Form R 2012 Explanatory Notes - Lembaga Hasil Dalam Negeri

Form R 2012 Explanatory Notes - Lembaga Hasil Dalam Negeri

Form R 2012 Explanatory Notes - Lembaga Hasil Dalam Negeri

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

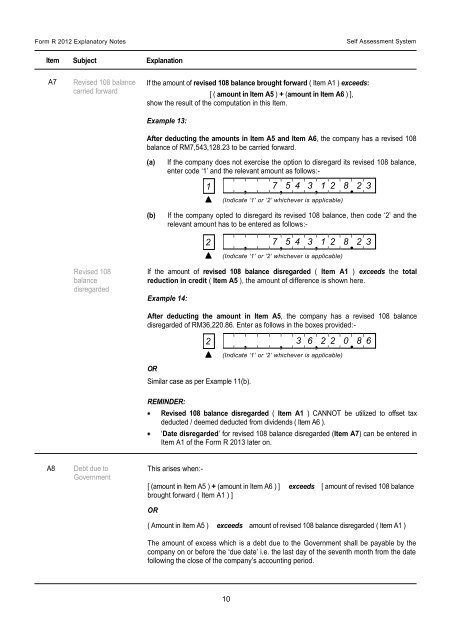

<strong>Form</strong> R <strong>2012</strong> <strong>Explanatory</strong> <strong>Notes</strong>Self Assessment SystemItem Subject ExplanationA7Revised 108 balancecarried forwardIf the amount of revised 108 balance brought forward ( Item A1 ) exceeds:[ ( amount in Item A5 ) + (amount in Item A6 ) ],show the result of the computation in this Item.Example 13:After deducting the amounts in Item A5 and Item A6, the company has a revised 108balance of RM7,543,128.23 to be carried forward.(a)(b)If the company does not exercise the option to disregard its revised 108 balance,enter code ‘1’ and the relevant amount as follows:-! 1 >_>>_>>_>?,7,5 4 3,1 2 8.2 3(Indicate ‘1’ or ‘2’ whichever is applicable)If the company opted to disregard its revised 108 balance, then code ‘2’ and therelevant amount has to be entered as follows:-! 2 >_>>_>>_>?, 7 , 5 4 3 , 1 2 8 .2 3(Indicate ‘1’ or ‘2’ whichever is applicable)Revised 108balancedisregardedIf the amount of revised 108 balance disregarded ( Item A1 ) exceeds the totalreduction in credit ( Item A5 ), the amount of difference is shown here.Example 14:After deducting the amount in Item A5, the company has a revised 108 balancedisregarded of RM36,220.86. Enter as follows in the boxes provided:-! 2 >_>>_>>_>?, , 3 6 , 2 2 0 .8 6(Indicate ‘1’ or ‘2’ whichever is applicable)ORSimilar case as per Example 11(b).REMINDER:Revised 108 balance disregarded ( Item A1 ) CANNOT be utilized to offset taxdeducted / deemed deducted from dividends ( Item A6 ).‘Date disregarded’ for revised 108 balance disregarded (Item A7) can be entered inItem A1 of the <strong>Form</strong> R 2013 later on.A8Debt due toGovernmentThis arises when:-[ (amount in Item A5 ) + (amount in Item A6 ) ] exceeds [ amount of revised 108 balancebrought forward ( Item A1 ) ]OR( Amount in Item A5 ) exceeds amount of revised 108 balance disregarded ( Item A1 )The amount of excess which is a debt due to the Government shall be payable by thecompany on or before the ‘due date’ i.e. the last day of the seventh month from the datefollowing the close of the company’s accounting period.10