Download full circular PDF - Anglo American Platinum

Download full circular PDF - Anglo American Platinum

Download full circular PDF - Anglo American Platinum

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

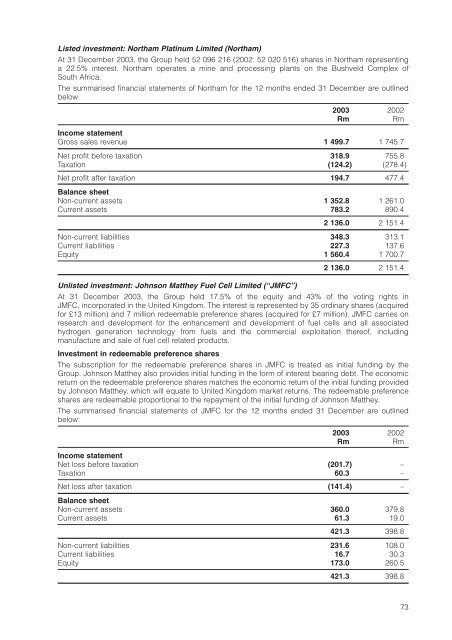

Listed investment: Northam <strong>Platinum</strong> Limited (Northam)At 31 December 2003, the Group held 52 096 216 (2002: 52 020 516) shares in Northam representinga 22.5% interest. Northam operates a mine and processing plants on the Bushveld Complex ofSouth Africa.The summarised financial statements of Northam for the 12 months ended 31 December are outlinedbelow:2003 2002RmRmIncome statementGross sales revenue 1 499.7 1 745.7Net profit before taxation 318.9 755.8Taxation (124.2) (278.4)Net profit after taxation 194.7 477.4Balance sheetNon-current assets 1 352.8 1 261.0Current assets 783.2 890.42 136.0 2 151.4Non-current liabilities 348.3 313.1Current liabilities 227.3 137.6Equity 1 560.4 1 700.72 136.0 2 151.4Unlisted investment: Johnson Matthey Fuel Cell Limited (“JMFC”)At 31 December 2003, the Group held 17.5% of the equity and 43% of the voting rights inJMFC, incorporated in the United Kingdom. The interest is represented by 35 ordinary shares (acquiredfor £13 million) and 7 million redeemable preference shares (acquired for £7 million). JMFC carries onresearch and development for the enhancement and development of fuel cells and all associatedhydrogen generation technology from fuels and the commercial exploitation thereof, includingmanufacture and sale of fuel cell related products.Investment in redeemable preference sharesThe subscription for the redeemable preference shares in JMFC is treated as initial funding by theGroup. Johnson Matthey also provides initial funding in the form of interest bearing debt. The economicreturn on the redeemable preference shares matches the economic return of the initial funding providedby Johnson Matthey, which will equate to United Kingdom market returns. The redeemable preferenceshares are redeemable proportional to the repayment of the initial funding of Johnson Matthey.The summarised financial statements of JMFC for the 12 months ended 31 December are outlinedbelow:2003 2002RmRmIncome statementNet loss before taxation (201.7) –Taxation 60.3 –Net loss after taxation (141.4) –Balance sheetNon-current assets 360.0 379.8Current assets 61.3 19.0421.3 398.8Non-current liabilities 231.6 108.0Current liabilities 16.7 30.3Equity 173.0 260.5421.3 398.873

![[PDF] Mogalakwena Mine - Anglo Platinum](https://img.yumpu.com/43065142/1/184x260/pdf-mogalakwena-mine-anglo-platinum.jpg?quality=85)