Index 371quarterly cash flow reports, 205relationship between net income and,202Operating efficiency, 143–44, 157–58asset turnover, 144gross margin, 143–44Operating income, on income statement,335Operating margin, 179Oracle, 101, 103, 180, 182Organic growth, 303acquisition growth vs., 277Outback Steakhouse, 254Outstanding shares estimate, 273Overblown competitive advantages, 118–20patents, 119proprietary technology/productionprocesses, 119–20Overburdened debtors, as bankruptcy candidates,130–31Overhead expenses, 188–89Ownership, 10, 235–40, 316, 349growth investing, 316insider, 237–40, 316institutional, 235–37, 316value stock analysis scorecards, 346PP/E range estimate, 274Patents, 118PEG, 60, 73–74, 295Penn National Gaming, 148, 203Pension plan income, as red flag, 228–29,314PeopleSoft, 181Pfizer, 86, 170–71, 172, 174, 254Piotroski, Joseph, 41, 139–45PolyMedica, 227–28Portfolio risk, 13–14Premade screens, 40–41Price charts, 10Price chart(s), 10, 11, 241–48, 316–17,349bar charts, 246chart types, 246–47downtrends, 242avoiding, 245–46growth investing, 316–17line charts, 246–47moving average (MA), 243–44exponential (EMA), 243growth investors, 244simple (SMA), 243value investors, 243–44risk zone, 244, 246trading volume, 247trends, 241–43value stock analysis scorecards, 346Price to earnings (P/E) ratio, 5Price to sales (P/S) ratio, 5Priceline.com, 176–77, 211Pro forma earnings, 74Product cycle, 115, 277, 303Product/market diversification, 115–16,303Product useful life/product price, 113, 276,302Products on allocation, as company-specificrisk, 20–21Profit margin estimate, 272Profitability, 141–42, 155–56, 307–11,348–49cash flow, 310–11and growth analysis, 9growth investing, 307–11margin analysis, 309–10net income, 141operating cash flow, 142quality of earnings, 142return on assets (ROA), 142, 310sales growth, 307–9trends, 307value stock analysis scorecards, 345–46Profitability analysis, 169–209, 280–83cash flow analysis, 199–205earnings, sources of, 170EBITDA vs. operating cash flow,205–8free EBITDA, 208–9growth investors, 177marginal return on assets, 198–99margins, 178–88analyzing, 184–85comparing, 180–84gross margin, 178–79high vs. low, 186–88net profit margin, 180operating margin, 179overhead expenses, 188–89profitability ratios, 189–98sales history,. analyzing, 171–77value investors, 177Profitability and growth analysis, 9Profitability ratios, 189–98return on assets (ROA), 195–98

