Class Plus 2 Information Folder and Contract Provisions - Empire Life

Class Plus 2 Information Folder and Contract Provisions - Empire Life

Class Plus 2 Information Folder and Contract Provisions - Empire Life

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

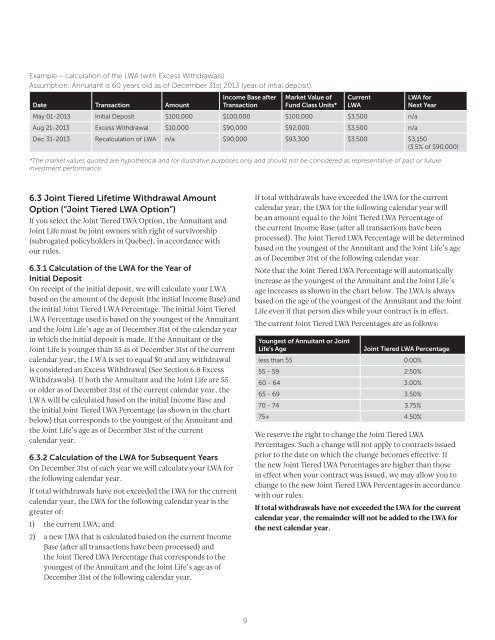

Example – calculation of the LWA (with Excess Withdrawals)Assumption: Annuitant is 60 years old as of December 31st 2013 (year of intial deposit).Date Transaction AmountIncome Base afterTransactionMarket Value ofFund <strong>Class</strong> Units*CurrentLWAMay 01-2013 Initial Deposit $100,000 $100,000 $100,000 $3,500 n/aAug 21-2013 Excess Withdrawal $10,000 $90,000 $92,000 $3,500 n/aLWA forNext YearDec 31-2013 Recalculation of LWA n/a $90,000 $93,300 $3,500 $3,150(3.5% of $90,000)*The market values quoted are hypothetical <strong>and</strong> for illustrative purposes only <strong>and</strong> should not be considered as representative of past or futureinvestment performance.6.3 Joint Tiered <strong>Life</strong>time Withdrawal AmountOption (“Joint Tiered LWA Option”)If you select the Joint Tiered LWA Option, the Annuitant <strong>and</strong>Joint <strong>Life</strong> must be joint owners with right of survivorship(subrogated policyholders in Quebec), in accordance withour rules.6.3.1 Calculation of the LWA for the Year ofInitial DepositOn receipt of the initial deposit, we will calculate your LWAbased on the amount of the deposit (the initial Income Base) <strong>and</strong>the initial Joint Tiered LWA Percentage. The initial Joint TieredLWA Percentage used is based on the youngest of the Annuitant<strong>and</strong> the Joint <strong>Life</strong>’s age as of December 31st of the calendar yearin which the initial deposit is made. If the Annuitant or theJoint <strong>Life</strong> is younger than 55 as of December 31st of the currentcalendar year, the LWA is set to equal $0 <strong>and</strong> any withdrawalis considered an Excess Withdrawal (See Section 6.8 ExcessWithdrawals). If both the Annuitant <strong>and</strong> the Joint <strong>Life</strong> are 55or older as of December 31st of the current calendar year, theLWA will be calculated based on the initial Income Base <strong>and</strong>the initial Joint Tiered LWA Percentage (as shown in the chartbelow) that corresponds to the youngest of the Annuitant <strong>and</strong>the Joint <strong>Life</strong>’s age as of December 31st of the currentcalendar year.6.3.2 Calculation of the LWA for Subsequent YearsOn December 31st of each year we will calculate your LWA forthe following calendar year.If total withdrawals have not exceeded the LWA for the currentcalendar year, the LWA for the following calendar year is thegreater of:1) the current LWA; <strong>and</strong>2) a new LWA that is calculated based on the current IncomeBase (after all transactions have been processed) <strong>and</strong>the Joint Tiered LWA Percentage that corresponds to theyoungest of the Annuitant <strong>and</strong> the Joint <strong>Life</strong>’s age as ofDecember 31st of the following calendar year.If total withdrawals have exceeded the LWA for the currentcalendar year, the LWA for the following calendar year willbe an amount equal to the Joint Tiered LWA Percentage ofthe current Income Base (after all transactions have beenprocessed). The Joint Tiered LWA Percentage will be determinedbased on the youngest of the Annuitant <strong>and</strong> the Joint <strong>Life</strong>’s ageas of December 31st of the following calendar year.Note that the Joint Tiered LWA Percentage will automaticallyincrease as the youngest of the Annuitant <strong>and</strong> the Joint <strong>Life</strong>’sage increases as shown in the chart below. The LWA is alwaysbased on the age of the youngest of the Annuitant <strong>and</strong> the Joint<strong>Life</strong> even if that person dies while your contract is in effect.The current Joint Tiered LWA Percentages are as follows:Youngest of Annuitant or Joint<strong>Life</strong>’s AgeJoint Tiered LWA Percentageless than 55 0.00%55 - 59 2.50%60 - 64 3.00%65 - 69 3.50%70 - 74 3.75%75+ 4.50%We reserve the right to change the Joint Tiered LWAPercentages. Such a change will not apply to contracts issuedprior to the date on which the change becomes effective. Ifthe new Joint Tiered LWA Percentages are higher than thosein effect when your contract was issued, we may allow you tochange to the new Joint Tiered LWA Percentages in accordancewith our rules.If total withdrawals have not exceeded the LWA for the currentcalendar year, the remainder will not be added to the LWA forthe next calendar year.9