<strong>WAUKESHA</strong> <strong>COUNTY</strong>, WISCONSINNOTES TO FINANCIAL STATEMENTSDecember 31, 2010NOTE 2 – RECONCILIATION OF GOVERNMENT-WIDE AND FUND FINANCIAL STATEMENTS (CONT’D)Capital outlay per fund financial statements $16,644,590Some capitalized items are reported as functional expenditures 175,471Some additions to capital assets are contributed to the County and therefore are notreported as expenditures in the fund financial statements 6,100,000Depreciation expense (net of internal service funds) (11,213,974)Total $11,706,087Another element of that reconciliation states, “Some expenses reported in the statement of activities,such as compensated absences and interest payable, do not require the use of current financialresources and therefore are not reported as expenditures in governmental funds.” The details of this areas follows:Debt premium (discount) ($68,642)Compensated absences 29,013Accrued interest payable (50,156)Debt issuance costs (18,905)Total ($108,690)NOTE 3 – STEWARDSHIP, COMPLIANCE, AND ACCOUNTABILITYA. BUDGETARY INFORMATIONBudgetary information is derived from the annual operating budget and is presented using the same basisof accounting for each fund as described in Note 1.<strong>Wisconsin</strong> Statute 65.90 requires that an annual budget be adopted for all funds. Accordingly, a budgethas been adopted for the general fund and all special revenue, debt service, capital project, enterprise,and internal service funds. These budgets are prepared on a basis consistent with generally acceptedaccounting principles. Budgets are not formally adopted for agency funds.Expenditures cannot legally exceed appropriations at the department level, pursuant to s.65.90,<strong>Wisconsin</strong> State Statutes. However, for the general and special revenue funds, the County has chosen amore restrictive control in the form of appropriation units, defined as groups of account classes within adepartment, including personnel costs, operating expenses, interdepartmental charges, and capitaloutlay. For proprietary funds, budgetary control is at the fund level. For capital project funds, budgetarycontrol is at the individual project level.54

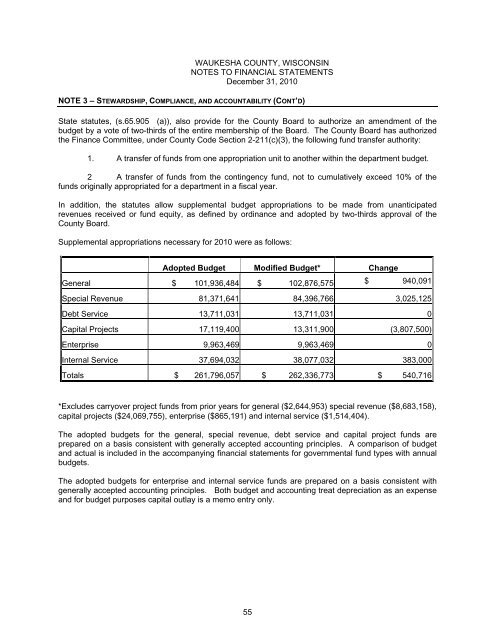

<strong>WAUKESHA</strong> <strong>COUNTY</strong>, WISCONSINNOTES TO FINANCIAL STATEMENTSDecember 31, 2010NOTE 3 – STEWARDSHIP, COMPLIANCE, AND ACCOUNTABILITY (CONT’D)State statutes, (s.65.905 (a)), also provide for the County Board to authorize an amendment of thebudget by a vote of two-thirds of the entire membership of the Board. The County Board has authorizedthe Finance Committee, under County Code Section 2-211(c)(3), the following fund transfer authority:1. A transfer of funds from one appropriation unit to another within the department budget.2 A transfer of funds from the contingency fund, not to cumulatively exceed 10% of thefunds originally appropriated for a department in a fiscal year.In addition, the statutes allow supplemental budget appropriations to be made from unanticipatedrevenues received or fund equity, as defined by ordinance and adopted by two-thirds approval of theCounty Board.Supplemental appropriations necessary for 2010 were as follows:Adopted Budget Modified Budget* ChangeGeneral $ 101,936,484 $ 102,876,575 $ 940,091Special Revenue 81,371,641 84,396,766 3,025,125Debt Service 13,711,031 13,711,031 0Capital Projects 17,119,400 13,311,900 (3,807,500)Enterprise 9,963,469 9,963,469 0Internal Service 37,694,032 38,077,032 383,000Totals $ 261,796,057 $ 262,336,773 $ 540,716*Excludes carryover project funds from prior years for general ($2,644,953) special revenue ($8,683,158),capital projects ($24,069,755), enterprise ($865,191) and internal service ($1,514,404).The adopted budgets for the general, special revenue, debt service and capital project funds areprepared on a basis consistent with generally accepted accounting principles. A comparison of budgetand actual is included in the accompanying financial statements for governmental fund types with annualbudgets.The adopted budgets for enterprise and internal service funds are prepared on a basis consistent withgenerally accepted accounting principles. Both budget and accounting treat depreciation as an expenseand for budget purposes capital outlay is a memo entry only.55

- Page 1 and 2:

WAUKESHA COUNTYCOMPREHENSIVE ANNUAL

- Page 3 and 4:

COMPREHENSIVE ANNUAL FINANCIAL REPO

- Page 5 and 6:

WAUKESHA COUNTY WISCONSINCOMPREHENS

- Page 7 and 8:

Daniel P. VrakasCounty ExecutiveJun

- Page 9 and 10:

WAUKESHA COUNTY, WISCONSINEqualized

- Page 11 and 12:

Residential property accounts for o

- Page 13 and 14:

