VIP Payroll

VIP Payroll

VIP Payroll

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

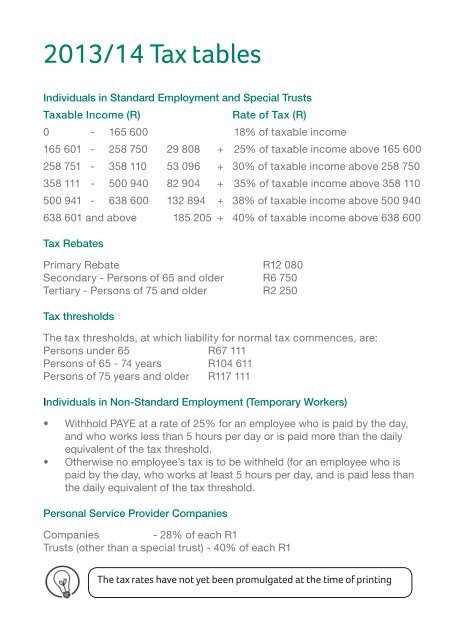

2013/14 Tax tablesIndividuals in Standard Employment and Special TrustsTaxable Income (R)Rate of Tax (R)0 - 165 600 18% of taxable income165 601 - 258 750 29 808 + 25% of taxable income above 165 600258 751 - 358 110 53 096 + 30% of taxable income above 258 750358 111 - 500 940 82 904 + 35% of taxable income above 358 110500 941 - 638 600 132 894 + 38% of taxable income above 500 940638 601 and above 185 205 + 40% of taxable income above 638 600Tax RebatesPrimary Rebate R12 080Secondary - Persons of 65 and older R6 750Tertiary - Persons of 75 and older R2 250Tax thresholdsThe tax thresholds, at which liability for normal tax commences, are:Persons under 65 R67 111Persons of 65 - 74 years R104 611Persons of 75 years and older R117 111Individuals in Non-Standard Employment (Temporary Workers)• Withhold PAYE at a rate of 25% for an employee who is paid by the day,and who works less than 5 hours per day or is paid more than the dailyequivalent of the tax threshold.• Otherwise no employee’s tax is to be withheld (for an employee who ispaid by the day, who works at least 5 hours per day, and is paid less thanthe daily equivalent of the tax threshold.Personal Service Provider CompaniesCompanies- 28% of each R1Trusts (other than a special trust) - 40% of each R1The tax rates have not yet been promulgated at the time of printing