Consolidated Financial Statements - Acer Group

Consolidated Financial Statements - Acer Group

Consolidated Financial Statements - Acer Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

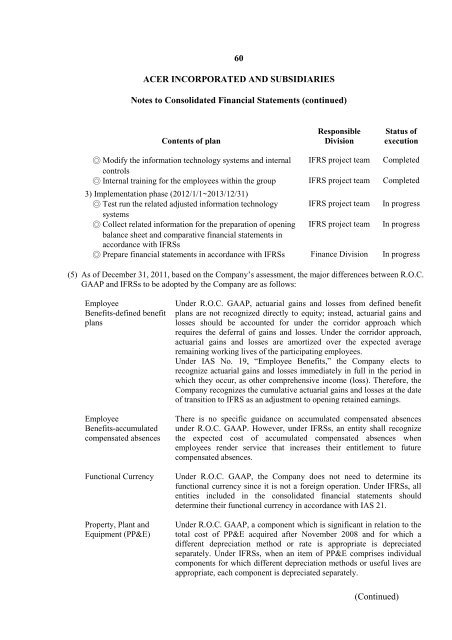

60ACER INCORPORATED AND SUBSIDIARIESNotes to <strong>Consolidated</strong> <strong>Financial</strong> <strong>Statements</strong> (continued)Contents of planResponsibleDivisionStatus ofexecution◎ Modify the information technology systems and internal IFRS project team Completedcontrols◎ Internal training for the employees within the group IFRS project team Completed3) Implementation phase (2012/1/1~2013/12/31)◎ Test run the related adjusted information technology IFRS project team In progresssystems◎ Collect related information for the preparation of opening IFRS project team In progressbalance sheet and comparative financial statements inaccordance with IFRSs◎ Prepare financial statements in accordance with IFRSs Finance Division In progress(5) As of December 31, 2011, based on the Company‟s assessment, the major differences between R.O.C.GAAP and IFRSs to be adopted by the Company are as follows:EmployeeBenefits-defined benefitplansEmployeeBenefits-accumulatedcompensated absencesFunctional CurrencyProperty, Plant andEquipment (PP&E)Under R.O.C. GAAP, actuarial gains and losses from defined benefitplans are not recognized directly to equity; instead, actuarial gains andlosses should be accounted for under the corridor approach whichrequires the deferral of gains and losses. Under the corridor approach,actuarial gains and losses are amortized over the expected averageremaining working lives of the participating employees.Under IAS No. 19, “Employee Benefits,” the Company elects torecognize actuarial gains and losses immediately in full in the period inwhich they occur, as other comprehensive income (loss). Therefore, theCompany recognizes the cumulative actuarial gains and losses at the dateof transition to IFRS as an adjustment to opening retained earnings.There is no specific guidance on accumulated compensated absencesunder R.O.C. GAAP. However, under IFRSs, an entity shall recognizethe expected cost of accumulated compensated absences whenemployees render service that increases their entitlement to futurecompensated absences.Under R.O.C. GAAP, the Company does not need to determine itsfunctional currency since it is not a foreign operation. Under IFRSs, allentities included in the consolidated financial statements shoulddetermine their functional currency in accordance with IAS 21.Under R.O.C. GAAP, a component which is significant in relation to thetotal cost of PP&E acquired after November 2008 and for which adifferent depreciation method or rate is appropriate is depreciatedseparately. Under IFRSs, when an item of PP&E comprises individualcomponents for which different depreciation methods or useful lives areappropriate, each component is depreciated separately.(Continued)