Consolidated Financial Statements - Acer Group

Consolidated Financial Statements - Acer Group

Consolidated Financial Statements - Acer Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

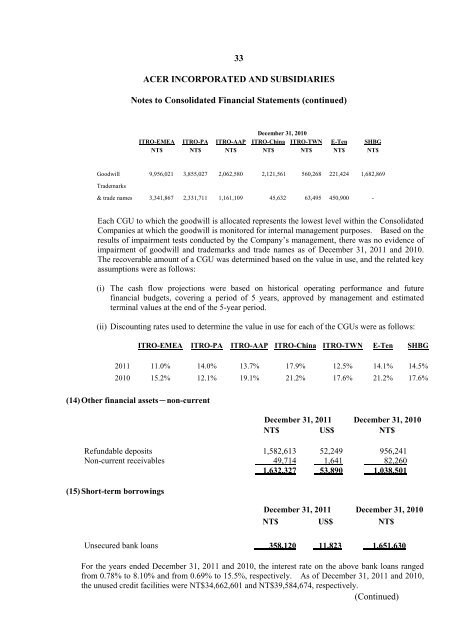

33ACER INCORPORATED AND SUBSIDIARIESNotes to <strong>Consolidated</strong> <strong>Financial</strong> <strong>Statements</strong> (continued)December 31, 2010ITRO-EMEA ITRO-PA ITRO-AAP ITRO-China ITRO-TWN E-Ten SHBGNT$ NT$ NT$ NT$ NT$ NT$ NT$Goodwill 9,956,021 3,855,027 2,062,580 2,121,561 560,268 221,424 1,682,869Trademarks& trade names 3,341,867 2,331,711 1,161,109 45,632 63,495 450,900 -Each CGU to which the goodwill is allocated represents the lowest level within the <strong>Consolidated</strong>Companies at which the goodwill is monitored for internal management purposes. Based on theresults of impairment tests conducted by the Company‟s management, there was no evidence ofimpairment of goodwill and trademarks and trade names as of December 31, 2011 and 2010.The recoverable amount of a CGU was determined based on the value in use, and the related keyassumptions were as follows:(i) The cash flow projections were based on historical operating performance and futurefinancial budgets, covering a period of 5 years, approved by management and estimatedterminal values at the end of the 5-year period.(ii) Discounting rates used to determine the value in use for each of the CGUs were as follows:ITRO-EMEA ITRO-PA ITRO-AAP ITRO-China ITRO-TWN E-Ten SHBG2011 11.0% 14.0% 13.7% 17.9% 12.5% 14.1% 14.5%2010 15.2% 12.1% 19.1% 21.2% 17.6% 21.2% 17.6%(14) Other financial assets-non-currentDecember 31, 2011 December 31, 2010NT$ US$ NT$Refundable deposits 1,582,613 52,249 956,241Non-current receivables 49,714 1,641 82,2601,632,327 53,890 1,038,501(15) Short-term borrowingsDecember 31, 2011 December 31, 2010NT$ US$ NT$Unsecured bank loans 358,120 11,823 1,651,630For the years ended December 31, 2011 and 2010, the interest rate on the above bank loans rangedfrom 0.78% to 8.10% and from 0.69% to 15.5%, respectively. As of December 31, 2011 and 2010,the unused credit facilities were NT$34,662,601 and NT$39,584,674, respectively.(Continued)