Download full circular PDF - Anglo American Platinum

Download full circular PDF - Anglo American Platinum

Download full circular PDF - Anglo American Platinum

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

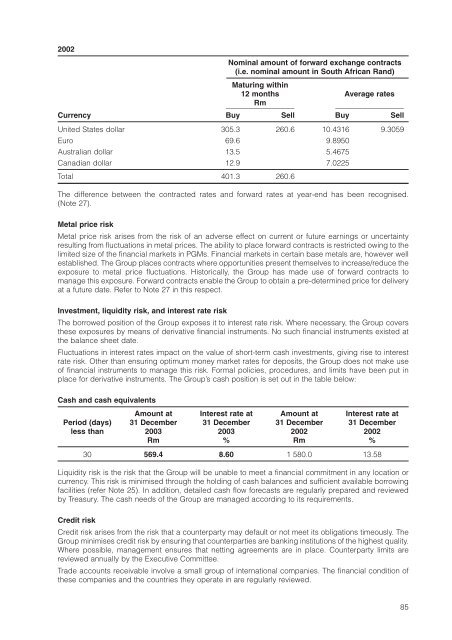

2002Nominal amount of forward exchange contracts(i.e. nominal amount in South African Rand)Maturing within12 months Average ratesRmCurrency Buy Sell Buy SellUnited States dollar 305.3 260.6 10.4316 9.3059Euro 69.6 9.8950Australian dollar 13.5 5.4675Canadian dollar 12.9 7.0225Total 401.3 260.6The difference between the contracted rates and forward rates at year-end has been recognised.(Note 27).Metal price riskMetal price risk arises from the risk of an adverse effect on current or future earnings or uncertaintyresulting from fluctuations in metal prices. The ability to place forward contracts is restricted owing to thelimited size of the financial markets in PGMs. Financial markets in certain base metals are, however wellestablished. The Group places contracts where opportunities present themselves to increase/reduce theexposure to metal price fluctuations. Historically, the Group has made use of forward contracts tomanage this exposure. Forward contracts enable the Group to obtain a pre-determined price for deliveryat a future date. Refer to Note 27 in this respect.Investment, liquidity risk, and interest rate riskThe borrowed position of the Group exposes it to interest rate risk. Where necessary, the Group coversthese exposures by means of derivative financial instruments. No such financial instruments existed atthe balance sheet date.Fluctuations in interest rates impact on the value of short-term cash investments, giving rise to interestrate risk. Other than ensuring optimum money market rates for deposits, the Group does not make useof financial instruments to manage this risk. Formal policies, procedures, and limits have been put inplace for derivative instruments. The Group’s cash position is set out in the table below:Cash and cash equivalentsAmount at Interest rate at Amount at Interest rate atPeriod (days) 31 December 31 December 31 December 31 Decemberless than 2003 2003 2002 2002Rm % Rm %30 569.4 8.60 1 580.0 13.58Liquidity risk is the risk that the Group will be unable to meet a financial commitment in any location orcurrency. This risk is minimised through the holding of cash balances and sufficient available borrowingfacilities (refer Note 25). In addition, detailed cash flow forecasts are regularly prepared and reviewedby Treasury. The cash needs of the Group are managed according to its requirements.Credit riskCredit risk arises from the risk that a counterparty may default or not meet its obligations timeously. TheGroup minimises credit risk by ensuring that counterparties are banking institutions of the highest quality.Where possible, management ensures that netting agreements are in place. Counterparty limits arereviewed annually by the Executive Committee.Trade accounts receivable involve a small group of international companies. The financial condition ofthese companies and the countries they operate in are regularly reviewed.85

![[PDF] Mogalakwena Mine - Anglo Platinum](https://img.yumpu.com/43065142/1/184x260/pdf-mogalakwena-mine-anglo-platinum.jpg?quality=85)