Financial Year - GMM Pfaudler Ltd

Financial Year - GMM Pfaudler Ltd

Financial Year - GMM Pfaudler Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

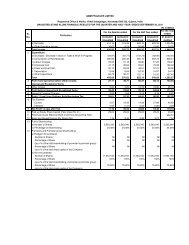

SCHEDULE 17: NOTES FORMING PART OF THE CONSOLIDATED ACCOUNTS1. BASIS OF CONSOLIDATIONThe consolidated financial statements relate to <strong>GMM</strong> <strong>Pfaudler</strong> <strong>Ltd</strong>., the holding Company and it’s wholly owned subsidiaries(collectively referred to as Group). The consolidation of the accounts of the holding Company with the subsidiaries is preparedin accordance with Accounting Standard (AS) 21 – ‘Consolidated <strong>Financial</strong> Statements’. The financial statements of the parentCompany and it’s subsidiaries are combined on line-by-line basis by adding together like items of assets, liabilities, income andexpenses. The intra-group balances and intra-group transactions and unrealized profits or losses are fully eliminated.In case of foreign subsidiaries, revenue items are consolidated at the average rate prevailing during the year. All the assets andliabilities are converted at the rates prevailing at the end of the year. Exchange gain / losses arising on conversion are recognizedunder Foreign Currency Translation Reserve.2. The Subsidiary Companies considered in the consolidated financial statements are:Sr. Name of Company Country of Incorporation % of HoldingNo. Current <strong>Year</strong> Previous <strong>Year</strong>1. Karamsad Investments <strong>Ltd</strong>. India 100% 100%2. Karamsad Holdings <strong>Ltd</strong>. India 100% 100%3. <strong>GMM</strong> Mavag AG Switzerland 100% 100%4. Mavag AG (subsidiary of <strong>GMM</strong> Mavag AG) Switzerland 100% 100%3. The financial statements of the Subsidiary Companies used in the consolidation are drawn up to the same reporting dateas of the Holding Company i.e. year ended March 31, 2011.4. SIGNIFICANT ACCOUNTING POLICIESa) Accounting conventionThe financial statements are prepared under the historical cost convention using the accrual method of accounting, inaccordance with generally accepted accounting principles in India, the Accounting Standards prescribed in the Companies(Accounting Standards) Rules, 2006 and the provisions of the Companies Act, 1956, as applicable.b) Use of EstimatesThe preparation of financial statements in conformity with Generally Accepted Accounting Principles requires the managementto make estimates and assumptions that affects the reported balances of assets and liabilities as of the date of the financialstatements and reported amounts of income and expense during the period. Management believes that the estimates used inpreparation of financial statements are prudent and reasonable. Actual results could differ from the estimates.c) Fixed assets and depreciationFixed assets are stated at cost less accumulated depreciation. Cost includes all expenses related to the acquisition andinstallation of fixed assets.Assets acquired under finance lease are capitalized at the lower of the fair value of the leased assets and the present value ofthe minimum lease payments as at the inception of the lease.Depreciation is provided pro rata to the period of use, on the straight line method at the rates specified in Schedule XIV to theCompanies Act, 1956 in respect of the assets situated in India and on the written down value method at the rates prescribedunder Swiss law in respect of the assets of the foreign subsidiaries. Moreover, the fixed assets of the foreign subsidiary havebeen consolidated at the written down value as on the date of acquisition as the particulars of the original cost and accumulateddepreciation are not available. The value of fixed assets in the foreign subsidiary not being significant, there is no materialimpact on account of depreciation on the consolidated financial statements.Leasehold land and lease improvements are amortised equally over the period of lease.53