Consolidated Financial Statements - Acer Group

Consolidated Financial Statements - Acer Group

Consolidated Financial Statements - Acer Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

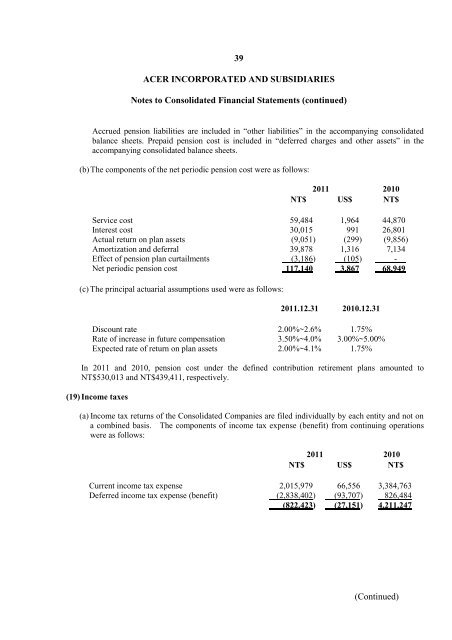

39ACER INCORPORATED AND SUBSIDIARIESNotes to <strong>Consolidated</strong> <strong>Financial</strong> <strong>Statements</strong> (continued)Accrued pension liabilities are included in “other liabilities” in the accompanying consolidatedbalance sheets. Prepaid pension cost is included in “deferred charges and other assets” in theaccompanying consolidated balance sheets.(b) The components of the net periodic pension cost were as follows:2011 2010NT$ US$ NT$Service cost 59,484 1,964 44,870Interest cost 30,015 991 26,801Actual return on plan assets (9,051) (299) (9,856)Amortization and deferral 39,878 1,316 7,134Effect of pension plan curtailments (3,186) (105) -Net periodic pension cost 117,140 3,867 68,949(c) The principal actuarial assumptions used were as follows:2011.12.31 2010.12.31Discount rate 2.00%~2.6% 1.75%Rate of increase in future compensation 3.50%~4.0% 3.00%~5.00%Expected rate of return on plan assets 2.00%~4.1% 1.75%In 2011 and 2010, pension cost under the defined contribution retirement plans amounted toNT$530,013 and NT$439,411, respectively.(19) Income taxes(a) Income tax returns of the <strong>Consolidated</strong> Companies are filed individually by each entity and not ona combined basis. The components of income tax expense (benefit) from continuing operationswere as follows:2011 2010NT$ US$ NT$Current income tax expense 2,015,979 66,556 3,384,763Deferred income tax expense (benefit) (2,838,402) (93,707) 826,484(822,423) (27,151) 4,211,247(Continued)