Download full circular PDF - Anglo American Platinum

Download full circular PDF - Anglo American Platinum

Download full circular PDF - Anglo American Platinum

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

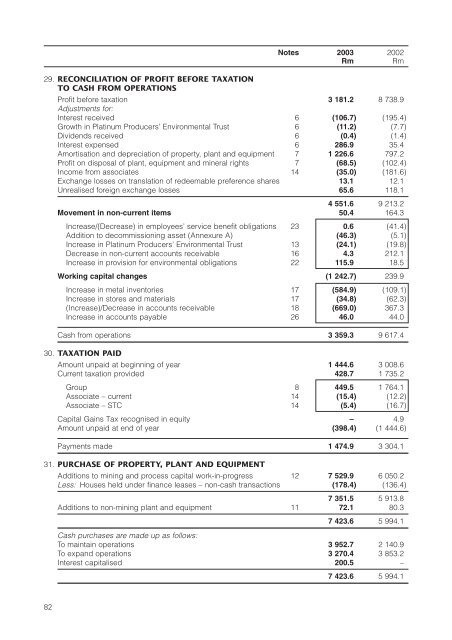

Notes 2003 2002RmRm29. RECONCILIATION OF PROFIT BEFORE TAXATIONTO CASH FROM OPERATIONSProfit before taxation 3 181.2 8 738.9Adjustments for:Interest received 6 (106.7) (195.4)Growth in <strong>Platinum</strong> Producers’ Environmental Trust 6 (11.2) (7.7)Dividends received 6 (0.4) (1.4)Interest expensed 6 286.9 35.4Amortisation and depreciation of property, plant and equipment 7 1 226.6 797.2Profit on disposal of plant, equipment and mineral rights 7 (68.5) (102.4)Income from associates 14 (35.0) (181.6)Exchange losses on translation of redeemable preference shares 13.1 12.1Unrealised foreign exchange losses 65.6 118.14 551.6 9 213.2Movement in non-current items 50.4 164.3Increase/(Decrease) in employees’ service benefit obligations 23 0.6 (41.4)Addition to decommissioning asset (Annexure A) (46.3) (5.1)Increase in <strong>Platinum</strong> Producers’ Environmental Trust 13 (24.1) (19.8)Decrease in non-current accounts receivable 16 4.3 212.1Increase in provision for environmental obligations 22 115.9 18.5Working capital changes (1 242.7) 239.9Increase in metal inventories 17 (584.9) (109.1)Increase in stores and materials 17 (34.8) (62.3)(Increase)/Decrease in accounts receivable 18 (669.0) 367.3Increase in accounts payable 26 46.0 44.0Cash from operations 3 359.3 9 617.430. TAXATION PAIDAmount unpaid at beginning of year 1 444.6 3 008.6Current taxation provided 428.7 1 735.2Group 8 449.5 1 764.1Associate – current 14 (15.4) (12.2)Associate – STC 14 (5.4) (16.7)Capital Gains Tax recognised in equity – 4.9Amount unpaid at end of year (398.4) (1 444.6)Payments made 1 474.9 3 304.131. PURCHASE OF PROPERTY, PLANT AND EQUIPMENTAdditions to mining and process capital work-in-progress 12 7 529.9 6 050.2Less: Houses held under finance leases – non-cash transactions (178.4) (136.4)7 351.5 5 913.8Additions to non-mining plant and equipment 11 72.1 80.37 423.6 5 994.1Cash purchases are made up as follows:To maintain operations 3 952.7 2 140.9To expand operations 3 270.4 3 853.2Interest capitalised 200.5 –7 423.6 5 994.182

![[PDF] Mogalakwena Mine - Anglo Platinum](https://img.yumpu.com/43065142/1/184x260/pdf-mogalakwena-mine-anglo-platinum.jpg?quality=85)