Consolidated Financial Statements - Acer Group

Consolidated Financial Statements - Acer Group

Consolidated Financial Statements - Acer Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

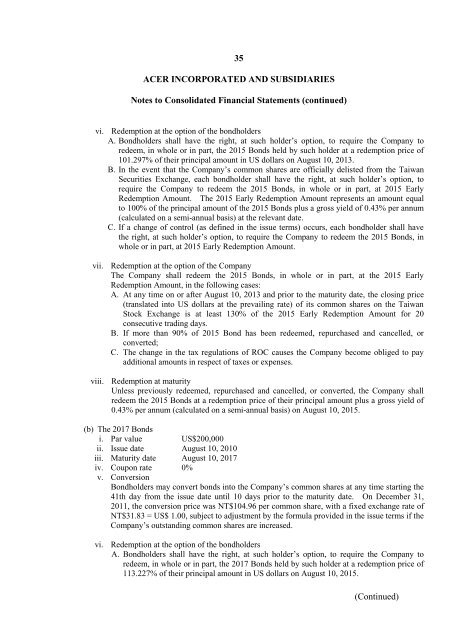

35ACER INCORPORATED AND SUBSIDIARIESNotes to <strong>Consolidated</strong> <strong>Financial</strong> <strong>Statements</strong> (continued)vi. Redemption at the option of the bondholdersA. Bondholders shall have the right, at such holder‟s option, to require the Company toredeem, in whole or in part, the 2015 Bonds held by such holder at a redemption price of101.297% of their principal amount in US dollars on August 10, 2013.B. In the event that the Company‟s common shares are officially delisted from the TaiwanSecurities Exchange, each bondholder shall have the right, at such holder‟s option, torequire the Company to redeem the 2015 Bonds, in whole or in part, at 2015 EarlyRedemption Amount. The 2015 Early Redemption Amount represents an amount equalto 100% of the principal amount of the 2015 Bonds plus a gross yield of 0.43% per annum(calculated on a semi-annual basis) at the relevant date.C. If a change of control (as defined in the issue terms) occurs, each bondholder shall havethe right, at such holder‟s option, to require the Company to redeem the 2015 Bonds, inwhole or in part, at 2015 Early Redemption Amount.vii. Redemption at the option of the CompanyThe Company shall redeem the 2015 Bonds, in whole or in part, at the 2015 EarlyRedemption Amount, in the following cases:A. At any time on or after August 10, 2013 and prior to the maturity date, the closing price(translated into US dollars at the prevailing rate) of its common shares on the TaiwanStock Exchange is at least 130% of the 2015 Early Redemption Amount for 20consecutive trading days.B. If more than 90% of 2015 Bond has been redeemed, repurchased and cancelled, orconverted;C. The change in the tax regulations of ROC causes the Company become obliged to payadditional amounts in respect of taxes or expenses.viii. Redemption at maturityUnless previously redeemed, repurchased and cancelled, or converted, the Company shallredeem the 2015 Bonds at a redemption price of their principal amount plus a gross yield of0.43% per annum (calculated on a semi-annual basis) on August 10, 2015.(b) The 2017 Bondsi. Par value US$200,000ii. Issue date August 10, 2010iii. Maturity date August 10, 2017iv. Coupon rate 0%v. ConversionBondholders may convert bonds into the Company‟s common shares at any time starting the41th day from the issue date until 10 days prior to the maturity date. On December 31,2011, the conversion price was NT$104.96 per common share, with a fixed exchange rate ofNT$31.83 = US$ 1.00, subject to adjustment by the formula provided in the issue terms if theCompany‟s outstanding common shares are increased.vi. Redemption at the option of the bondholdersA. Bondholders shall have the right, at such holder‟s option, to require the Company toredeem, in whole or in part, the 2017 Bonds held by such holder at a redemption price of113.227% of their principal amount in US dollars on August 10, 2015.(Continued)