuse. The second <strong>is</strong> the letterth<strong>at</strong> accompanies th<strong>is</strong> article. It can beremoved from the magazine and mailedto your st<strong>at</strong>e <strong>at</strong>torney general and yourelected represent<strong>at</strong>ives.Thanks to the launch of the IRSQuestionable Employment TaxPractice (QETP) initi<strong>at</strong>ive in 2008, theemployment tax <strong>is</strong>sue <strong>is</strong> now spreading tost<strong>at</strong>e governments. More than two dozenst<strong>at</strong>es have signed d<strong>at</strong>a sharing agreementswith the IRS, which will help ensureproper worker classific<strong>at</strong>ion and ferret outemployers who exploit the system.As it turns out, the timing of theQETP couldn’t have been better forst<strong>at</strong>e taxing authorities. The economicdownturn cre<strong>at</strong>ed significant shortagesin tax collections in most st<strong>at</strong>es, so st<strong>at</strong>egovernments are eager to find ways toboost revenues. Therefore, st<strong>at</strong>es are nowramping up efforts to identify companiesengaged in employment tax schemes,including those th<strong>at</strong> are deliber<strong>at</strong>elym<strong>is</strong>classifying their workers in order togain favorable tax tre<strong>at</strong>ment. Recently,in fact, New York, New Jersey andMontana announced their intent to sueFedEx for viol<strong>at</strong>ions of st<strong>at</strong>e labor laws.And last September, the IRS announcedplans to audit 6,000 companies forevidence of worker m<strong>is</strong>classific<strong>at</strong>ion andunderpayment of employment taxes.When a company calls its workersindependent contractors and then turnsaround and bl<strong>at</strong>antly tre<strong>at</strong>s them likeemployees, it <strong>is</strong> up to the workers toreport it. Failure to report such tre<strong>at</strong>mentsends the message th<strong>at</strong> the company’sbehavior <strong>is</strong> acceptable, which only leadsto more control and exploit<strong>at</strong>ion.The following letter was drafted basedon inform<strong>at</strong>ion obtained by NAPAAfrom agents, company m<strong>at</strong>erials andmanagement communic<strong>at</strong>ions. Webelieve it to be a truthful represent<strong>at</strong>ion ofthe st<strong>at</strong>e of affairs <strong>at</strong> Allst<strong>at</strong>e. If you agreeand believe you are being tre<strong>at</strong>ed likean employee instead of an independentcontractor, we urge you to send it to the<strong>at</strong>torney general in your st<strong>at</strong>e. The lettercan be sent anonymously if desired.By now we’ve all heard th<strong>at</strong> asignificant number of Allst<strong>at</strong>e agentswill be termin<strong>at</strong>ed in the next 12 to 24months. Th<strong>is</strong> <strong>is</strong> a startling revel<strong>at</strong>ion forsome and an “I told you so” moment forothers. Wh<strong>at</strong>ever your beliefs, it <strong>is</strong> clearth<strong>at</strong> the company <strong>is</strong> intent on elimin<strong>at</strong>ingmany of us and it <strong>is</strong> time for us to dosomething about it.You can help save our jobs by detachingand mailing the letter found in thecenter of th<strong>is</strong> magazine. Mail it to yourst<strong>at</strong>e’s <strong>at</strong>torney general, your electedrepresent<strong>at</strong>ives, the Department of Laborand other departments or officials.Sending the <strong>at</strong>torney general letter <strong>is</strong>easy. For all st<strong>at</strong>es, except New Jersey*,follow the steps below:1. Remove and read the multi-pageletter from the magazine.2. From the l<strong>is</strong>t beginning on the nextpage, loc<strong>at</strong>e the name and address of the<strong>at</strong>torney general in your st<strong>at</strong>e.3. Fill in the address and salut<strong>at</strong>ionsection loc<strong>at</strong>ed on the upper left side ofthe letter (see instructions on next page).4. Sign your name or if you prefer,write the words “Name Withheld forFear of Retali<strong>at</strong>ion” on the last page ofthe letter under “Respectfully yours.”5. Address envelope to your st<strong>at</strong>e<strong>at</strong>torney general and insert letter.6. Optional additional step: Makeadditional copies to send to your electedrepresent<strong>at</strong>ives. Be sure to make copies ofthe letter before completing the addresssection. Th<strong>at</strong> way you can send a letter toother officials or government agencies.*New Jersey agents: Please contact NAPAAHeadquarters for a special version of the letter.Winter 2009/2010 Exclusivefocus — 29