Class Plus 2 Information Folder and Contract Provisions - Empire Life

Class Plus 2 Information Folder and Contract Provisions - Empire Life

Class Plus 2 Information Folder and Contract Provisions - Empire Life

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

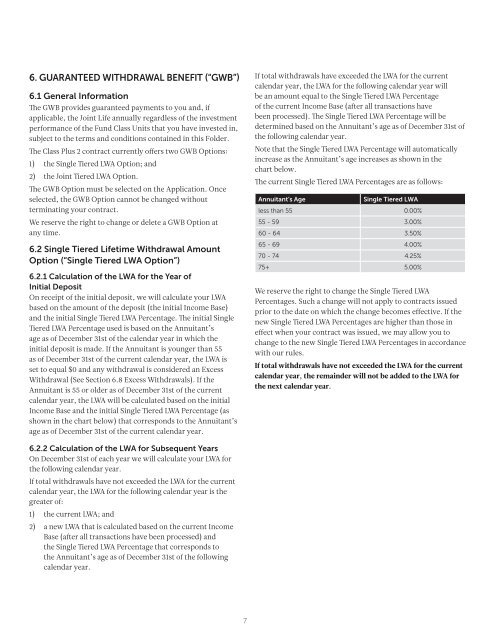

6. GUARANTEED WITHDRAWAL BENEFIT (“GWB”)6.1 General <strong>Information</strong>The GWB provides guaranteed payments to you <strong>and</strong>, ifapplicable, the Joint <strong>Life</strong> annually regardless of the investmentperformance of the Fund <strong>Class</strong> Units that you have invested in,subject to the terms <strong>and</strong> conditions contained in this <strong>Folder</strong>.The <strong>Class</strong> <strong>Plus</strong> 2 contract currently offers two GWB Options:1) the Single Tiered LWA Option; <strong>and</strong>2) the Joint Tiered LWA Option.The GWB Option must be selected on the Application. Onceselected, the GWB Option cannot be changed withoutterminating your contract.We reserve the right to change or delete a GWB Option atany time.6.2 Single Tiered <strong>Life</strong>time Withdrawal AmountOption (“Single Tiered LWA Option”)6.2.1 Calculation of the LWA for the Year ofInitial DepositOn receipt of the initial deposit, we will calculate your LWAbased on the amount of the deposit (the initial Income Base)<strong>and</strong> the initial Single Tiered LWA Percentage. The initial SingleTiered LWA Percentage used is based on the Annuitant’sage as of December 31st of the calendar year in which theinitial deposit is made. If the Annuitant is younger than 55as of December 31st of the current calendar year, the LWA isset to equal $0 <strong>and</strong> any withdrawal is considered an ExcessWithdrawal (See Section 6.8 Excess Withdrawals). If theAnnuitant is 55 or older as of December 31st of the currentcalendar year, the LWA will be calculated based on the initialIncome Base <strong>and</strong> the initial Single Tiered LWA Percentage (asshown in the chart below) that corresponds to the Annuitant’sage as of December 31st of the current calendar year.If total withdrawals have exceeded the LWA for the currentcalendar year, the LWA for the following calendar year willbe an amount equal to the Single Tiered LWA Percentageof the current Income Base (after all transactions havebeen processed). The Single Tiered LWA Percentage will bedetermined based on the Annuitant’s age as of December 31st ofthe following calendar year.Note that the Single Tiered LWA Percentage will automaticallyincrease as the Annuitant’s age increases as shown in thechart below.The current Single Tiered LWA Percentages are as follows:Annuitant’s AgeSingle Tiered LWAless than 55 0.00%55 - 59 3.00%60 - 64 3.50%65 - 69 4.00%70 - 74 4.25%75+ 5.00%We reserve the right to change the Single Tiered LWAPercentages. Such a change will not apply to contracts issuedprior to the date on which the change becomes effective. If thenew Single Tiered LWA Percentages are higher than those ineffect when your contract was issued, we may allow you tochange to the new Single Tiered LWA Percentages in accordancewith our rules.If total withdrawals have not exceeded the LWA for the currentcalendar year, the remainder will not be added to the LWA forthe next calendar year.6.2.2 Calculation of the LWA for Subsequent YearsOn December 31st of each year we will calculate your LWA forthe following calendar year.If total withdrawals have not exceeded the LWA for the currentcalendar year, the LWA for the following calendar year is thegreater of:1) the current LWA; <strong>and</strong>2) a new LWA that is calculated based on the current IncomeBase (after all transactions have been processed) <strong>and</strong>the Single Tiered LWA Percentage that corresponds tothe Annuitant’s age as of December 31st of the followingcalendar year.7