NOTE 4 – DEPOSITS AND INVESTMENTS<strong>WAUKESHA</strong> <strong>COUNTY</strong>, WISCONSINNOTES TO FINANCIAL STATEMENTSDecember 31, 2010The County maintains a cash and investment pool that is available for use by all funds, except AgencyFunds. The deposits and investments of the Agency Funds are held separately from those of otherCounty funds. The deposit and investment balances of the various fund types on December 31, 2010 areas follows:General Fund $48,364,776Special Revenue Funds 13,965,366Debt Service Funds 4,248,449Capital Projects Funds 37,195,237Enterprise Funds 18,040,830Internal Service Funds 16,865,182Internal Service Funds – Restricted 500,000Agency Funds 39,082,556Total $178,262,396The County has adopted a formal investment policy which delegates authority to the Director ofAdministration to invest the money of the County, to sell or exchange securities purchased and to providefor the safekeeping of such securities. The Department of Administration contracts with investmentadvisory firms for investment management services.Investment Risk FactorsThere are many factors that can affect the value of investments, such as credit risk, custodial credit risk,concentration of credit risk, interest rate risk and foreign currency risk.Credit RiskFixed income securities are subject to credit risk, which is the chance that a bond issuer will fail to payinterest or principal in a timely manner, or that negative perceptions of the issuer’s ability to make thesepayments will cause security prices to decline. The circumstances may arise due to a variety of factorssuch as financial weakness, bankruptcy, litigation and/or adverse political developments.A bond’s credit quality is an assessment of the issuer’s ability to pay interest on the bond, and ultimately,to pay the principal. Credit quality is evaluated by one of the independent bond rating agencies, such asMoody’s Investors Service (Moody’s) or Standard and Poor’s (S&P). The lower the rating, the greater thechance, in the rating agency’s opinion, that the bond issuer will default or fail to meet its paymentobligations. Generally, the lower a bond’s credit rating, the higher its yield should be to compensate forthe additional risk. The County’s investment policy permits investments in securities only rated in the toptwo rating categories by Moody’s and/or S&P.Certain fixed income securities, including obligations of the U.S. government or those explicitlyguaranteed by the U.S. government are not considered to have credit risk.58

