BEECHER - NAWC

BEECHER - NAWC

BEECHER - NAWC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

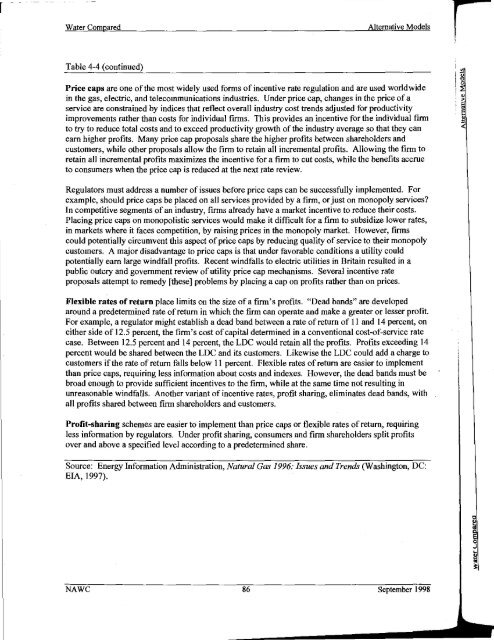

Water ComparedAlternative ModelsrTable 4-4 (continued)Price caps are one of the most widely used forms of incentive rate regulation and are used worldwidein the gas, electric, and telecommunications industries. Under price cap, changes in the price of aservice are constrained by indices that reflect overall industry cost trends adjusted for productivityimprovements rather than costs for individual firms. This provides an incentive for the individual firmto try to reduce total costs and to exceed productivity growth of the industry average so that they canearn higher profits. Many price cap proposals share the higher profits between shareholders andcustomers, while other proposals allow the firm to retain all incremental profits. Allowing the firm toretain all incremental profits maximizes the incentive for a firm to cut costs, while the benefits accrueto consumers when the price cap is reduced at the next rate review.Regulators must address a number of issues before price caps can be successfully implemented. Forexample, should price caps be placed on all services provided by a finn, or just on monopoly services?In competitive segments of an industry, firms already have a market incentive to reduce their costs.Placing price caps on monopolistic services would make it difficult for a firm to subsidize lower rates,in markets where it faces competition, by raising prices in the monopoly market. However, firmscould potentially circumvent this aspect of price caps by reducing quality of service to their monopolycustomers. A major disadvantage to price caps is that under favorable conditions a utility couldpotentially earn large windfall profits. Recent windfalls to electric utilities in Britain resulted in apublic outcry and government review of utility price cap mechanisms. Several incentive rateproposals attempt to remedy [these] problems by placing a cap on profits rather than on prices.Flexible rates of return place limits on the size of a firm's profits. "Dead bands" are developedaround a predetermined rate of return in which the firm can operate and make a greater or lesser profit.For example, a regulator might establish a dead band between a rate of return of II and 14 percent, oneither side of 12.5 percent, the firm's cost of capital determined in a conventional cost-of-service ratecase. Between 12.5 percent and 14 percent, the LDC would retain all the profits. Profits exceeding 14percent would be shared between the LDC and its customers. Likewise the LDC could add a charge tocustomers if the rate of return falls below II percent. Flexible rates of return are easier to implementthan price caps, requiring less information about costs and indexes. However, the dead bands must bebroad enough to provide sufficient incentives to the firm, while at the same time not resulting inunreasonable windfalls. Another variant of incentive rates, profit sharing, eliminates dead bands, withall profits shared between firm shareholders and customers.Profit-sharing schemes are easier to implement than price caps or flexible rates of return, requiringless information by regulators. Under profit sharing, consumers and firm shareholders split profitsover and above a specified level according to a predetermined share.Source: Energy Information Administration, Natural Gas 1996: Issues and Trends (Washington, DC:EIA, 1997).<strong>NAWC</strong> 86 September 1998