VIP Payroll

VIP Payroll

VIP Payroll

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

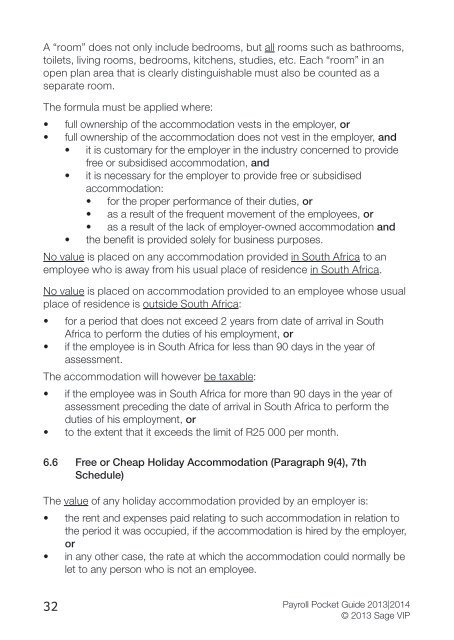

A “room” does not only include bedrooms, but all rooms such as bathrooms,toilets, living rooms, bedrooms, kitchens, studies, etc. Each “room” in anopen plan area that is clearly distinguishable must also be counted as aseparate room.The formula must be applied where:• full ownership of the accommodation vests in the employer, or• full ownership of the accommodation does not vest in the employer, and• it is customary for the employer in the industry concerned to providefree or subsidised accommodation, and• it is necessary for the employer to provide free or subsidisedaccommodation:• for the proper performance of their duties, or• as a result of the frequent movement of the employees, or• as a result of the lack of employer-owned accommodation and• the benefit is provided solely for business purposes.No value is placed on any accommodation provided in South Africa to anemployee who is away from his usual place of residence in South Africa.No value is placed on accommodation provided to an employee whose usualplace of residence is outside South Africa:• for a period that does not exceed 2 years from date of arrival in SouthAfrica to perform the duties of his employment, or• if the employee is in South Africa for less than 90 days in the year ofassessment.The accommodation will however be taxable:• if the employee was in South Africa for more than 90 days in the year ofassessment preceding the date of arrival in South Africa to perform theduties of his employment, or• to the extent that it exceeds the limit of R25 000 per month.6.6 Free or Cheap Holiday Accommodation (Paragraph 9(4), 7thSchedule)The value of any holiday accommodation provided by an employer is:• the rent and expenses paid relating to such accommodation in relation tothe period it was occupied, if the accommodation is hired by the employer,or• in any other case, the rate at which the accommodation could normally belet to any person who is not an employee.32 <strong>Payroll</strong> Pocket Guide 2013|2014© 2013 Sage <strong>VIP</strong>