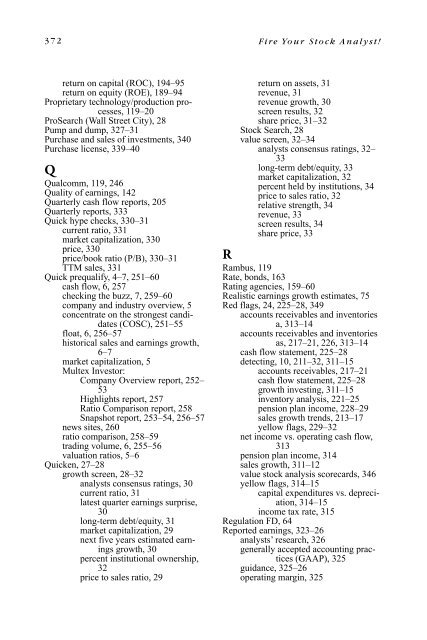

372<strong>Fire</strong> <strong>Your</strong> <strong>Stock</strong> <strong>Analyst</strong>!return on capital (ROC), 194–95return on equity (ROE), 189–94Proprietary technology/production processes,119–20ProSearch (Wall Street City), 28Pump and dump, 327–31Purchase and sales of investments, 340Purchase license, 339–40QQualcomm, 119, 246Quality of earnings, 142Quarterly cash flow reports, 205Quarterly reports, 333Quick hype checks, 330–31current ratio, 331market capitalization, 330price, 330price/book ratio (P/B), 330–31TTM sales, 331Quick prequalify, 4–7, 251–60cash flow, 6, 257checking the buzz, 7, 259–60company and industry overview, 5concentrate on the strongest candidates(COSC), 251–55float, 6, 256–57historical sales and earnings growth,6–7market capitalization, 5Multex Investor:Company Overview report, 252–53Highlights report, 257Ratio Comparison report, 258Snapshot report, 253–54, 256–57news sites, 260ratio comparison, 258–59trading volume, 6, 255–56valuation ratios, 5–6Quicken, 27–28growth screen, 28–32analysts consensus ratings, 30current ratio, 31latest quarter earnings surprise,30long-term debt/equity, 31market capitalization, 29next five years estimated earningsgrowth, 30percent institutional ownership,32price to sales ratio, 29return on assets, 31revenue, 31revenue growth, 30screen results, 32share price, 31–32<strong>Stock</strong> Search, 28value screen, 32–34analysts consensus ratings, 32–33long-term debt/equity, 33market capitalization, 32percent held by institutions, 34price to sales ratio, 32relative strength, 34revenue, 33screen results, 34share price, 33RRambus, 119Rate, bonds, 163Rating agencies, 159–60Realistic earnings growth estimates, 75Red flags, 24, 225–28, 349accounts receivables and inventoriesa, 313–14accounts receivables and inventoriesas, 217–21, 226, 313–14cash flow statement, 225–28detecting, 10, 211–32, 311–15accounts receivables, 217–21cash flow statement, 225–28growth investing, 311–15inventory analysis, 221–25pension plan income, 228–29sales growth trends, 213–17yellow flags, 229–32net income vs. operating cash flow,313pension plan income, 314sales growth, 311–12value stock analysis scorecards, 346yellow flags, 314–15capital expenditures vs. depreciation,314–15income tax rate, 315Regulation FD, 64Reported earnings, 323–26analysts’ research, 326generally accepted accounting practices(GAAP), 325guidance, 325–26operating margin, 325

- Page 2 and 3:

Fire YourStock Analyst!

- Page 4 and 5:

Fire YourStock Analyst!Analyzing St

- Page 6 and 7:

FINANCIAL TIMES PRENTICE HALL BOOKS

- Page 8 and 9:

Robin MillerThe Online Rules of Suc

- Page 10:

To my loving wife Norma,who read ev

- Page 13 and 14:

xiiFire Your Stock Analyst!When to

- Page 15 and 16:

xivFire Your Stock Analyst!Chapter

- Page 17 and 18:

xviFire Your Stock Analyst!Chapter

- Page 19 and 20:

xviiiFire Your Stock Analyst!Shoest

- Page 21 and 22:

xxFire Your Stock Analyst!through t

- Page 23 and 24:

xxiiFire Your Stock Analyst!How to

- Page 25 and 26:

xxivFire Your Stock Analyst!Frequen

- Page 28 and 29:

ACKNOWLEDGMENTSGuru Acknowledgments

- Page 30 and 31:

AcknowledgmentsxxixCollins employs

- Page 32 and 33:

Acknowledgmentsxxxiship, few analys

- Page 34 and 35:

Acknowledgmentsxxxiiiand earnings g

- Page 36:

Acknowledgmentsxxxv■ “Cash Flow

- Page 40 and 41:

1THE ANALYSIS PROCESSExperts tell u

- Page 42 and 43:

Chapter 1 • The Analysis Process

- Page 44 and 45:

Chapter 1 • The Analysis Process

- Page 46 and 47:

Chapter 1 • The Analysis Process

- Page 48:

Chapter 1 • The Analysis Process

- Page 51 and 52:

14Fire Your Stock Analyst!ing incre

- Page 53 and 54:

16Fire Your Stock Analyst!One way t

- Page 55 and 56:

18Fire Your Stock Analyst!Market Di

- Page 57 and 58:

20Fire Your Stock Analyst!FIGURE 2-

- Page 59 and 60:

22Fire Your Stock Analyst!Sector Ou

- Page 61 and 62:

24Fire Your Stock Analyst!Valuation

- Page 64 and 65:

3SCREENINGScreening is the most eff

- Page 66 and 67:

Chapter 3 • Screening 29The scree

- Page 68 and 69:

Chapter 3 • Screening 31Current R

- Page 70 and 71:

