Download full circular PDF - Anglo American Platinum

Download full circular PDF - Anglo American Platinum

Download full circular PDF - Anglo American Platinum

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

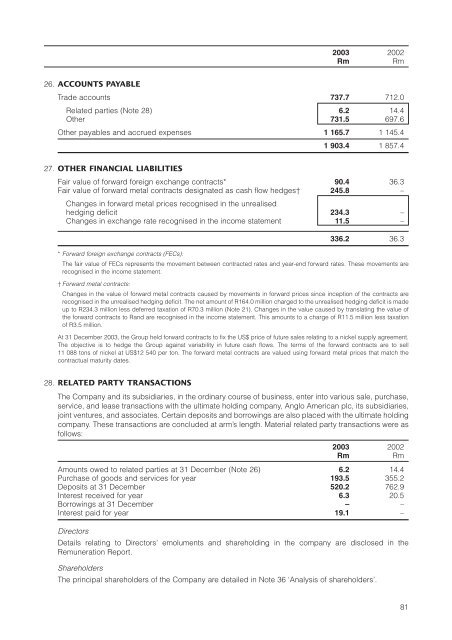

2003 2002RmRm26. ACCOUNTS PAYABLETrade accounts 737.7 712.0Related parties (Note 28) 6.2 14.4Other 731.5 697.6Other payables and accrued expenses 1 165.7 1 145.41 903.4 1 857.427. OTHER FINANCIAL LIABILITIESFair value of forward foreign exchange contracts* 90.4 36.3Fair value of forward metal contracts designated as cash flow hedges† 245.8 –Changes in forward metal prices recognised in the unrealisedhedging deficit 234.3 –Changes in exchange rate recognised in the income statement 11.5 –336.2 36.3* Forward foreign exchange contracts (FECs):The fair value of FECs represents the movement between contracted rates and year-end forward rates. These movements arerecognised in the income statement.† Forward metal contracts:Changes in the value of forward metal contracts caused by movements in forward prices since inception of the contracts arerecognised in the unrealised hedging deficit. The net amount of R164.0 million charged to the unrealised hedging deficit is madeup to R234.3 million less deferred taxation of R70.3 million (Note 21). Changes in the value caused by translating the value ofthe forward contracts to Rand are recognised in the income statement. This amounts to a charge of R11.5 million less taxationof R3.5 million.At 31 December 2003, the Group held forward contracts to fix the US$ price of future sales relating to a nickel supply agreement.The objective is to hedge the Group against variability in future cash flows. The terms of the forward contracts are to sell11 088 tons of nickel at US$12 540 per ton. The forward metal contracts are valued using forward metal prices that match thecontractual maturity dates.28. RELATED PARTY TRANSACTIONSThe Company and its subsidiaries, in the ordinary course of business, enter into various sale, purchase,service, and lease transactions with the ultimate holding company, <strong>Anglo</strong> <strong>American</strong> plc, its subsidiaries,joint ventures, and associates. Certain deposits and borrowings are also placed with the ultimate holdingcompany. These transactions are concluded at arm’s length. Material related party transactions were asfollows:2003 2002RmRmAmounts owed to related parties at 31 December (Note 26) 6.2 14.4Purchase of goods and services for year 193.5 355.2Deposits at 31 December 520.2 762.9Interest received for year 6.3 20.5Borrowings at 31 December – –Interest paid for year 19.1 –DirectorsDetails relating to Directors’ emoluments and shareholding in the company are disclosed in theRemuneration Report.ShareholdersThe principal shareholders of the Company are detailed in Note 36 ‘Analysis of shareholders’.81

![[PDF] Mogalakwena Mine - Anglo Platinum](https://img.yumpu.com/43065142/1/184x260/pdf-mogalakwena-mine-anglo-platinum.jpg?quality=85)