VIP Payroll

VIP Payroll

VIP Payroll

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

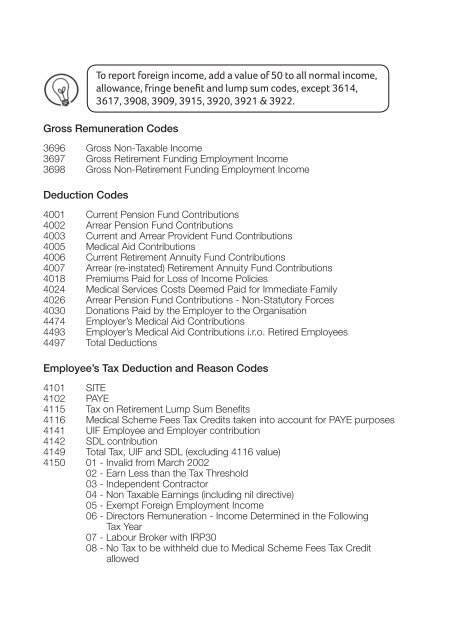

To report foreign income, add a value of 50 to all normal income,allowance, fringe benefit and lump sum codes, except 3614,3617, 3908, 3909, 3915, 3920, 3921 & 3922.Gross Remuneration Codes3696 Gross Non-Taxable Income3697 Gross Retirement Funding Employment Income3698 Gross Non-Retirement Funding Employment IncomeDeduction Codes4001 Current Pension Fund Contributions4002 Arrear Pension Fund Contributions4003 Current and Arrear Provident Fund Contributions4005 Medical Aid Contributions4006 Current Retirement Annuity Fund Contributions4007 Arrear (re-instated) Retirement Annuity Fund Contributions4018 Premiums Paid for Loss of Income Policies4024 Medical Services Costs Deemed Paid for Immediate Family4026 Arrear Pension Fund Contributions - Non-Statutory Forces4030 Donations Paid by the Employer to the Organisation4474 Employer’s Medical Aid Contributions4493 Employer’s Medical Aid Contributions i.r.o. Retired Employees4497 Total DeductionsEmployee’s Tax Deduction and Reason Codes4101 SITE4102 PAYE4115 Tax on Retirement Lump Sum Benefits4116 Medical Scheme Fees Tax Credits taken into account for PAYE purposes4141 UIF Employee and Employer contribution4142 SDL contribution4149 Total Tax, UIF and SDL (excluding 4116 value)4150 01 - Invalid from March 200202 - Earn Less than the Tax Threshold03 - Independent Contractor04 - Non Taxable Earnings (including nil directive)05 - Exempt Foreign Employment Income06 - Directors Remuneration - Income Determined in the Following5 Tax Year07 - Labour Broker with IRP3008 - No Tax to be withheld due to Medical Scheme Fees Tax Credit5 allowed