Class Plus 2 Information Folder and Contract Provisions - Empire Life

Class Plus 2 Information Folder and Contract Provisions - Empire Life

Class Plus 2 Information Folder and Contract Provisions - Empire Life

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

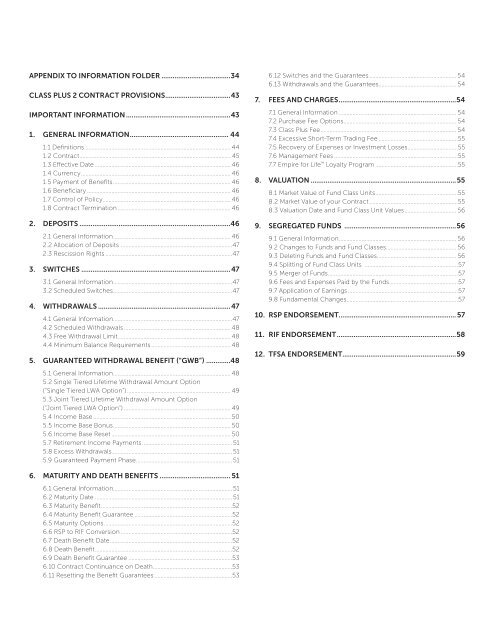

APPENDIX TO INFORMATION FOLDER......................................34CLASS PLUS 2 CONTRACT PROVISIONS....................................43IMPORTANT INFORMATION.........................................................431. GENERAL INFORMATION...................................................... 441.1 Definitions................................................................................................. 441.2 <strong>Contract</strong>.................................................................................................... 451.3 Effective Date.......................................................................................... 461.4 Currency................................................................................................... 461.5 Payment of Benefits.............................................................................. 461.6 Beneficiary............................................................................................... 461.7 Control of Policy.................................................................................... 461.8 <strong>Contract</strong> Termination........................................................................... 462. DEPOSITS..................................................................................462.1 General <strong>Information</strong>.............................................................................. 462.2 Allocation of Deposits ..........................................................................472.3 Rescission Rights....................................................................................473. SWITCHES.................................................................................473.1 General <strong>Information</strong>...............................................................................473.2 Scheduled Switches...............................................................................474. WITHDRAWALS........................................................................474.1 General <strong>Information</strong>...............................................................................474.2 Scheduled Withdrawals....................................................................... 484.3 Free Withdrawal Limit........................................................................... 484.4 Minimum Balance Requirements..................................................... 485. GUARANTEED WITHDRAWAL BENEFIT (“GWB”)..............485.1 General <strong>Information</strong>.............................................................................. 485.2 Single Tiered <strong>Life</strong>time Withdrawal Amount Option(“Single Tiered LWA Option”)..................................................................... 495.3 Joint Tiered <strong>Life</strong>time Withdrawal Amount Option(“Joint Tiered LWA Option”)....................................................................... 495.4 Income Base........................................................................................... 505.5 Income Base Bonus.............................................................................. 505.6 Income Base Reset............................................................................... 505.7 Retirement Income Payments............................................................ 515.8 Excess Withdrawals................................................................................ 515.9 Guaranteed Payment Phase................................................................ 516.12 Switches <strong>and</strong> the Guarantees.......................................................... 546.13 Withdrawals <strong>and</strong> the Guarantees................................................... 547. FEES AND CHARGES................................................................547.1 General <strong>Information</strong>.............................................................................. 547.2 Purchase Fee Options........................................................................... 547.3 <strong>Class</strong> <strong>Plus</strong> Fee.......................................................................................... 547.4 Excessive Short-Term Trading Fee.....................................................557.5 Recovery of Expenses or Investment Losses..................................557.6 Management Fees..................................................................................557.7 <strong>Empire</strong> for <strong>Life</strong> Loyalty Program.......................................................558. VALUATION...............................................................................558.1 Market Value of Fund <strong>Class</strong> Units.......................................................558.2 Market Value of your <strong>Contract</strong>...........................................................558.3 Valuation Date <strong>and</strong> Fund <strong>Class</strong> Unit Values................................... 569. SEGREGATED FUNDS .............................................................569.1 General <strong>Information</strong>.............................................................................. 569.2 Changes to Funds <strong>and</strong> Fund <strong>Class</strong>es............................................... 569.3 Deleting Funds <strong>and</strong> Fund <strong>Class</strong>es..................................................... 569.4 Splitting of Fund <strong>Class</strong> Units ..............................................................579.5 Merger of Funds......................................................................................579.6 Fees <strong>and</strong> Expenses Paid by the Funds..............................................579.7 Application of Earnings.........................................................................579.8 Fundamental Changes.........................................................................5710. RSP ENDORSEMENT................................................................ 5711. RIF ENDORSEMENT.................................................................5812. TFSA ENDORSEMENT..............................................................596. MATURITY AND DEATH BENEFITS....................................... 516.1 General <strong>Information</strong>.............................................................................. 516.2 Maturity Date........................................................................................... 516.3 Maturity Benefit.......................................................................................526.4 Maturity Benefit Guarantee.................................................................526.5 Maturity Options.....................................................................................526.6 RSP to RIF Conversion..........................................................................526.7 Death Benefit Date.................................................................................526.8 Death Benefit...........................................................................................526.9 Death Benefit Guarantee.....................................................................536.10 <strong>Contract</strong> Continuance on Death.....................................................536.11 Resetting the Benefit Guarantees....................................................53