Form R 2012 Explanatory Notes - Lembaga Hasil Dalam Negeri

Form R 2012 Explanatory Notes - Lembaga Hasil Dalam Negeri

Form R 2012 Explanatory Notes - Lembaga Hasil Dalam Negeri

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

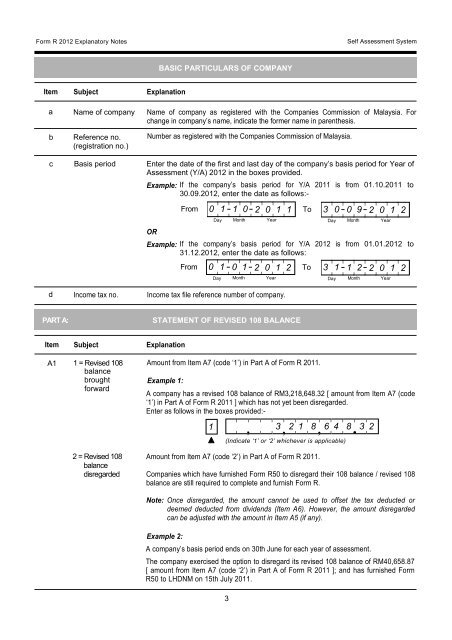

<strong>Form</strong> R <strong>2012</strong> <strong>Explanatory</strong> <strong>Notes</strong>Self Assessment SystemBASIC PARTICULARS OF COMPANYItem Subject ExplanationabcdName of companyReference no.(registration no.)Basis periodIncome tax no.Name of company as registered with the Companies Commission of Malaysia. Forchange in company’s name, indicate the former name in parenthesis.Number as registered with the Companies Commission of Malaysia.Enter the date of the first and last day of the company’s basis period for Year ofAssessment (Y/A) <strong>2012</strong> in the boxes provided.Example:ORExample:If the company’s basis period for Y/A 2011 is from 01.10.2011 to30.09.<strong>2012</strong>, enter the date as follows:-FromIf the company’s basis period for Y/A <strong>2012</strong> is from 01.01.<strong>2012</strong> to31.12.<strong>2012</strong>, enter the date as follows:From0 1 1 0>>>>>?2 0 1 1Day Month Year0 1 0 1>>>>>?2 0 1 2Income tax file reference number of company.ToTo3 0 0 9>>>>>?2 0 1 2Day Month Year3 1 1 2>>>>>?2 0 1 2Day Month Year Day Month YearPART A:STATEMENT OF REVISED 108 BALANCEItem Subject ExplanationA11 = Revised 108 Amount from Item A7 (code ‘1’) in Part A of <strong>Form</strong> R 2011.balancebroughtExample 1:forwardA company has a revised 108 balance of RM3,218,648.32 [ amount from Item A7 (code‘1’) in Part A of <strong>Form</strong> R 2011 ] which has not yet been disregarded.Enter as follows in the boxes provided:-! 1 >_>>_>>_>?, 3 , 2 1 8 , 6 4 8 .3 2(Indicate ‘1’ or ‘2’ whichever is applicable)2 = Revised 108balancedisregardedAmount from Item A7 (code ‘2’) in Part A of <strong>Form</strong> R 2011.Companies which have furnished <strong>Form</strong> R50 to disregard their 108 balance / revised 108balance are still required to complete and furnish <strong>Form</strong> R.Note: Once disregarded, the amount cannot be used to offset the tax deducted ordeemed deducted from dividends (Item A6). However, the amount disregardedcan be adjusted with the amount in Item A5 (if any).Example 2:A company’s basis period ends on 30th June for each year of assessment.The company exercised the option to disregard its revised 108 balance of RM40,658.87[ amount from Item A7 (code ‘2’) in Part A of <strong>Form</strong> R 2011 ]; and has furnished <strong>Form</strong>R50 to LHDNM on 15th July 2011.3