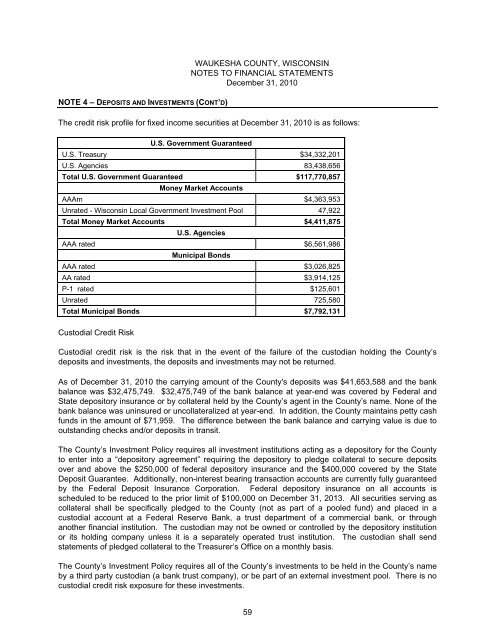

NOTE 4 – DEPOSITS AND INVESTMENTS (CONT’D)<strong>WAUKESHA</strong> <strong>COUNTY</strong>, WISCONSINNOTES TO FINANCIAL STATEMENTSDecember 31, 2010The credit risk profile for fixed income securities at December 31, 2010 is as follows:U.S. Government GuaranteedU.S. Treasury $34,332,201U.S. Agencies 83,438,656Total U.S. Government Guaranteed $117,770,857Money Market AccountsAAAm $4,363,953Unrated - <strong>Wisconsin</strong> Local Government Investment Pool 47,922Total Money Market Accounts $4,411,875U.S. AgenciesAAA rated $6,561,986Municipal BondsAAA rated $3,026,825AA rated $3,914,125P-1 rated $125,601Unrated 725,580Total Municipal Bonds $7,792,131Custodial Credit RiskCustodial credit risk is the risk that in the event of the failure of the custodian holding the County’sdeposits and investments, the deposits and investments may not be returned.As of December 31, 2010 the carrying amount of the County's deposits was $41,653,588 and the bankbalance was $32,475,749. $32,475,749 of the bank balance at year-end was covered by Federal andState depository insurance or by collateral held by the County’s agent in the County’s name. None of thebank balance was uninsured or uncollateralized at year-end. In addition, the County maintains petty cashfunds in the amount of $71,959. The difference between the bank balance and carrying value is due tooutstanding checks and/or deposits in transit.The County’s Investment Policy requires all investment institutions acting as a depository for the Countyto enter into a “depository agreement” requiring the depository to pledge collateral to secure depositsover and above the $250,000 of federal depository insurance and the $400,000 covered by the StateDeposit Guarantee. Additionally, non-interest bearing transaction accounts are currently fully guaranteedby the Federal Deposit Insurance Corporation. Federal depository insurance on all accounts isscheduled to be reduced to the prior limit of $100,000 on December 31, 2013. All securities serving ascollateral shall be specifically pledged to the County (not as part of a pooled fund) and placed in acustodial account at a Federal Reserve Bank, a trust department of a commercial bank, or throughanother financial institution. The custodian may not be owned or controlled by the depository institutionor its holding company unless it is a separately operated trust institution. The custodian shall sendstatements of pledged collateral to the Treasurer’s Office on a monthly basis.The County’s Investment Policy requires all of the County’s investments to be held in the County’s nameby a third party custodian (a bank trust company), or be part of an external investment pool. There is nocustodial credit risk exposure for these investments.59

- Page 1 and 2:

WAUKESHA COUNTYCOMPREHENSIVE ANNUAL

- Page 3 and 4:

COMPREHENSIVE ANNUAL FINANCIAL REPO

- Page 5 and 6:

WAUKESHA COUNTY WISCONSINCOMPREHENS

- Page 7 and 8:

Daniel P. VrakasCounty ExecutiveJun

- Page 9 and 10:

WAUKESHA COUNTY, WISCONSINEqualized

- Page 11 and 12:

Residential property accounts for o

- Page 13 and 14:

The County’s tax levy rate, which

- Page 15:

udget controls are maintained at th

- Page 19 and 20:

WAUKESHA COUNTYDepartment HeadsAdmi

- Page 21:

JUDICIARY AND LAW ENFORCEMENT COMMI

- Page 24 and 25:

To the Honorable Board of County Su

- Page 27 and 28: WAUKESHA COUNTY, WISCONSINMANAGEMEN

- Page 29 and 30: WAUKESHA COUNTY, WISCONSINMANAGEMEN

- Page 31 and 32: WAUKESHA COUNTY, WISCONSINMANAGEMEN

- Page 33 and 34: WAUKESHA COUNTY, WISCONSINMANAGEMEN

- Page 35 and 36: WAUKESHA COUNTY, WISCONSINMANAGEMEN

- Page 37 and 38: WAUKESHA COUNTY, WISCONSINMANAGEMEN

- Page 39: GOVERNMENT-WIDE STATEMENTS

- Page 42 and 43: WAUKESHA COUNTY, WISCONSINSTATEMENT

- Page 45 and 46: WAUKESHA COUNTY, WISCONSINBALANCE S

- Page 47 and 48: WAUKESHA COUNTY, WISCONSINSTATEMENT

- Page 49: MAJOR PROPRIETARY FUNDSAIRPORT OPER

- Page 52 and 53: WAUKESHA COUNTY, WISCONSINSTATEMENT

- Page 54 and 55: WAUKESHA COUNTY, WISCONSINSTATEMENT

- Page 57 and 58: WAUKESHA COUNTY, WISCONSINSTATEMENT

- Page 59 and 60: WAUKESHA COUNTY, WISCONSININDEX TO

- Page 61 and 62: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 63 and 64: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 65 and 66: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 67 and 68: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 69 and 70: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 71 and 72: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 73 and 74: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 75: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 79 and 80: NOTE 4 - DEPOSITS AND INVESTMENTS (