Chapter 3 • Screening 33that ever

- Page 72 and 73:

Chapter 3 • Screening 35It’s wo

- Page 74 and 75:

Chapter 3 • Screening 37growth. T

- Page 76 and 77:

Chapter 3 • Screening 39Price to

- Page 78:

Chapter 3 • Screening 41Graham, J

- Page 82 and 83:

4ANALYSIS TOOL #1:ANALYZINGANALYSTS

- Page 84 and 85:

Chapter 4 • Analysis Tool #1: Ana

- Page 86 and 87:

Chapter 4 • Analysis Tool #1: Ana

- Page 88 and 89:

Chapter 4 • Analysis Tool #1: Ana

- Page 90 and 91:

Chapter 4 • Analysis Tool #1: Ana

- Page 92 and 93:

Chapter 4 • Analysis Tool #1: Ana

- Page 94 and 95:

Chapter 4 • Analysis Tool #1: Ana

- Page 96 and 97:

Chapter 4 • Analysis Tool #1: Ana

- Page 98 and 99:

Chapter 4 • Analysis Tool #1: Ana

- Page 100 and 101:

Chapter 4 • Analysis Tool #1: Ana

- Page 102:

Chapter 4 • Analysis Tool #1: Ana

- Page 105 and 106:

68Fire Your Stock Analyst!las. That

- Page 107 and 108:

70Fire Your Stock Analyst!For examp

- Page 109 and 110:

72Fire Your Stock Analyst!Most of t

- Page 111 and 112:

74Fire Your Stock Analyst!momentum

- Page 113 and 114:

76Fire Your Stock Analyst!TABLE 5-5

- Page 115 and 116:

6ANALYSIS TOOL #3:ESTABLISHINGTARGE

- Page 117 and 118:

Chapter 6 • Analysis Tool #3: Est

- Page 119 and 120:

Chapter 6 • Analysis Tool #3: Est

- Page 121 and 122:

Chapter 6 • Analysis Tool #3: Est

- Page 123 and 124:

Chapter 6 • Analysis Tool #3: Est

- Page 125 and 126:

Chapter 6 • Analysis Tool #3: Est

- Page 127 and 128:

Chapter 6 • Analysis Tool #3: Est

- Page 129:

Chapter 6 • Analysis Tool #3: Est

- Page 133 and 134:

96Fire Your Stock Analyst!Surprisin

- Page 135 and 136:

98Fire Your Stock Analyst!Convert E

- Page 137 and 138:

100Fire Your Stock Analyst!TABLE 7-

- Page 139 and 140:

102Fire Your Stock Analyst!For inst

- Page 141 and 142:

104Fire Your Stock Analyst!TABLE 7-

- Page 143 and 144:

106Fire Your Stock Analyst!TABLE 7-

- Page 146 and 147:

8ANALYSIS TOOL #5:BUSINESS PLAN ANA

- Page 148 and 149:

Chapter 8 • Analysis Tool #5: Bus

- Page 150 and 151:

Chapter 8 • Analysis Tool #5: Bus

- Page 152 and 153:

Chapter 8 • Analysis Tool #5: Bus

- Page 154 and 155:

Chapter 8 • Analysis Tool #5: Bus

- Page 156 and 157:

Chapter 8 • Analysis Tool #5: Bus

- Page 158 and 159:

9ANALYSIS TOOL # 6:MANAGEMENT QUALI

- Page 160 and 161:

Chapter 9 • Analysis Tool # 6: Ma

- Page 162 and 163:

Chapter 9 • Analysis Tool # 6: Ma

- Page 164:

BUSINESS PLAN SCORECARDBrand Identi

- Page 167 and 168:

130Fire Your Stock Analyst!ron’s

- Page 169 and 170:

132Fire Your Stock Analyst!■ Debt

- Page 171 and 172:

134Fire Your Stock Analyst!$2,000 t

- Page 173 and 174:

136Fire Your Stock Analyst!Next, es

- Page 175 and 176:

138Fire Your Stock Analyst!• CALI

- Page 177 and 178:

140Fire Your Stock Analyst!Piotrosk

- Page 179 and 180:

142Fire Your Stock Analyst!sures wh

- Page 181 and 182:

