Download full circular PDF - Anglo American Platinum

Download full circular PDF - Anglo American Platinum

Download full circular PDF - Anglo American Platinum

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

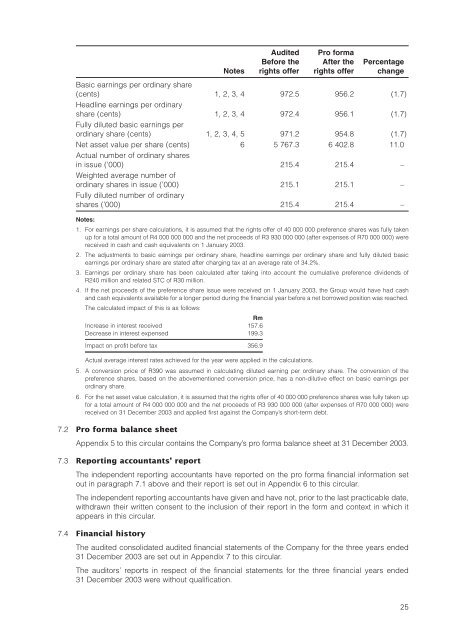

Audited Pro formaBefore the After the PercentageNotes rights offer rights offer changeBasic earnings per ordinary share(cents) 1, 2, 3, 4 972.5 956.2 (1.7)Headline earnings per ordinaryshare (cents) 1, 2, 3, 4 972.4 956.1 (1.7)Fully diluted basic earnings perordinary share (cents) 1, 2, 3, 4, 5 971.2 954.8 (1.7)Net asset value per share (cents) 6 5 767.3 6 402.8 11.0Actual number of ordinary sharesin issue (’000) 215.4 215.4 –Weighted average number ofordinary shares in issue (’000) 215.1 215.1 –Fully diluted number of ordinaryshares (’000) 215.4 215.4 –Notes:1. For earnings per share calculations, it is assumed that the rights offer of 40 000 000 preference shares was <strong>full</strong>y takenup for a total amount of R4 000 000 000 and the net proceeds of R3 930 000 000 (after expenses of R70 000 000) werereceived in cash and cash equivalents on 1 January 2003.2. The adjustments to basic earnings per ordinary share, headline earnings per ordinary share and <strong>full</strong>y diluted basicearnings per ordinary share are stated after charging tax at an average rate of 34.2%.3. Earnings per ordinary share has been calculated after taking into account the cumulative preference dividends ofR240 million and related STC of R30 million.4. If the net proceeds of the preference share issue were received on 1 January 2003, the Group would have had cashand cash equivalents available for a longer period during the financial year before a net borrowed position was reached.The calculated impact of this is as follows:RmIncrease in interest received 157.6Decrease in interest expensed 199.3Impact on profit before tax 356.9Actual average interest rates achieved for the year were applied in the calculations.5. A conversion price of R390 was assumed in calculating diluted earning per ordinary share. The conversion of thepreference shares, based on the abovementioned conversion price, has a non-dilutive effect on basic earnings perordinary share.6. For the net asset value calculation, it is assumed that the rights offer of 40 000 000 preference shares was <strong>full</strong>y taken upfor a total amount of R4 000 000 000 and the net proceeds of R3 930 000 000 (after expenses of R70 000 000) werereceived on 31 December 2003 and applied first against the Company’s short-term debt.7.2 Pro forma balance sheetAppendix 5 to this <strong>circular</strong> contains the Company’s pro forma balance sheet at 31 December 2003.7.3 Reporting accountants’ reportThe independent reporting accountants have reported on the pro forma financial information setout in paragraph 7.1 above and their report is set out in Appendix 6 to this <strong>circular</strong>.The independent reporting accountants have given and have not, prior to the last practicable date,withdrawn their written consent to the inclusion of their report in the form and context in which itappears in this <strong>circular</strong>.7.4 Financial historyThe audited consolidated audited financial statements of the Company for the three years ended31 December 2003 are set out in Appendix 7 to this <strong>circular</strong>.The auditors’ reports in respect of the financial statements for the three financial years ended31 December 2003 were without qualification.25

![[PDF] Mogalakwena Mine - Anglo Platinum](https://img.yumpu.com/43065142/1/184x260/pdf-mogalakwena-mine-anglo-platinum.jpg?quality=85)