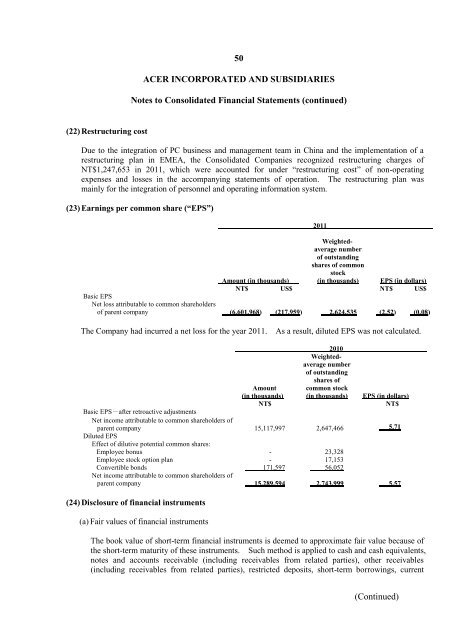

50ACER INCORPORATED AND SUBSIDIARIESNotes to <strong>Consolidated</strong> <strong>Financial</strong> <strong>Statements</strong> (continued)(22) Restructuring costDue to the integration of PC business and management team in China and the implementation of arestructuring plan in EMEA, the <strong>Consolidated</strong> Companies recognized restructuring charges ofNT$1,247,653 in 2011, which were accounted for under “restructuring cost” of non-operatingexpenses and losses in the accompanying statements of operation. The restructuring plan wasmainly for the integration of personnel and operating information system.(23) Earnings per common share (“EPS”)Amount (in thousands)Weightedaveragenumberof outstandingshares of commonstock(in thousands) EPS (in dollars)NT$ US$ NT$ US$Basic EPSNet loss attributable to common shareholdersof parent company (6,601,968) (217,959) 2,624,535 (2.52) (0.08)2011The Company had incurred a net loss for the year 2011.As a result, diluted EPS was not calculated.2010Weightedaveragenumberof outstandingshares ofAmount(in thousands)common stock(in thousands) EPS (in dollars)NT$NT$Basic EPS-after retroactive adjustmentsNet income attributable to common shareholders ofparent company 15,117,997 2,647,466 5.71Diluted EPSEffect of dilutive potential common shares:Employee bonus - 23,328Employee stock option plan - 17,153Convertible bonds 171,597 56,052Net income attributable to common shareholders ofparent company 15,289,594 2,743,999 5.57(24) Disclosure of financial instruments(a) Fair values of financial instrumentsThe book value of short-term financial instruments is deemed to approximate fair value because ofthe short-term maturity of these instruments. Such method is applied to cash and cash equivalents,notes and accounts receivable (including receivables from related parties), other receivables(including receivables from related parties), restricted deposits, short-term borrowings, current(Continued)

51ACER INCORPORATED AND SUBSIDIARIESNotes to <strong>Consolidated</strong> <strong>Financial</strong> <strong>Statements</strong> (continued)portion of long-term debt, notes and accounts payables (including payables to related parties), otherpayables to related parties and royalties payable.The estimated fair values and carrying amounts of all other financial assets and liabilities as ofDecember 31, 2011 and 2010 were as follows:2011 2010Fair valueFair valueCarryingamountPublic quotedpriceValuationamountCarryingamountPublic quotedpriceValuationamountNT$ NT$ NT$ NT$ NT$ NT$Non-derivative financial instruments<strong>Financial</strong> assets:Available-for-sale financial assets-current 109,721 109,721 - 225,710 225,710 -Available-for-sale financial assets-noncurrent 775,702 775,702 - 2,274,902 2,274,902 -<strong>Financial</strong> assets carried at cost-noncurrent 1,157,773 - see below (b) 1,722,677 - see below (b)Refundable deposits (classified as “other1,582,613 - 1,582,613 956,241 - 956,241financial assets-noncurrent”)Noncurrent receivables (classified as “other49,714 - 49,714 82,260 - 82,260financial assets-noncurrent”)<strong>Financial</strong> liabilities:Bonds payable 14,064,997 - 15,584,854 13,103,887 - 13,668,171Long-term debt 9,123,094 - 9,123,094 6,221,933 6,221,933Derivative financial instruments<strong>Financial</strong> assets:Foreign currency forward contracts 1,110,435 - 1,110,435 118,753 - 118,753Foreign currency options - - - 8,514 - 8,514<strong>Financial</strong> liabilities:Foreign currency forward contracts 235,897 - 235,897 1,049,142 - 1,049,142Foreign currency options - - - 9,722 - 9,722Redemption option of convertible bonds 1,216,586 - 1,216,586 1,338,524 - 1,338,524(b) The following methods and assumptions were used to estimate the fair value of each class offinancial instruments:(i) Available-for-sale financial assetsThe fair value of publicly traded stocks is based on the closing quotation price at the balancesheet date.(ii) <strong>Financial</strong> assets carried at cost-noncurrent<strong>Financial</strong> assets carried at cost represent investments in privately held stock. It is notpracticable to estimate the fair value of privately held stock as it is not traded in an activepublic market.(iii) Refundable depositsThe fair values of refundable deposits with no fixed maturities are based on carrying amounts.(iv) Non-current receivablesThe fair values of non-current receivables are their present value discounted at the marketinterest rate.(Continued)