144Fire Your Stock Analyst!9. Asset

- Page 183 and 184:

146Fire Your Stock Analyst!Tables 1

- Page 185 and 186:

148Fire Your Stock Analyst!TABLE 10

- Page 187 and 188:

150Fire Your Stock Analyst!Computin

- Page 189 and 190:

152Fire Your Stock Analyst!FIGURE 1

- Page 191 and 192:

154Fire Your Stock Analyst!i) Compu

- Page 193 and 194:

156Fire Your Stock Analyst!4) Quali

- Page 195 and 196:

158Fire Your Stock Analyst!FIGURE 1

- Page 197 and 198:

160Fire Your Stock Analyst!■ Two

- Page 199 and 200:

162Fire Your Stock Analyst!curred b

- Page 201 and 202:

164Fire Your Stock Analyst!■ Yiel

- Page 203 and 204:

166Fire Your Stock Analyst!Analyzin

- Page 206 and 207:

11ANALYSIS TOOL #8:PROFITABILITY AN

- Page 208 and 209:

Chapter 11 • Analysis Tool #8: Pr

- Page 210 and 211:

Chapter 11 • Analysis Tool #8: Pr

- Page 212 and 213:

Chapter 11 • Analysis Tool #8: Pr

- Page 214 and 215:

Chapter 11 • Analysis Tool #8: Pr

- Page 216 and 217:

Chapter 11 • Analysis Tool #8: Pr

- Page 218 and 219:

Chapter 11 • Analysis Tool #8: Pr

- Page 220 and 221:

Chapter 11 • Analysis Tool #8: Pr

- Page 222 and 223:

Chapter 11 • Analysis Tool #8: Pr

- Page 224 and 225:

Chapter 11 • Analysis Tool #8: Pr

- Page 226 and 227:

Chapter 11 • Analysis Tool #8: Pr

- Page 228 and 229:

Chapter 11 • Analysis Tool #8: Pr

- Page 230 and 231:

Chapter 11 • Analysis Tool #8: Pr

- Page 232 and 233:

Chapter 11 • Analysis Tool #8: Pr

- Page 234 and 235:

Chapter 11 • Analysis Tool #8: Pr

- Page 236 and 237:

Chapter 11 • Analysis Tool #8: Pr

- Page 238 and 239:

Chapter 11 • Analysis Tool #8: Pr

- Page 240 and 241:

Chapter 11 • Analysis Tool #8: Pr

- Page 242 and 243:

Chapter 11 • Analysis Tool #8: Pr

- Page 244 and 245:

Chapter 11 • Analysis Tool #8: Pr

- Page 246:

Chapter 11 • Analysis Tool #8: Pr

- Page 249 and 250:

212Fire Your Stock Analyst!The funn

- Page 251 and 252:

214Fire Your Stock Analyst!TABLE 12

- Page 253 and 254:

216Fire Your Stock Analyst!TABLE 12

- Page 255 and 256:

218Fire Your Stock Analyst!Days Sal

- Page 257 and 258:

220Fire Your Stock Analyst!TABLE 12

- Page 259 and 260:

222Fire Your Stock Analyst!where be

- Page 261 and 262:

224Fire Your Stock Analyst!TABLE 12

- Page 263 and 264:

226Fire Your Stock Analyst!TABLE 12

- Page 265 and 266:

228Fire Your Stock Analyst!February

- Page 267 and 268:

230Fire Your Stock Analyst!TABLE 12

- Page 269 and 270:

232Fire Your Stock Analyst!FIGURE 1

- Page 272:

13STEP 10: OWNERSHIPCONSIDERATIONSE

- Page 275 and 276:

238Fire Your Stock Analyst!FIGURE 1

- Page 277 and 278:

240Fire Your Stock Analyst!they’r

- Page 279 and 280:

242Fire Your Stock Analyst!Apollo c

- Page 281 and 282:

244Fire Your Stock Analyst!in a ste

- Page 283 and 284:

246Fire Your Stock Analyst!Don’t

- Page 286:

PART THREETHE ANALYSIS PROCESS

- Page 289 and 290:

252Fire Your Stock Analyst!You coul

- Page 291 and 292:

254Fire Your Stock Analyst!TABLE 15

- Page 293 and 294:

