Form R 2012 Explanatory Notes - Lembaga Hasil Dalam Negeri

Form R 2012 Explanatory Notes - Lembaga Hasil Dalam Negeri

Form R 2012 Explanatory Notes - Lembaga Hasil Dalam Negeri

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

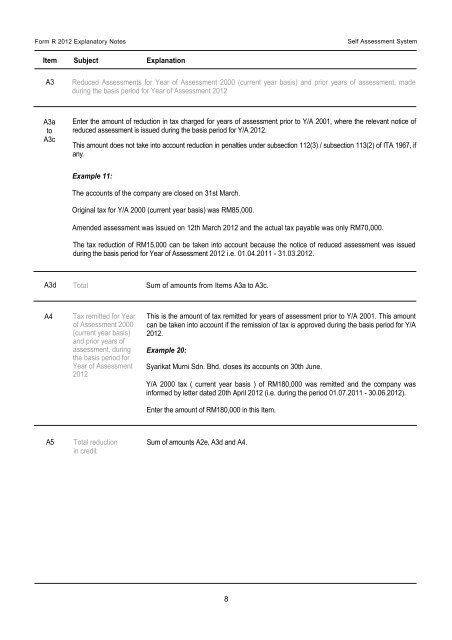

<strong>Form</strong> R <strong>2012</strong> <strong>Explanatory</strong> <strong>Notes</strong>Self Assessment SystemItem Subject ExplanationA3Reduced Assessments for Year of Assessment 2000 (current year basis) and prior years of assessment, madeduring the basis period for Year of Assessment <strong>2012</strong>A3atoA3cEnter the amount of reduction in tax charged for years of assessment prior to Y/A 2001, where the relevant notice ofreduced assessment is issued during the basis period for Y/A <strong>2012</strong>.This amount does not take into account reduction in penalties under subsection 112(3) / subsection 113(2) of ITA 1967, ifany.Example 11:The accounts of the company are closed on 31st March.Original tax for Y/A 2000 (current year basis) was RM85,000.Amended assessment was issued on 12th March <strong>2012</strong> and the actual tax payable was only RM70,000.The tax reduction of RM15,000 can be taken into account because the notice of reduced assessment was issuedduring the basis period for Year of Assessment <strong>2012</strong> i.e. 01.04.2011 - 31.03.<strong>2012</strong>.A3dTotalSum of amounts from Items A3a to A3c.A4Tax remitted for Yearof Assessment 2000(current year basis)and prior years ofassessment, duringthe basis period forYear of Assessment<strong>2012</strong>This is the amount of tax remitted for years of assessment prior to Y/A 2001. This amountcan be taken into account if the remission of tax is approved during the basis period for Y/A<strong>2012</strong>.Example 20:Syarikat Murni Sdn. Bhd. closes its accounts on 30th June.Y/A 2000 tax ( current year basis ) of RM180,000 was remitted and the company wasinformed by letter dated 20th April <strong>2012</strong> (i.e. during the period 01.07.2011 - 30.06.<strong>2012</strong>).Enter the amount of RM180,000 in this Item.A5Total reductionin creditSum of amounts A2e, A3d and A4.8