Form R 2012 Explanatory Notes - Lembaga Hasil Dalam Negeri

Form R 2012 Explanatory Notes - Lembaga Hasil Dalam Negeri

Form R 2012 Explanatory Notes - Lembaga Hasil Dalam Negeri

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

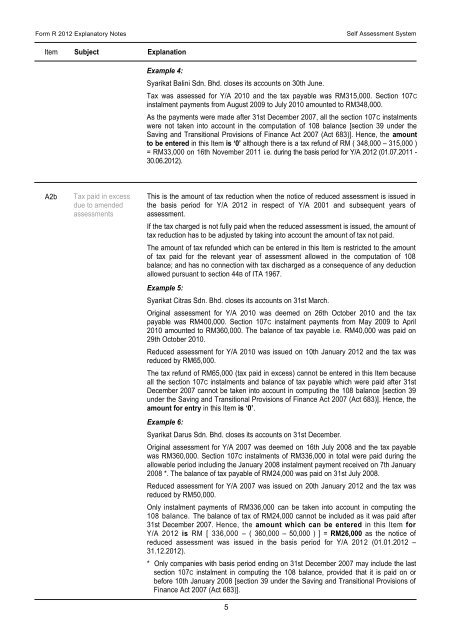

<strong>Form</strong> R <strong>2012</strong> <strong>Explanatory</strong> <strong>Notes</strong>Self Assessment SystemItem Subject ExplanationExample 4:Syarikat Balini Sdn. Bhd. closes its accounts on 30th June.Tax was assessed for Y/A 2010 and the tax payable was RM315,000. Section 107Cinstalment payments from August 2009 to July 2010 amounted to RM348,000.As the payments were made after 31st December 2007, all the section 107C instalmentswere not taken into account in the computation of 108 balance [section 39 under theSaving and Transitional Provisions of Finance Act 2007 (Act 683)]. Hence, the amountto be entered in this Item is ‘0’ although there is a tax refund of RM ( 348,000 – 315,000 )= RM33,000 on 16th November 2011 i.e. during the basis period for Y/A <strong>2012</strong> (01.07.2011 -30.06.<strong>2012</strong>).A2bTax paid in excessdue to amendedassessmentsThis is the amount of tax reduction when the notice of reduced assessment is issued inthe basis period for Y/A <strong>2012</strong> in respect of Y/A 2001 and subsequent years ofassessment.If the tax charged is not fully paid when the reduced assessment is issued, the amount oftax reduction has to be adjusted by taking into account the amount of tax not paid.The amount of tax refunded which can be entered in this Item is restricted to the amountof tax paid for the relevant year of assessment allowed in the computation of 108balance; and has no connection with tax discharged as a consequence of any deductionallowed pursuant to section 44B of ITA 1967.Example 5:Syarikat Citras Sdn. Bhd. closes its accounts on 31st March.Original assessment for Y/A 2010 was deemed on 26th October 2010 and the taxpayable was RM400,000. Section 107C instalment payments from May 2009 to April2010 amounted to RM360,000. The balance of tax payable i.e. RM40,000 was paid on29th October 2010.Reduced assessment for Y/A 2010 was issued on 10th January <strong>2012</strong> and the tax wasreduced by RM65,000.The tax refund of RM65,000 (tax paid in excess) cannot be entered in this Item becauseall the section 107C instalments and balance of tax payable which were paid after 31stDecember 2007 cannot be taken into account in computing the 108 balance [section 39under the Saving and Transitional Provisions of Finance Act 2007 (Act 683)]. Hence, theamount for entry in this Item is ‘0’.Example 6:Syarikat Darus Sdn. Bhd. closes its accounts on 31st December.Original assessment for Y/A 2007 was deemed on 16th July 2008 and the tax payablewas RM360,000. Section 107C instalments of RM336,000 in total were paid during theallowable period including the January 2008 instalment payment received on 7th January2008 *. The balance of tax payable of RM24,000 was paid on 31st July 2008.Reduced assessment for Y/A 2007 was issued on 20th January <strong>2012</strong> and the tax wasreduced by RM50,000.Only instalment payments of RM336,000 can be taken into account in computing the108 balance. The balance of tax of RM24,000 cannot be included as it was paid after31st December 2007. Hence, the amount which can be entered in this Item forY/A <strong>2012</strong> is RM [ 336,000 – ( 360,000 – 50,000 ) ] = RM26,000 as the notice ofreduced assessment was issued in the basis period for Y/A <strong>2012</strong> (01.01.<strong>2012</strong> –31.12.<strong>2012</strong>).* Only companies with basis period ending on 31st December 2007 may include the lastsection 107C instalment in computing the 108 balance, provided that it is paid on orbefore 10th January 2008 [section 39 under the Saving and Transitional Provisions ofFinance Act 2007 (Act 683)].5