Class Plus 2 Information Folder and Contract Provisions - Empire Life

Class Plus 2 Information Folder and Contract Provisions - Empire Life

Class Plus 2 Information Folder and Contract Provisions - Empire Life

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

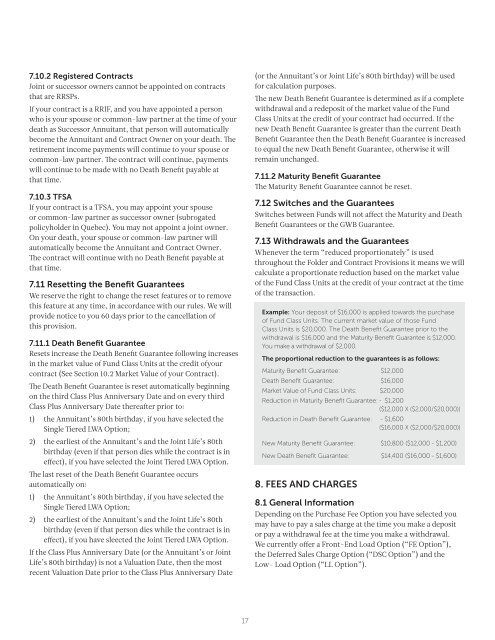

7.10.2 Registered <strong>Contract</strong>sJoint or successor owners cannot be appointed on contractsthat are RRSPs.If your contract is a RRIF, <strong>and</strong> you have appointed a personwho is your spouse or common-law partner at the time of yourdeath as Successor Annuitant, that person will automaticallybecome the Annuitant <strong>and</strong> <strong>Contract</strong> Owner on your death. Theretirement income payments will continue to your spouse orcommon-law partner. The contract will continue, paymentswill continue to be made with no Death Benefit payable atthat time.7.10.3 TFSAIf your contract is a TFSA, you may appoint your spouseor common-law partner as successor owner (subrogatedpolicyholder in Quebec). You may not appoint a joint owner.On your death, your spouse or common-law partner willautomatically become the Annuitant <strong>and</strong> <strong>Contract</strong> Owner.The contract will continue with no Death Benefit payable atthat time.7.11 Resetting the Benefit GuaranteesWe reserve the right to change the reset features or to removethis feature at any time, in accordance with our rules. We willprovide notice to you 60 days prior to the cancellation ofthis provision.7.11.1 Death Benefit GuaranteeResets increase the Death Benefit Guarantee following increasesin the market value of Fund <strong>Class</strong> Units at the credit ofyourcontract (See Section 10.2 Market Value of your <strong>Contract</strong>).The Death Benefit Guarantee is reset automatically beginningon the third <strong>Class</strong> <strong>Plus</strong> Anniversary Date <strong>and</strong> on every third<strong>Class</strong> <strong>Plus</strong> Anniversary Date thereafter prior to:1) the Annuitant’s 80th birthday, if you have selected theSingle Tiered LWA Option;2) the earliest of the Annuitant’s <strong>and</strong> the Joint <strong>Life</strong>’s 80thbirthday (even if that person dies while the contract is ineffect), if you have selected the Joint Tiered LWA Option.The last reset of the Death Benefit Guarantee occursautomatically on:1) the Annuitant’s 80th birthday, if you have selected theSingle Tiered LWA Option;2) the earliest of the Annuitant’s <strong>and</strong> the Joint <strong>Life</strong>’s 80thbirthday (even if that person dies while the contract is ineffect), if you have sleected the Joint Tiered LWA Option.If the <strong>Class</strong> <strong>Plus</strong> Anniversary Date (or the Annuitant’s or Joint<strong>Life</strong>’s 80th birthday) is not a Valuation Date, then the mostrecent Valuation Date prior to the <strong>Class</strong> <strong>Plus</strong> Anniversary Date(or the Annuitant’s or Joint <strong>Life</strong>’s 80th birthday) will be usedfor calculation purposes.The new Death Benefit Guarantee is determined as if a completewithdrawal <strong>and</strong> a redeposit of the market value of the Fund<strong>Class</strong> Units at the credit of your contract had occurred. If thenew Death Benefit Guarantee is greater than the current DeathBenefit Guarantee then the Death Benefit Guarantee is increasedto equal the new Death Benefit Guarantee, otherwise it willremain unchanged.7.11.2 Maturity Benefit GuaranteeThe Maturity Benefit Guarantee cannot be reset.7.12 Switches <strong>and</strong> the GuaranteesSwitches between Funds will not affect the Maturity <strong>and</strong> DeathBenefit Guarantees or the GWB Guarantee.7.13 Withdrawals <strong>and</strong> the GuaranteesWhenever the term “reduced proportionately” is usedthroughout the <strong>Folder</strong> <strong>and</strong> <strong>Contract</strong> <strong>Provisions</strong> it means we willcalculate a proportionate reduction based on the market valueof the Fund <strong>Class</strong> Units at the credit of your contract at the timeof the transaction.Example: Your deposit of $16,000 is applied towards the purchaseof Fund <strong>Class</strong> Units. The current market value of those Fund<strong>Class</strong> Units is $20,000. The Death Benefit Guarantee prior to thewithdrawal is $16,000 <strong>and</strong> the Maturity Benefit Guarantee is $12,000.You make a withdrawal of $2,000.The proportional reduction to the guarantees is as follows:Maturity Benefit Guarantee: $12,000Death Benefit Guarantee: $16,000Market Value of Fund <strong>Class</strong> Units: $20,000Reduction in Maturity Benefit Guarantee: - $1,200($12,000 X ($2,000/$20,000))Reduction in Death Benefit Guarantee: - $1,600($16,000 X ($2,000/$20,000))New Maturity Benefit Guarantee: $10,800 ($12,000 - $1,200)New Death Benefit Guarantee: $14,400 ($16,000 - $1,600)8. FEES AND CHARGES8.1 General <strong>Information</strong>Depending on the Purchase Fee Option you have selected youmay have to pay a sales charge at the time you make a depositor pay a withdrawal fee at the time you make a withdrawal.We currently offer a Front-End Load Option (“FE Option”),the Deferred Sales Charge Option (“DSC Option”) <strong>and</strong> theLow- Load Option (“LL Option”).17