Pdf 2012 www jagranjosh com - Dainik Jagran Hindi News

Pdf 2012 www jagranjosh com - Dainik Jagran Hindi News

Pdf 2012 www jagranjosh com - Dainik Jagran Hindi News

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

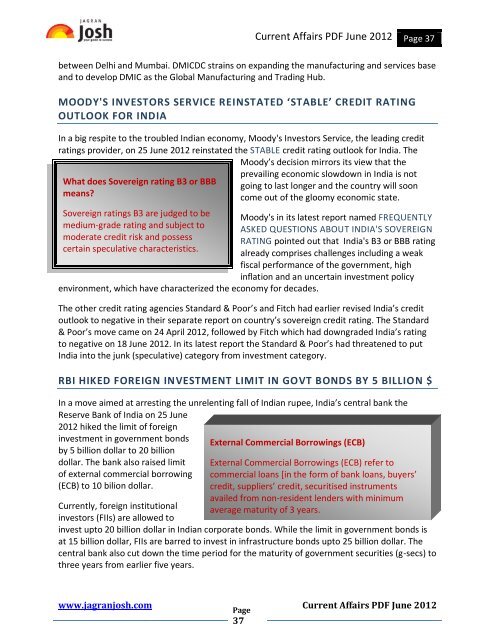

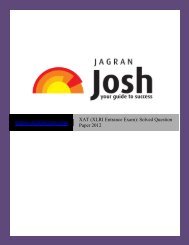

Current Affairs PDF June <strong>2012</strong> Page 37between Delhi and Mumbai. DMICDC strains on expanding the manufacturing and services baseand to develop DMIC as the Global Manufacturing and Trading Hub.MOODY'S INVESTORS SERVICE REINSTATED ‘STABLE’ CREDIT RATINGOUTLOOK FOR INDIAIn a big respite to the troubled Indian economy, Moody's Investors Service, the leading creditratings provider, on 25 June <strong>2012</strong> reinstated the STABLE credit rating outlook for India. TheMoody’s decision mirrors its view that theWhat does Sovereign rating B3 or BBBmeans?Sovereign ratings B3 are judged to bemedium-grade rating and subject tomoderate credit risk and possesscertain speculative characteristics.environment, which have characterized the economy for decades.prevailing economic slowdown in India is notgoing to last longer and the country will soon<strong>com</strong>e out of the gloomy economic state.Moody's in its latest report named FREQUENTLYASKED QUESTIONS ABOUT INDIA'S SOVEREIGNRATING pointed out that India's B3 or BBB ratingalready <strong>com</strong>prises challenges including a weakfiscal performance of the government, highinflation and an uncertain investment policyThe other credit rating agencies Standard & Poor’s and Fitch had earlier revised India’s creditoutlook to negative in their separate report on country’s sovereign credit rating. The Standard& Poor’s move came on 24 April <strong>2012</strong>, followed by Fitch which had downgraded India’s ratingto negative on 18 June <strong>2012</strong>. In its latest report the Standard & Poor’s had threatened to putIndia into the junk (speculative) category from investment category.RBI HIKED FOREIGN INVESTMENT LIMIT IN GOVT BONDS BY 5 BILLION $In a move aimed at arresting the unrelenting fall of Indian rupee, India’s central bank theReserve Bank of India on 25 June<strong>2012</strong> hiked the limit of foreigninvestment in government bondsby 5 billion dollar to 20 billiondollar. The bank also raised limitof external <strong>com</strong>mercial borrowing(ECB) to 10 bilion dollar.Currently, foreign institutionalinvestors (FIIs) are allowed toExternal Commercial Borrowings (ECB)External Commercial Borrowings (ECB) refer to<strong>com</strong>mercial loans *in the form of bank loans, buyers’credit, suppliers’ credit, securitised instrumentsavailed from non-resident lenders with minimumaverage maturity of 3 years.invest upto 20 billion dollar in Indian corporate bonds. While the limit in government bonds isat 15 billion dollar, FIIs are barred to invest in infrastructure bonds upto 25 billion dollar. Thecentral bank also cut down the time period for the maturity of government securities (g-secs) tothree years from earlier five years.<strong>www</strong>.<strong>jagranjosh</strong>.<strong>com</strong>Page37Current Affairs PDF June <strong>2012</strong>