Financial Year - GMM Pfaudler Ltd

Financial Year - GMM Pfaudler Ltd

Financial Year - GMM Pfaudler Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

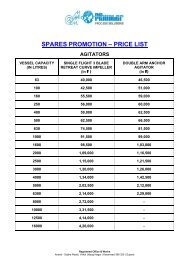

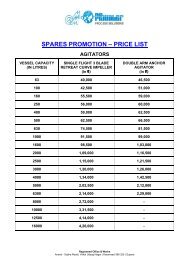

<strong>GMM</strong> PFAUDLER LIMITEDAnnual Report 2010 - 2011MANAGEMENT DISCUSSION AND ANALYSIS REPORTCOMPANY OVERVIEW:The Company which was established in the year 1962,has a state of the art manufacturing facility spread overa 20 acre plot of land located at Karamsad in GujaratState, about 45 km from Vadodara. The Companyenjoys the leadership position in design, manufacture andmarketing of glass-lined reactor vessels, storage tanks,valves and pipe & fittings. The Company also undertakesdesign and fabrication of specialized chemical processequipment in Alloy steel. It has created for itself a nicheposition in the chemical process equipment market forproprietary products manufactured by it such as AgitatedNutsche Filters & Filter Dryers, Wiped Film Evaporators,EconoMix Mixing Systems, Thermal Control Units and PTFElined pipes & fittings. Its access to the Mavag’s high endtechnology for top driven Spherical Dryers, Agitated NutscheFilters & Filter Dryers for sterile applications and MagneticDrive Agitators has complemented the Company’s positionas a complete process solution provider for pharmaceuticals,bio pharmaceuticals, chemicals and allied segments.INDUSTRY STRUCTURE AND DEVELOPMENT:While the chemical industry in India grew as a whole at morethan 11% in 2011, the Pharmaceutical industry grew by over18% during the year and it is expected to grow at a CAGRof 15% till 2015. The continued focus on India as a basefor bulk drugs, both of a generic nature and increasingly forspecialty patent protected drugs and chemicals, the industryis expected to continue its growth momentum in the nearterm.With investments by established Companies, both Indianand multi nationals, as well as from new Companies, yourCompany expects to see broadening of its customer baseas well as increasing revenues from its existing customers.OPPORTUNITIES & THREATS:New markets due to migration of chemical business intoIndia from the western world continue to be an opportunityfor your Company’s products. In addition to the inclusionof Mavag products your Company has potential for greatershare of the customer spend. In addition to the growthin the chemical industry, the capital spend in fertilizer,petrochemical, power, bio technology is expected to offeropportunities for growth.With multiple code accreditations that allows our products tobe sold overseas in markets in USA, Europe and China, yourCompany is poised to exploit the export markets as well.Commodities price fluctuations, especially in steel, highrate of inflation and interest rates could hamper the industrygrowth.FINANCIAL PERFORMANCE:The market environment had picked up during the year. Risein raw material input cost, increased cost of out sourcing dueto inflationary pressure and increase in borrowing cost haveimpacted profitability.Sales of the Company increased by 35% in the second halfof the year. Lower sales in first half of the year, however,had an adverse impact upon the overall performance of theCompany. The growth witnessed by the Pharmaceutical andSpecialty Chemicals during the year helped the Companyin sustaining the strong build up of order backlog which isexpected to show better performance in the next year.SEGMENT WISE OPERATIONAL PERFORMANCE:Chemical Process EquipmentThis Division of the Company designs, manufactures andmarkets <strong>GMM</strong> <strong>Pfaudler</strong> Reactor Systems product linewhich primarily includes glass-lined corrosion resistantreactors, storage vessels and alloy steel equipment.This Division reported sales of ` 1,220.17 million, 4.6% lowerthan that of previous year due to lower sale of alloy steelequipment. This division contributes to 85% of the total salesof the Company. This Division of the Company continues toenjoy the number one position in manufacturer of glass-linedequipment in India. The profit from this segment was ` 177.4million, a decrease of about 4.5% over the previous yeardue to higher cost of raw materials of alloy steel equipment.The capital employed for this division was ` 625.9 millionincreased by over 29% from the previous year level, due tobuilt up of inventory driven by higher order backlog.Mixing SystemThis Division designs, manufactures and marketsEconoMix Agitators which provide solutions to customer’smixing requirements. In addition to serving the CPI thisDivision also caters to the bio-technology, mining andwaste water treatment industry. Sales of this Division ofthe Company decreased by over 32% to ` 110.54 millionfrom 162.90 million in the previous financial year. The profitfrom this segment was ` 10.83 million, a decrease of morethan 41% over the previous year. This segment was mostaffected by the rise in input cost of the drive systems. Capitalemployed for this Division was ` 30.34 million decreased byover 27% from the previous year.Filtration & SeparationThis Division’s primary business is design, manufactureand marketing of Agitated Nutsche Filter & Filter Dryers forseparation of solids & liquid and Wiped Film Evaporators forseparation of liquids & liquids. Mavag’s high end technologyand products have greatly benefited this Division. ThisDivision of the Company reported a sales of ` 109.50million, an increase of 6% over previous year in thisDivision. Profits however were lower by 11% at ` 6.30million. Capital employed for this Division was ` 36.72 milliondecreased marginally by 0.4% from the previous year.8