Annual Report 2001~ 2002 - Belfast Education & Library Board

Annual Report 2001~ 2002 - Belfast Education & Library Board

Annual Report 2001~ 2002 - Belfast Education & Library Board

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

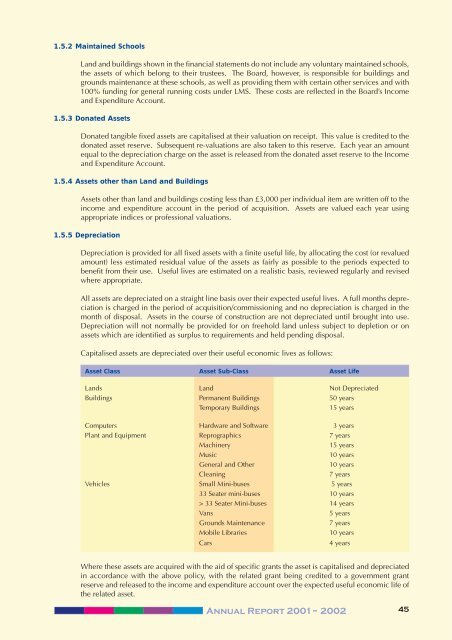

1.5.2 Maintained SchoolsLand and buildings shown in the financial statements do not include any voluntary maintained schools,the assets of which belong to their trustees. The <strong>Board</strong>, however, is responsible for buildings andgrounds maintenance at these schools, as well as providing them with certain other services and with100% funding for general running costs under LMS. These costs are reflected in the <strong>Board</strong>’s Incomeand Expenditure Account.1.5.3 Donated AssetsDonated tangible fixed assets are capitalised at their valuation on receipt. This value is credited to thedonated asset reserve. Subsequent re-valuations are also taken to this reserve. Each year an amountequal to the depreciation charge on the asset is released from the donated asset reserve to the Incomeand Expenditure Account.1.5.4 Assets other than Land and BuildingsAssets other than land and buildings costing less than £3,000 per individual item are written off to theincome and expenditure account in the period of acquisition. Assets are valued each year usingappropriate indices or professional valuations.1.5.5 DepreciationDepreciation is provided for all fixed assets with a finite useful life, by allocating the cost (or revaluedamount) less estimated residual value of the assets as fairly as possible to the periods expected tobenefit from their use. Useful lives are estimated on a realistic basis, reviewed regularly and revisedwhere appropriate.All assets are depreciated on a straight line basis over their expected useful lives. A full months depreciationis charged in the period of acquisition/commissioning and no depreciation is charged in themonth of disposal. Assets in the course of construction are not depreciated until brought into use.Depreciation will not normally be provided for on freehold land unless subject to depletion or onassets which are identified as surplus to requirements and held pending disposal.Capitalised assets are depreciated over their useful economic lives as follows:Asset Class Asset Sub-Class Asset LifeLands Land Not DepreciatedBuildings Permanent Buildings 50 yearsTemporary Buildings15 yearsComputers Hardware and Software 3 yearsPlant and Equipment Reprographics 7 yearsMachinery15 yearsMusic10 yearsGeneral and Other10 yearsCleaning7 yearsVehicles Small Mini-buses 5 years33 Seater mini-buses 10 years> 33 Seater Mini-buses 14 yearsVans5 yearsGrounds Maintenance7 yearsMobile Libraries10 yearsCars4 yearsWhere these assets are acquired with the aid of specific grants the asset is capitalised and depreciatedin accordance with the above policy, with the related grant being credited to a government grantreserve and released to the income and expenditure account over the expected useful economic life ofthe related asset.<strong>Annual</strong> <strong>Report</strong> <strong>2001~</strong> <strong>2002</strong>45