- Page 81 and 82: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 83 and 84: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 85 and 86: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 87 and 88: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 89 and 90: NOTE 11- LEASE DISCLOSURES (CONT’

- Page 91 and 92: NOTE 13- COMPONENT UNIT (CONT’D)W

- Page 93 and 94: NOTE 13- COMPONENT UNIT (CONT’D)W

- Page 95 and 96: NOTE 13- COMPONENT UNIT (CONT’D)N

- Page 97 and 98: NOTE 15- RISK MANAGEMENT/SELF INSUR

- Page 99 and 100: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 101: REQUIRED SUPPLEMENTARY INFORMATION

- Page 104 and 105: WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 106 and 107: WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 108 and 109: WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 110 and 111: WAUKESHA COUNTY, WISCONSINNOTES TO

- Page 113 and 114: WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 115: NON-MAJOR SPECIAL REVENUE FUNDSSpec

- Page 118 and 119: WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 120 and 121: WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 122 and 123: WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 124 and 125: WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 126 and 127:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 128 and 129:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 130 and 131:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 132 and 133:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 134 and 135:

THIS PAGE LEFT BLANK

- Page 137 and 138:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 139 and 140:

NON-MAJOR CAPITAL PROJECTS FUNDSCap

- Page 141 and 142:

THIS PAGE LEFT BLANK

- Page 143 and 144:

WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 145 and 146:

WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 147 and 148:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 149 and 150:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 151 and 152:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 153 and 154:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 155 and 156:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 157:

NON-MAJOR ENTERPRISE FUNDSEnterpris

- Page 160 and 161:

WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 162 and 163:

THIS PAGE LEFT BLANK

- Page 165 and 166:

THIS PAGE LEFT BLANK

- Page 167 and 168:

WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 169 and 170:

WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 171:

NON-MAJOR FIDUCIARY FUNDSAGENCY FUN

- Page 174 and 175:

WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 176 and 177:

WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 178 and 179:

WAUKESHA COUNTY, WISCONSINCOMBINING

- Page 181 and 182:

THIS PAGE LEFT BLANK

- Page 183 and 184:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 185 and 186:

WAUKESHA COUNTY, WISCONSINSCHEDULE

- Page 187:

CAPITAL ASSETS USED IN THE OPERATIO

- Page 190 and 191:

WAUKESHA COUNTY, WISCONSINCAPITAL A

- Page 192 and 193:

WAUKESHA COUNTY, WISCONSINACCUMULAT

- Page 195 and 196:

THIS PAGE LEFT BLANK

- Page 197 and 198:

WAUKESHA COUNTY, WISCONSINTABLE 1NE

- Page 199 and 200:

WAUKESHA COUNTY, WISCONSINTABLE 2CH

- Page 201 and 202:

WAUKESHA COUNTY, WISCONSINTABLE 2CH

- Page 203 and 204:

WAUKESHA COUNTY, WISCONSINTABLE 3CH

- Page 205 and 206:

WAUKESHA COUNTY, WISCONSINTABLE 4CH

- Page 207 and 208:

WAUKESHA COUNTY, WISCONSINTABLE 6DI

- Page 209 and 210:

WAUKESHA COUNTY, WISCONSINTABLE 8PR

- Page 211 and 212:

THIS PAGE LEFT BLANK

- Page 213 and 214:

WAUKESHA COUNTY, WISCONSINTABLE 10L

- Page 215 and 216:

WAUKESHA COUNTY, WISCONSINTABLE 11C

- Page 217 and 218:

WAUKESHA COUNTY, WISCONSINTABLE 13T

- Page 219 and 220:

WAUKESHA COUNTY, WISCONSINTABLE 14F

- Page 221 and 222:

WAUKESHA COUNTY, WISCONSINTABLE 15M

- Page 223 and 224:

WAUKESHA COUNTY, WISCONSINTABLE 16C