Class Plus 2 Information Folder and Contract Provisions - Empire Life

Class Plus 2 Information Folder and Contract Provisions - Empire Life

Class Plus 2 Information Folder and Contract Provisions - Empire Life

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

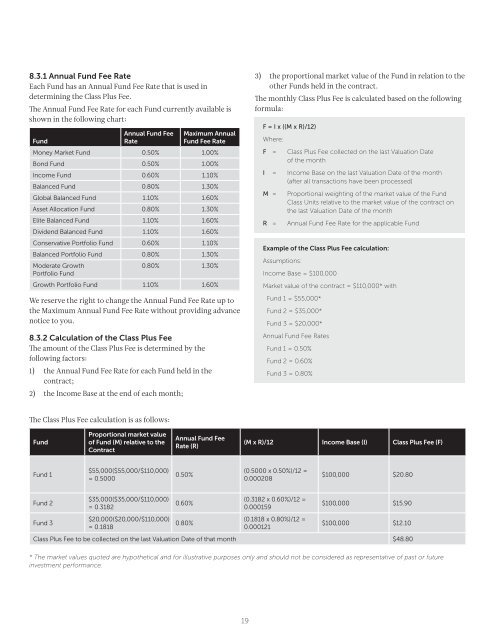

8.3.1 Annual Fund Fee RateEach Fund has an Annual Fund Fee Rate that is used indetermining the <strong>Class</strong> <strong>Plus</strong> Fee.The Annual Fund Fee Rate for each Fund currently available isshown in the following chart:FundAnnual Fund FeeRateMaximum AnnualFund Fee RateMoney Market Fund 0.50% 1.00%Bond Fund 0.50% 1.00%Income Fund 0.60% 1.10%Balanced Fund 0.80% 1.30%Global Balanced Fund 1.10% 1.60%Asset Allocation Fund 0.80% 1.30%Elite Balanced Fund 1.10% 1.60%Dividend Balanced Fund 1.10% 1.60%Conservative Portfolio Fund 0.60% 1.10%Balanced Portfolio Fund 0.80% 1.30%Moderate GrowthPortfolio Fund0.80% 1.30%Growth Portfolio Fund 1.10% 1.60%We reserve the right to change the Annual Fund Fee Rate up tothe Maximum Annual Fund Fee Rate without providing advancenotice to you.8.3.2 Calculation of the <strong>Class</strong> <strong>Plus</strong> FeeThe amount of the <strong>Class</strong> <strong>Plus</strong> Fee is determined by thefollowing factors:1) the Annual Fund Fee Rate for each Fund held in thecontract;2) the Income Base at the end of each month;3) the proportional market value of the Fund in relation to theother Funds held in the contract.The monthly <strong>Class</strong> <strong>Plus</strong> Fee is calculated based on the followingformula:F = I x ((M x R)/12)Where:F =<strong>Class</strong> <strong>Plus</strong> Fee collected on the last Valuation Dateof the monthI = Income Base on the last Valuation Date of the month(after all transactions have been processed)M =R =Proportional weighting of the market value of the Fund<strong>Class</strong> Units relative to the market value of the contract onthe last Valuation Date of the monthAnnual Fund Fee Rate for the applicable FundExample of the <strong>Class</strong> <strong>Plus</strong> Fee calculation:Assumptions:Income Base = $100,000Market value of the contract = $110,000* withFund 1 = $55,000*Fund 2 = $35,000*Fund 3 = $20,000*Annual Fund Fee RatesFund 1 = 0.50%Fund 2 = 0.60%Fund 3 = 0.80%The <strong>Class</strong> <strong>Plus</strong> Fee calculation is as follows:FundProportional market valueof Fund (M) relative to the<strong>Contract</strong>Annual Fund FeeRate (R)(M x R)/12 Income Base (I) <strong>Class</strong> <strong>Plus</strong> Fee (F)Fund 1$55,000($55,000/$110,000)= 0.50000.50%(0.5000 x 0.50%)/12 =0.000208$100,000 $20.80Fund 2Fund 3$35,000($35,000/$110,000)= 0.3182$20,000($20,000/$110,000)= 0.18180.60%0.80%(0.3182 x 0.60%)/12 =0.000159(0.1818 x 0.80%)/12 =0.000121$100,000 $15.90$100,000 $12.10<strong>Class</strong> <strong>Plus</strong> Fee to be collected on the last Valuation Date of that month $48.80* The market values quoted are hypothetical <strong>and</strong> for illustrative purposes only <strong>and</strong> should not be considered as representative of past or futureinvestment performance.19