256Fire Your Stock Analyst!buy stoc

- Page 295 and 296:

258Fire Your Stock Analyst!TABLE 15

- Page 297 and 298:

260Fire Your Stock Analyst!On the o

- Page 299 and 300:

262Fire Your Stock Analyst!Nvidia w

- Page 301 and 302:

264Fire Your Stock Analyst!9. Searc

- Page 303 and 304:

266Fire Your Stock Analyst!Surprise

- Page 305 and 306:

268Fire Your Stock Analyst!ATI’s

- Page 307 and 308:

270Fire Your Stock Analyst!TABLE 16

- Page 309 and 310:

272Fire Your Stock Analyst!TABLE 16

- Page 311 and 312:

274Fire Your Stock Analyst!Estimate

- Page 313 and 314:

276Fire Your Stock Analyst!Industry

- Page 315 and 316:

278Fire Your Stock Analyst!Step 6:

- Page 317 and 318:

280Fire Your Stock Analyst!TABLE 16

- Page 319 and 320:

282Fire Your Stock Analyst!TABLE 16

- Page 321 and 322:

284Fire Your Stock Analyst!Step 10:

- Page 323 and 324:

286Fire Your Stock Analyst!Red Flag

- Page 325 and 326:

288Fire Your Stock Analyst!nual ear

- Page 327 and 328:

290Fire Your Stock Analyst!turned u

- Page 329 and 330:

292Fire Your Stock Analyst!FORECAST

- Page 331 and 332:

294Fire Your Stock Analyst!Research

- Page 333 and 334:

296Fire Your Stock Analyst!Step 3:

- Page 335 and 336:

298Fire Your Stock Analyst!TABLE 17

- Page 337 and 338:

300Fire Your Stock Analyst!TABLE 17

- Page 339 and 340:

302Fire Your Stock Analyst!Industry

- Page 341 and 342:

304Fire Your Stock Analyst!held num

- Page 343 and 344:

306Fire Your Stock Analyst!Impath

- Page 345 and 346:

308Fire Your Stock Analyst!TABLE 17

- Page 347 and 348:

310Fire Your Stock Analyst!TABLE 17

- Page 349 and 350:

312Fire Your Stock Analyst!TABLE 17

- Page 351 and 352:

314Fire Your Stock Analyst!TABLE 17

- Page 353 and 354:

316Fire Your Stock Analyst!Institut

- Page 355 and 356:

318Fire Your Stock Analyst!Consecut

- Page 358: PART FOURMORE TOOLS

- Page 361 and 362: 324Fire Your Stock Analyst!open the

- Page 363 and 364: 326Fire Your Stock Analyst!forecast

- Page 365 and 366: 328Fire Your Stock Analyst!Opportun

- Page 367 and 368: 330Fire Your Stock Analyst!Quick Hy

- Page 370 and 371: AHOW TO READFINANCIAL STATEMENTSThe

- Page 372 and 373: Appendix A • How to Read Financia

- Page 374 and 375: Appendix A • How to Read Financia

- Page 376 and 377: Appendix A • How to Read Financia

- Page 378: Appendix A • How to Read Financia

- Page 381 and 382: 344Fire Your Stock Analyst!After yo

- Page 383 and 384: 346Fire Your Stock Analyst!eraging

- Page 385 and 386: 348Fire Your Stock Analyst!less tha

- Page 387 and 388: 350Fire Your Stock Analyst!SummaryI

- Page 389 and 390: Step 9. Red FlagsHistorical Capital

- Page 391 and 392: Step 8. ProfitabilitySales GrowthAd

- Page 393 and 394: 356Fire Your Stock Analyst!Bond Rat

- Page 395 and 396: 358Fire Your Stock Analyst!Insider

- Page 397 and 398: 360Fire Your Stock Analyst!Return o

- Page 400 and 401: INDEXAAAA corporate bond rate, 69-7

- Page 402 and 403: Index 365stock ownership, 279value

- Page 404 and 405: Index 367free EBITDA, 208-9operatin

- Page 406 and 407: Index 369Industry, defined, 99Indus

- Page 410 and 411: Index 373pro forma, 324receivables/

- Page 412: Index 375implied growth, 266-69pric

- Page 415 and 416: The Financial Times deliversa world