The County’s tax levy rate, which

- Page 15:

udget controls are maintained at th

- Page 19 and 20:

WAUKESHA COUNTYDepartment HeadsAdmi

- Page 21: JUDICIARY AND LAW ENFORCEMENT COMMI

- Page 24 and 25: To the Honorable Board of County Su

- Page 27 and 28: WAUKESHA COUNTY, WISCONSINMANAGEMEN

- Page 29 and 30: WAUKESHA COUNTY, WISCONSINMANAGEMEN

- Page 31 and 32: WAUKESHA COUNTY, WISCONSINMANAGEMEN

- Page 33 and 34: WAUKESHA COUNTY, WISCONSINMANAGEMEN

- Page 35 and 36: WAUKESHA COUNTY, WISCONSINMANAGEMEN

- Page 37 and 38: WAUKESHA COUNTY, WISCONSINMANAGEMEN

- Page 39: GOVERNMENT-WIDE STATEMENTS

- Page 42 and 43: WAUKESHA COUNTY, WISCONSINSTATEMENT

- Page 45 and 46: WAUKESHA COUNTY, WISCONSINBALANCE S

- Page 47 and 48: WAUKESHA COUNTY, WISCONSINSTATEMENT

- Page 49: MAJOR PROPRIETARY FUNDSAIRPORT OPER

- Page 52 and 53: WAUKESHA COUNTY, WISCONSINSTATEMENT

- Page 54 and 55: WAUKESHA COUNTY, WISCONSINSTATEMENT

- Page 57 and 58: WAUKESHA COUNTY, WISCONSINSTATEMENT

- Page 59 and 60: WAUKESHA COUNTY, WISCONSININDEX TO

- Page 61 and 62: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 63 and 64: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 65 and 66: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 67 and 68: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 69 and 70: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 71: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 75 and 76: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 77 and 78: NOTE 4 - DEPOSITS AND INVESTMENTS (

- Page 79 and 80: NOTE 4 - DEPOSITS AND INVESTMENTS (

- Page 81 and 82: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 83 and 84: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 85 and 86: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 87 and 88: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 89 and 90: NOTE 11- LEASE DISCLOSURES (CONT’

- Page 91 and 92: NOTE 13- COMPONENT UNIT (CONT’D)W

- Page 93 and 94: NOTE 13- COMPONENT UNIT (CONT’D)W

- Page 95 and 96: NOTE 13- COMPONENT UNIT (CONT’D)N

- Page 97 and 98: NOTE 15- RISK MANAGEMENT/SELF INSUR

- Page 99 and 100: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 101: REQUIRED SUPPLEMENTARY INFORMATION

- Page 104 and 105: WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 106 and 107: WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 108 and 109: WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 110 and 111: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 113 and 114: WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 115: NON-MAJOR SPECIAL REVENUE FUNDSSpec

- Page 118 and 119: WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 120 and 121: WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 122 and 123:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 124 and 125:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 126 and 127:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 128 and 129:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 130 and 131:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 132 and 133:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 134 and 135:

THIS PAGE LEFT BLANK

- Page 137 and 138:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 139 and 140:

NON-MAJOR CAPITAL PROJECTS FUNDSCap

- Page 141 and 142:

THIS PAGE LEFT BLANK

- Page 143 and 144:

WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 145 and 146:

WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 147 and 148:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 149 and 150:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 151 and 152:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 153 and 154:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 155 and 156:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 157:

NON-MAJOR ENTERPRISE FUNDSEnterpris

- Page 160 and 161:

WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 162 and 163:

THIS PAGE LEFT BLANK

- Page 165 and 166:

THIS PAGE LEFT BLANK

- Page 167 and 168:

WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 169 and 170:

WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 171:

NON-MAJOR FIDUCIARY FUNDSAGENCY FUN

- Page 174 and 175:

WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 176 and 177:

WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 178 and 179:

WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 181 and 182:

THIS PAGE LEFT BLANK

- Page 183 and 184:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 185 and 186:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 187:

CAPITAL ASSETS USED IN THE OPERATIO

- Page 190 and 191:

WAUKESHA COUNTY, WISCONSINCAPITAL A

- Page 192 and 193:

WAUKESHA COUNTY, WISCONSINACCUMULAT

- Page 195 and 196:

THIS PAGE LEFT BLANK

- Page 197 and 198:

WAUKESHA COUNTY, WISCONSINTABLE 1NE

- Page 199 and 200:

WAUKESHA COUNTY, WISCONSINTABLE 2CH

- Page 201 and 202:

WAUKESHA COUNTY, WISCONSINTABLE 2CH

- Page 203 and 204:

WAUKESHA COUNTY, WISCONSINTABLE 3CH

- Page 205 and 206:

WAUKESHA COUNTY, WISCONSINTABLE 4CH

- Page 207 and 208:

WAUKESHA COUNTY, WISCONSINTABLE 6DI

- Page 209 and 210:

WAUKESHA COUNTY, WISCONSINTABLE 8PR

- Page 211 and 212:

THIS PAGE LEFT BLANK

- Page 213 and 214:

WAUKESHA COUNTY, WISCONSINTABLE 10L

- Page 215 and 216:

WAUKESHA COUNTY, WISCONSINTABLE 11C

- Page 217 and 218:

WAUKESHA COUNTY, WISCONSINTABLE 13T

- Page 219 and 220:

WAUKESHA COUNTY, WISCONSINTABLE 14F

- Page 221 and 222:

WAUKESHA COUNTY, WISCONSINTABLE 15M

- Page 223 and 224:

WAUKESHA COUNTY, WISCONSINTABLE 16C